Blank Pennsylvania Durable Power of Attorney Form

Documents used along the form

When setting up a Pennsylvania Durable Power of Attorney, it’s important to consider additional documents that can complement your estate planning. These documents can help ensure your wishes are respected and provide clarity in various situations.

- Advance Healthcare Directive: This document allows you to outline your healthcare preferences in case you become unable to communicate them. It includes your wishes regarding medical treatment and appoints someone to make decisions on your behalf.

- Promissory Note Form: To facilitate legal financial agreements, consider using our detailed Promissory Note form guide for proper documentation and terms of repayment.

- Last Will and Testament: A will specifies how you want your assets distributed after your death. It can also name guardians for minor children, ensuring that your loved ones are cared for according to your wishes.

- Living Trust: A living trust holds your assets during your lifetime and specifies how they should be distributed after your death. It can help avoid probate and provide more privacy than a will.

- HIPAA Release Form: This form allows designated individuals access to your medical records. It ensures that your healthcare providers can share information with those you trust, facilitating better decision-making during medical emergencies.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants someone authority to manage your financial affairs. It can be effective immediately or only when you become incapacitated.

These documents work together to create a comprehensive plan for your future. Taking the time to prepare them can provide peace of mind for you and your loved ones.

Other Popular State-specific Durable Power of Attorney Templates

Poa Form Texas - A Durable Power of Attorney can help avoid conflicts among family members regarding your intentions.

To ensure a smooth incorporation process, it's essential to gather all necessary information before completing the form. For detailed guidance and to access the form, visit pdftemplates.info/wisconsin-articles-of-incorporation-form, where you can find resources to assist you in creating your corporation in Wisconsin.

Does Durable Power of Attorney Cover Medical - It's crucial to choose an agent who will act in your best interest when signing this form.

Similar forms

The Pennsylvania Durable Power of Attorney (DPOA) form is similar to the General Power of Attorney (GPOA) in that both documents grant authority to an agent to act on behalf of the principal. However, the DPOA remains effective even if the principal becomes incapacitated, while the GPOA ceases to be valid under such circumstances. This distinction is crucial for individuals seeking to ensure their affairs are managed during times of diminished capacity.

Another document comparable to the DPOA is the Medical Power of Attorney (MPOA). The MPOA specifically allows an agent to make healthcare decisions for the principal when they are unable to do so. While the DPOA may cover financial matters, the MPOA is focused on medical choices, highlighting the importance of having separate documents for distinct areas of decision-making.

The Living Will is also similar to the DPOA in that it addresses the principal's wishes regarding medical treatment. However, the Living Will is more focused on end-of-life decisions, such as whether to receive life-sustaining treatment. Unlike the DPOA, which designates someone to make decisions, the Living Will provides guidance to healthcare providers and loved ones about the principal’s preferences.

A Healthcare Proxy is another document that bears resemblance to the DPOA. It allows an individual to designate someone to make healthcare decisions on their behalf. Like the MPOA, the Healthcare Proxy is specifically tailored for medical situations, emphasizing the need for clear directives in healthcare matters, which may not be covered by the DPOA.

The Revocable Living Trust shares similarities with the DPOA in that both can be used to manage assets and provide for the principal’s needs. A Revocable Living Trust allows the principal to maintain control over their assets during their lifetime and can help avoid probate upon death. However, it is a separate legal entity, while the DPOA simply grants authority to an agent without creating a trust structure.

When transferring ownership of a vehicle, it's crucial to utilize the appropriate documentation, such as the Auto Bill of Sale Forms, to ensure a smooth and legally compliant process. This form not only captures essential details about the transaction but also protects the interests of both the buyer and seller during the ownership transfer.

The Guardianship document is another related form, as it can be utilized when an individual is unable to manage their own affairs. A court appoints a guardian to make decisions for the incapacitated person. Unlike the DPOA, which is created voluntarily by the principal, guardianship is typically established through a legal process, emphasizing the need for intervention when individuals can no longer care for themselves.

The Consent to Treatment form is similar to the DPOA in that it allows individuals to authorize medical treatment. This document is often used in specific situations, such as for minors or individuals who cannot provide consent themselves. While the DPOA may encompass broader financial and legal decisions, the Consent to Treatment focuses solely on healthcare, reinforcing the necessity for clear and specific authorizations.

Lastly, the Financial Power of Attorney is akin to the DPOA as both authorize an agent to handle financial matters. However, the Financial Power of Attorney may not include the durable provisions that allow it to remain effective during the principal's incapacity. This can lead to gaps in financial management if the principal’s condition changes, making the DPOA a more comprehensive choice for long-term planning.

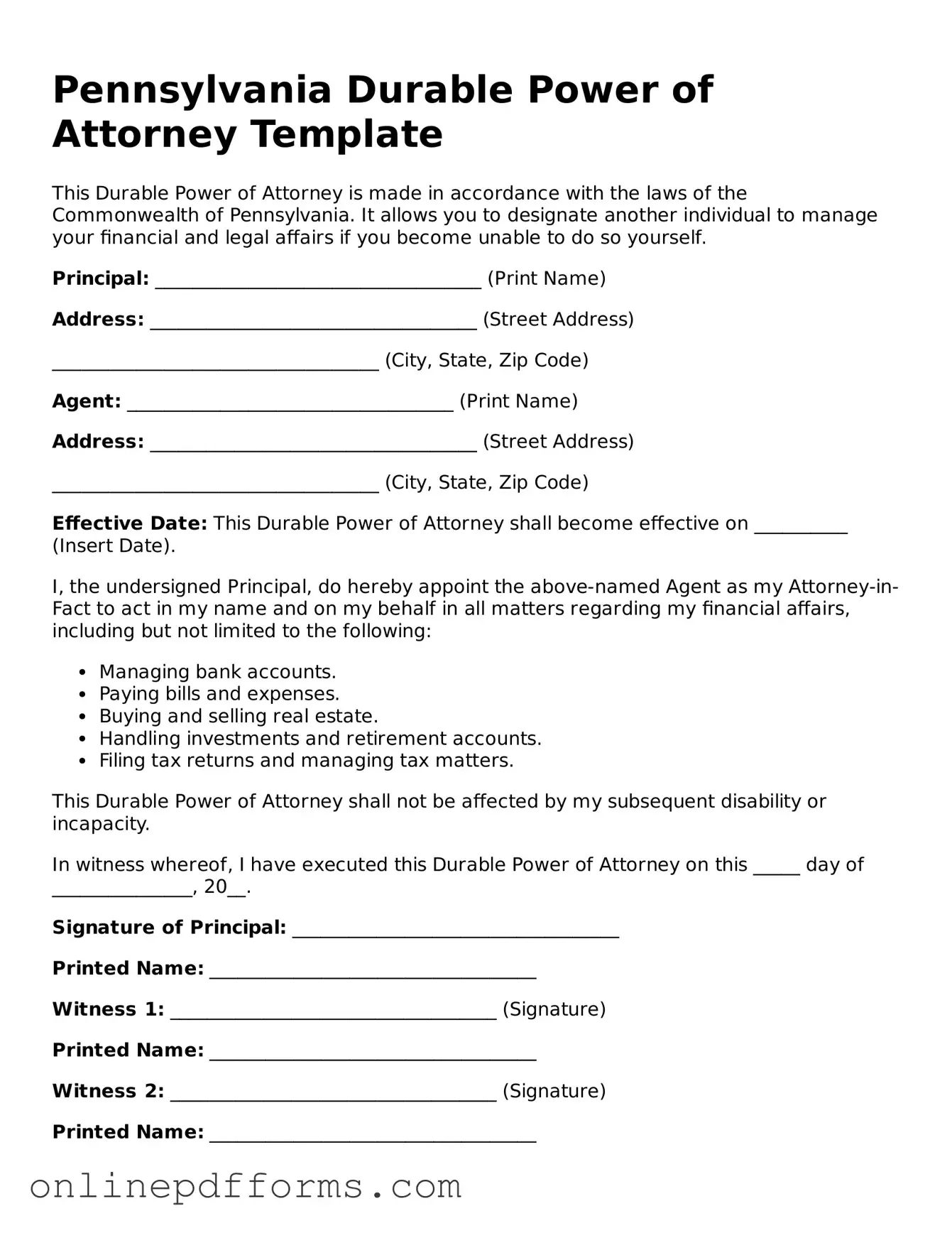

Steps to Filling Out Pennsylvania Durable Power of Attorney

Filling out the Pennsylvania Durable Power of Attorney form is an important step in ensuring that your financial and legal matters can be managed according to your wishes should you become unable to do so yourself. The process requires careful attention to detail, but by following the steps outlined below, you can complete the form accurately and confidently.

- Obtain the Pennsylvania Durable Power of Attorney form. You can find it online or at legal stationery stores.

- Read through the form carefully to understand the sections and requirements.

- In the designated area, write your full name, address, and date of birth as the principal (the person granting the power).

- Identify your agent by providing their full name and address. This is the person who will have the authority to act on your behalf.

- Decide whether you want to grant your agent broad powers or specific powers. If you choose specific powers, list them clearly in the form.

- Include any limitations or special instructions regarding the powers granted, if applicable.

- Choose whether the Durable Power of Attorney will be effective immediately or only upon your incapacitation.

- Sign and date the form in the presence of a notary public. Your signature must be witnessed by at least two individuals who are not named as agents in the document.

- Provide copies of the completed form to your agent, any alternate agents, and any financial institutions or individuals who may need it.

Once you have completed the form, it is essential to keep it in a safe place and inform your agent and family members about its location. This ensures that your wishes will be respected when the time comes.