Blank Pennsylvania Operating Agreement Form

Documents used along the form

When forming a business in Pennsylvania, particularly a limited liability company (LLC), several key documents work alongside the Pennsylvania Operating Agreement. Each of these documents serves a specific purpose, ensuring that your business is set up correctly and operates smoothly. Below is a list of commonly used forms and documents that you might encounter.

- Articles of Organization: This document is filed with the Pennsylvania Department of State to officially create your LLC. It outlines basic information about your business, such as its name, address, and the registered agent.

- Employer Identification Number (EIN): An EIN is a unique number assigned by the IRS for tax purposes. Most businesses need an EIN to hire employees, open a bank account, and file taxes.

- Bylaws: While not required for LLCs, bylaws can be beneficial. They outline the internal rules governing the management and operation of your business, including the roles of members and procedures for meetings.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to formalize their stake in the company.

- Initial Resolutions: These are documents that record important decisions made by the members at the formation of the LLC, such as the appointment of officers or approval of the Operating Agreement.

- Business Licenses and Permits: Depending on your business type and location, you may need various licenses and permits to operate legally. These can include local business licenses, health permits, and zoning permits.

- Tax Registration Forms: You may need to register for state and local taxes, which can include sales tax, income tax, and employer taxes. This ensures compliance with tax obligations.

- Vehicle Bill of Sale: Essential for the transfer of ownership, a Vehicle Bill of Sale Forms ensures that both the buyer and seller have a clear record of the transaction.

- Annual Reports: Some states require LLCs to file annual reports to maintain good standing. This document typically updates the state on the business's activities and confirms that it remains compliant with state regulations.

Understanding these documents and their roles in the formation and operation of your LLC can help you navigate the process more effectively. By ensuring that you have all the necessary paperwork in place, you can focus on building and growing your business with confidence.

Other Popular State-specific Operating Agreement Templates

Operating Agreement Llc Florida Sample - It can set forth expectations for member participation in the business.

Operating Agreement Llc California Template - It may outline succession planning for the business.

For those interested in ensuring a smooth transaction, understanding the essential details of the Florida Tractor Bill of Sale documentation is crucial for recording the sale and ownership transfer of a tractor, safeguarding the rights of both buyers and sellers.

How to Create an Operating Agreement for an Llc - It establishes guidelines for operating procedures within the company.

Similar forms

The Pennsylvania Operating Agreement is similar to a Partnership Agreement. Both documents outline the structure and operation of a business entity. A Partnership Agreement is specifically used for partnerships, detailing the roles, responsibilities, and profit-sharing arrangements among partners. Like the Operating Agreement, it serves to clarify expectations and protect the interests of all parties involved, ensuring smooth operations and minimizing disputes.

The Texas Trailer Bill of Sale form is a crucial document that facilitates the process of buying or selling a trailer in the state of Texas. It serves as a formal record of the transaction, detailing the exchange between buyer and seller. This form not only confirms the sale but also transfers ownership of the trailer, making it an essential part of the sales process. For those seeking comprehensive documentation, Auto Bill of Sale Forms can provide additional resources and templates to ensure a seamless transaction.

Another document akin to the Pennsylvania Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, specifying the roles of directors and officers, meeting protocols, and voting procedures. Both Bylaws and Operating Agreements provide a framework for governance, although Bylaws are specific to corporations, while Operating Agreements apply to limited liability companies (LLCs). Each document is essential for establishing clear operational guidelines and decision-making processes.

The Shareholder Agreement shares similarities with the Pennsylvania Operating Agreement as well. This document is used by corporations to outline the rights and responsibilities of shareholders. It addresses issues such as the transfer of shares, voting rights, and dispute resolution. Like the Operating Agreement, a Shareholder Agreement aims to protect the interests of its members and ensure that everyone understands their roles within the organization.

Lastly, the Joint Venture Agreement is another document comparable to the Pennsylvania Operating Agreement. A Joint Venture Agreement outlines the terms of a partnership between two or more parties working together on a specific project or business activity. It includes details on contributions, profit sharing, and decision-making processes. Similar to an Operating Agreement, it establishes the framework for collaboration and helps prevent misunderstandings among the parties involved.

Steps to Filling Out Pennsylvania Operating Agreement

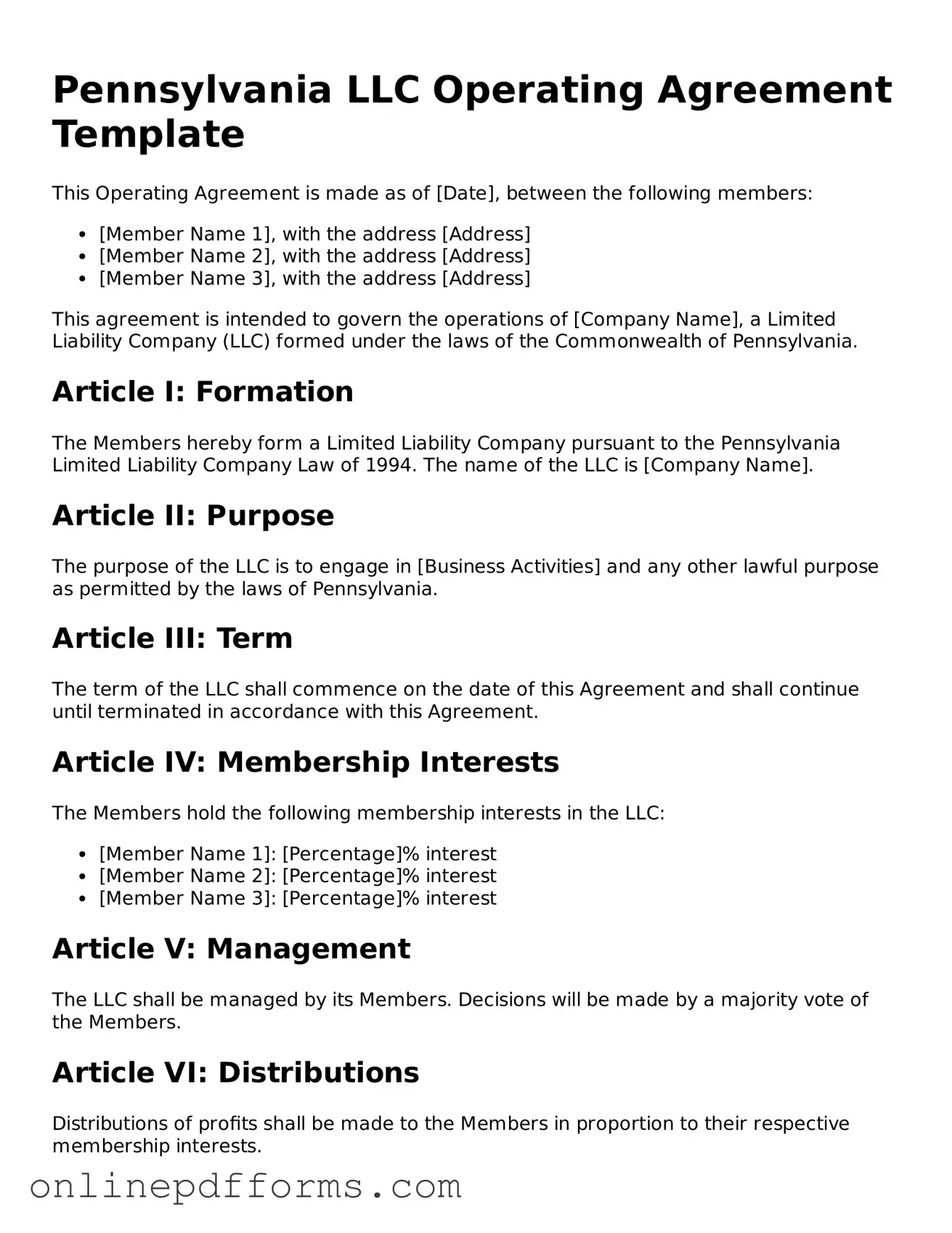

After obtaining the Pennsylvania Operating Agreement form, you will need to fill it out carefully to ensure all necessary information is accurately provided. This document plays a crucial role in outlining the structure and operational guidelines of your business. Follow the steps below to complete the form effectively.

- Begin by entering the name of your business at the top of the form. Ensure that the name matches the one registered with the state.

- Next, provide the principal office address. This should be the physical location where your business operates.

- List the names and addresses of all members involved in the business. Include their roles and any ownership percentages they hold.

- Specify the purpose of the business. Describe what activities the business will engage in.

- Outline the management structure. Indicate whether the business will be member-managed or manager-managed.

- Detail the capital contributions of each member. Clearly state how much each member is investing in the business.

- Include the distribution of profits and losses. Explain how earnings will be shared among members.

- State the duration of the business. Specify whether it is intended to be ongoing or for a fixed period.

- Provide any additional provisions that may be relevant to your business operations. This could include decision-making processes or dispute resolution methods.

- Finally, ensure all members sign and date the document. This confirms their agreement to the terms outlined in the Operating Agreement.