Blank Pennsylvania Promissory Note Form

Documents used along the form

When engaging in a loan agreement in Pennsylvania, the Promissory Note is a key document. However, several other forms and documents often accompany it to ensure clarity and legal compliance. Here’s a list of some important documents that may be used alongside a Pennsylvania Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both parties.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being pledged. It details the rights of the lender in case of default.

- Disclosure Statement: This document provides borrowers with important information about the loan, including fees, interest rates, and any potential penalties for late payments. It ensures transparency in the lending process.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from a third party. This document makes that individual responsible for the loan if the borrower defaults.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal. It helps borrowers understand their payment obligations.

- Vehicle Bill of Sale: When selling a mobile home, it's vital to have a clear record of the transaction. You can find essential documentation for this process, including Vehicle Bill of Sale Forms, to safeguard your interests.

- Default Notice: Should a borrower fail to make payments, this document serves as a formal notification of default. It outlines the consequences and may initiate the process for collection or foreclosure.

- Payment Receipt: After a payment is made, a receipt can be issued to document the transaction. This is important for both parties to keep accurate records of payments received and made.

- Modification Agreement: If any terms of the original loan need to be changed, this document outlines the new terms and requires the agreement of both parties. It ensures that any changes are legally recognized.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations and confirms that the lender has no claims against them.

These documents, when used in conjunction with the Pennsylvania Promissory Note, help to create a clear and legally sound framework for the lending relationship. Understanding each document's purpose can lead to a smoother transaction and minimize potential disputes in the future.

Other Popular State-specific Promissory Note Templates

New York Promissory Note Requirements - Parties should discuss potential changes to payment terms before finalizing the promissory note.

When it comes to facilitating a smooth transaction, it is important to utilize the Arizona Motorcycle Bill of Sale form, which can be found at https://mypdfform.com/blank-arizona-motorcycle-bill-of-sale/. This document serves as essential proof of ownership transfer and details the terms of the sale, ensuring that both the buyer and seller are protected during this process.

Promissory Note Georgia - This document usually contains details about the borrower's obligations and rights.

Promissory Note Template Ohio - Notes can be tailored to fit the specific needs and expectations of both the borrower and lender.

Illinois Promissory Note - Promissory Notes can be transferred to another lender if both parties agree to the change.

Similar forms

A loan agreement is a document that outlines the terms and conditions under which a borrower receives funds from a lender. Like a promissory note, it specifies the amount borrowed, interest rates, repayment schedule, and consequences for default. However, a loan agreement often includes additional clauses related to collateral, warranties, and representations, providing a more comprehensive framework for both parties involved.

A mortgage is another document that shares similarities with a promissory note. While a promissory note is a promise to repay borrowed money, a mortgage secures that promise with real property. In essence, the borrower agrees to pay back the loan, and the lender has a legal claim on the property until the debt is satisfied. Both documents work together to formalize the lending arrangement and protect the lender's interests.

An installment agreement allows a borrower to repay a debt in smaller, manageable payments over time. This document resembles a promissory note in that it outlines the repayment terms, including the total amount owed and the schedule for payments. However, installment agreements often cover a broader range of debts, such as unpaid taxes or medical bills, and may include specific provisions for late payments or defaults.

A personal guarantee is a document in which an individual agrees to be responsible for another person's debt. This is similar to a promissory note in that it establishes a commitment to pay back a loan. However, a personal guarantee usually applies when a business borrows money and the owner or another individual provides assurance that they will repay the debt if the business cannot. This adds an extra layer of security for the lender.

A secured loan agreement is another document akin to a promissory note. It specifies that the loan is backed by collateral, which can be seized if the borrower fails to repay. Like a promissory note, it includes details about the loan amount, interest rates, and repayment terms. The key difference lies in the collateral, which provides the lender with additional security, reducing their risk compared to an unsecured promissory note.

If you're looking to form a corporation in Wisconsin, it's essential to understand the significance of the Articles of Incorporation form, which is the official document required for legally establishing your business entity. This form not only delineates your corporation's name and purpose but also acts as a fundamental building block for your entrepreneurial venture. To get started, fill out the necessary details on the Wisconsin Articles of Incorporation form found here: https://pdftemplates.info/wisconsin-articles-of-incorporation-form/.

A lease agreement also shares characteristics with a promissory note, particularly in the context of rental payments. It outlines the terms under which a tenant agrees to pay rent to a landlord. Both documents detail payment amounts and schedules. However, a lease agreement typically covers the use of property rather than a loan, and it may include additional terms related to property maintenance, duration of the lease, and tenant rights.

A debt settlement agreement is a document that outlines the terms under which a debtor agrees to pay less than the full amount owed to a creditor. Similar to a promissory note, it establishes a commitment to repay a portion of the debt. However, it often involves negotiations and compromises, which can result in a lump-sum payment rather than a structured repayment plan. This type of agreement aims to resolve debts more quickly, often in situations of financial hardship.

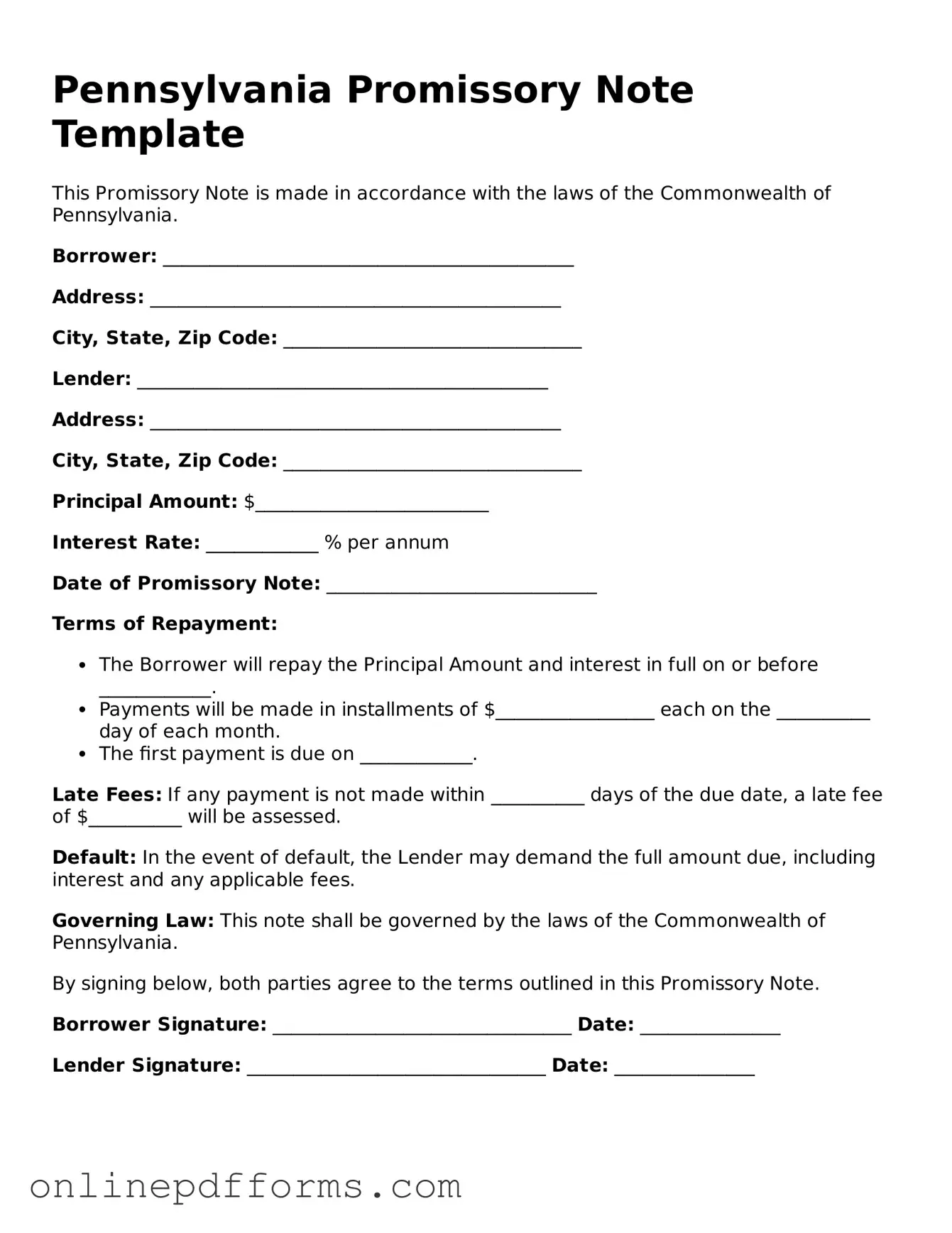

Steps to Filling Out Pennsylvania Promissory Note

Once you have the Pennsylvania Promissory Note form in hand, you can begin filling it out. This document will outline the terms of the loan and the obligations of both the borrower and the lender. Be sure to provide accurate information to avoid any potential issues in the future.

- Start by entering the date at the top of the form. Use the format month/day/year.

- Next, fill in the name and address of the borrower. This is the individual or entity receiving the loan.

- Provide the name and address of the lender. This is the individual or entity providing the loan.

- Clearly state the principal amount of the loan. This is the total amount borrowed and should be written numerically and in words.

- Indicate the interest rate, if applicable. Specify whether it is fixed or variable.

- Outline the repayment terms. Include details such as the frequency of payments (monthly, quarterly, etc.) and the final due date.

- If there are any late fees, describe them in this section. Specify the amount and conditions under which they apply.

- Sign the form where indicated. Both the borrower and the lender should sign to make it legally binding.

- Finally, date the signatures. This is important for establishing the timeline of the agreement.

After completing the form, both parties should keep a copy for their records. It's advisable to consult with a legal professional if there are any uncertainties about the terms or conditions outlined in the note.