Blank Pennsylvania Last Will and Testament Form

Documents used along the form

When creating a Pennsylvania Last Will and Testament, individuals often consider additional documents that can complement their estate planning efforts. These forms serve various purposes, from outlining specific wishes to managing assets effectively. Below is a list of six commonly used documents that can accompany a will.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated. It ensures that financial matters can be handled smoothly without court intervention.

- Healthcare Power of Attorney: This form appoints a trusted person to make medical decisions for someone who is unable to do so. It provides guidance on healthcare preferences and ensures that an individual's wishes are respected in medical situations.

- Living Will: A living will outlines an individual's preferences regarding medical treatment in end-of-life situations. It specifies what types of medical interventions should or should not be administered, providing clarity to healthcare providers and family members.

- Revocable Trust: A revocable trust allows individuals to place their assets into a trust during their lifetime. This document helps avoid probate, provides privacy, and can be altered as circumstances change, offering flexibility in estate management.

- Beneficiary Designations: These forms are often used for financial accounts, insurance policies, and retirement plans. They specify who will receive assets upon the individual's death, allowing for a direct transfer of assets outside of probate.

- USCIS I-864 Form: This vital document, also known as the Affidavit of Support, is essential for sponsors of immigrants to demonstrate their financial capability. To learn more about it, visit pdftemplates.info/uscis-i-864-form/.

- Letter of Intent: While not a legally binding document, a letter of intent provides additional guidance to executors and beneficiaries. It can explain the individual's wishes regarding asset distribution, funeral arrangements, and other personal matters that may not be fully addressed in the will.

Incorporating these documents into estate planning can help ensure that wishes are clearly communicated and respected. Each form plays a vital role in managing both health and financial decisions, ultimately providing peace of mind for individuals and their families.

Other Popular State-specific Last Will and Testament Templates

Ohio Will Template - This form can provide specific instructions for the care of dependents.

What Are the Requirements for a Will to Be Valid in Florida - A legal document specifying how a person's estate will be handled after their death.

For those looking to understand the process more thoroughly, the Florida RV Bill of Sale document is a crucial resource that outlines the necessary steps for transferring ownership in a legal manner. You can find a suitable version of this document by visiting the accurate RV Bill of Sale template that meets your needs.

Making Will - A will can provide peace of mind to the testator, knowing their wishes regarding their estate will be followed.

Similar forms

The Pennsylvania Last Will and Testament form is similar to a Living Will. A Living Will outlines an individual's preferences regarding medical treatment in situations where they are unable to communicate their wishes. Both documents serve to express personal desires, but while a Last Will and Testament deals with the distribution of assets after death, a Living Will focuses on healthcare decisions during a person’s lifetime. Each document ensures that an individual's intentions are respected, albeit in different contexts—one for financial matters and the other for health care choices.

Another document comparable to the Last Will and Testament is the Durable Power of Attorney. This legal instrument allows a person to designate someone else to make decisions on their behalf if they become incapacitated. Like a Last Will, it is a means of ensuring that personal wishes are followed, but it does so during a person’s life rather than after death. Both documents provide clarity and direction, helping to avoid potential disputes among family members or loved ones regarding one's wishes.

When dealing with various types of transactions, it's essential to have the right documentation to facilitate the process. For instance, the Auto Bill of Sale Forms serve as a useful tool for properly recording the sale and transfer of ownership, ensuring that all parties involved have their rights protected and responsibilities clear.

The Revocable Trust shares similarities with the Last Will and Testament in that both are used for the distribution of assets. A Revocable Trust allows an individual to place their assets in a trust during their lifetime, which can be managed by a trustee. Upon the individual's death, the assets in the trust are distributed according to the terms set forth in the trust document. While a Last Will goes through probate, a Revocable Trust typically avoids this process, providing a quicker and more private transfer of assets to beneficiaries.

Lastly, the Codicil serves as an amendment to an existing Last Will and Testament. It allows an individual to make changes or updates without drafting an entirely new will. This document can address various issues, such as adding new beneficiaries or altering asset distributions. Both a Codicil and a Last Will work together to ensure that an individual's final wishes are accurately reflected and legally binding, offering a means to adapt to changing circumstances over time.

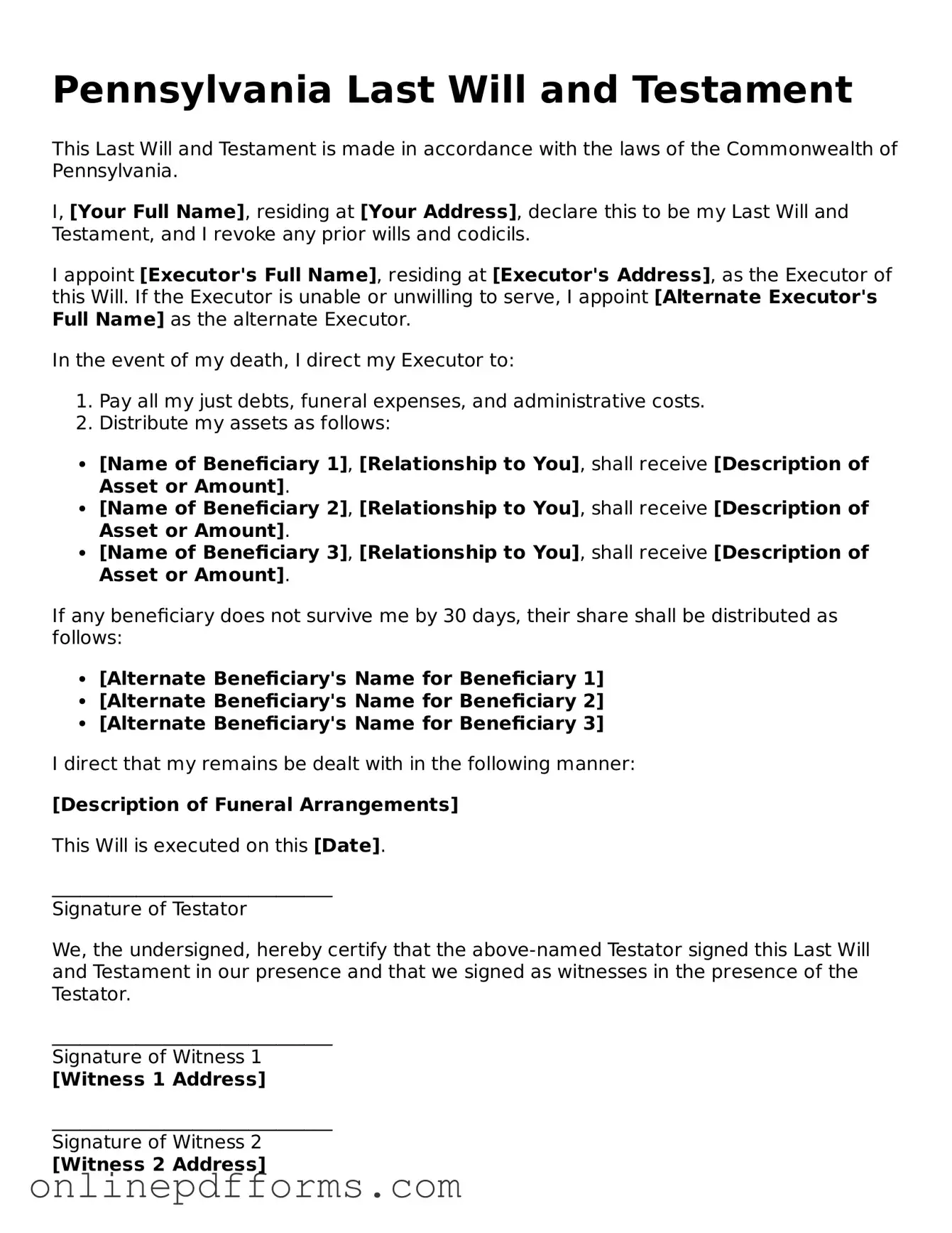

Steps to Filling Out Pennsylvania Last Will and Testament

Once you have the Pennsylvania Last Will and Testament form in hand, you are ready to begin the process of filling it out. This form allows you to specify how you want your assets distributed after your passing. It is important to take your time and ensure that all information is accurate and complete.

- Begin by entering your full name at the top of the form. Make sure to include any middle names or initials.

- Next, provide your current address. This should be the address where you reside at the time of completing the will.

- Identify any beneficiaries. These are the individuals or organizations you wish to inherit your assets. List their names and relationship to you.

- Clearly specify what each beneficiary will receive. You can choose to divide your assets equally or assign specific items or amounts to each person.

- Designate an executor. This person will be responsible for carrying out the instructions in your will. Include their full name and contact information.

- If you have minor children, appoint a guardian for them. Provide the guardian’s name and relationship to your children.

- Review the document for accuracy. Ensure all names, addresses, and other details are correct.

- Sign and date the form in the presence of two witnesses. They should also sign the document, affirming that they witnessed your signing.

- Keep the completed will in a safe place. It’s a good idea to inform your executor and loved ones where they can find it.