Blank Pennsylvania Quitclaim Deed Form

Documents used along the form

A Pennsylvania Quitclaim Deed is often accompanied by several other forms and documents to ensure a smooth property transfer process. Below is a list of common documents that may be used alongside the Quitclaim Deed.

- Property Transfer Tax Exemption Certificate: This form is used to claim an exemption from property transfer taxes. It provides necessary details about the transaction and the reasons for the exemption.

- Vehicle Bill of Sale Forms: This document records the details of a vehicle transaction, providing essential evidence of the sale and helping to protect the rights of both the buyer and the seller. For further information, visit Vehicle Bill of Sale Forms.

- Affidavit of Residence: This document verifies the residency status of the grantor or grantee. It may be required to confirm that the property is the primary residence for tax purposes.

- Title Search Report: A title search report outlines the current ownership of the property and any liens or encumbrances. This document helps ensure that the title is clear before the transfer.

- Notice of Settlement: This notice informs all parties involved in the transaction about the date, time, and location of the property settlement. It is essential for coordinating the closing process.

- Settlement Statement (HUD-1): This document provides a detailed account of all financial transactions related to the property transfer. It outlines costs, fees, and any adjustments that need to be made at closing.

Using these documents in conjunction with the Pennsylvania Quitclaim Deed can help facilitate a more organized and efficient property transfer process. Each form plays a vital role in ensuring that all legal requirements are met.

Other Popular State-specific Quitclaim Deed Templates

Quitclaim Form - This form is commonly used in situations where confidence in the other party exists.

For those considering their options in employment law, understanding the "New York Non-compete Agreement" is vital for protecting business interests while allowing employees to explore new opportunities. A thorough grasp of this legal contract can prove beneficial when dealing with restrictive covenants. For your reference, you can find more information on a comprehensive New York Non-compete Agreement form.

Quitclaim Deed Ny - The deed can be used in situations where trust is present between parties.

Florida Quit Claim Deed - This form conveys any interest a grantor has in a property without warranties.

How Do I File a Quit Claim Deed - A Quitclaim Deed requires recording with local authorities to ensure the transfer is legally recognized.

Similar forms

The warranty deed is one of the most common documents used in property transactions. It provides a guarantee from the seller to the buyer that the title is clear of any encumbrances, except those specifically listed in the deed. Unlike a quitclaim deed, which offers no such assurances, a warranty deed ensures that the seller is legally responsible for any claims against the property. This added layer of security makes the warranty deed a preferred choice for buyers seeking to minimize risks associated with property ownership.

A special warranty deed shares some similarities with the warranty deed but with key differences. This document guarantees that the seller has not encumbered the property during their ownership but does not provide assurances regarding any issues that may have existed before their ownership. Buyers often encounter special warranty deeds in commercial real estate transactions, where the seller may be unwilling to assume liability for prior claims. Thus, while it offers some protection, it does not match the comprehensive assurances of a full warranty deed.

Understanding the intricacies of real estate transactions can be complicated, which is why resources such as the californiapdf.com/ can be invaluable. Each type of deed serves a different purpose, providing various levels of security and assurance to buyers and sellers involved in property sales. From Warranty Deeds that guarantee clear title to Quitclaim Deeds which transfer ownership without warranties, it is crucial for parties to comprehend their rights and responsibilities to navigate these processes effectively.

The bargain and sale deed is another document that resembles a quitclaim deed in its straightforward nature. This type of deed implies that the seller has the right to transfer the property but does not guarantee a clear title. It is often used in foreclosure sales or by fiduciaries who may not have full knowledge of the property’s history. Like a quitclaim deed, it transfers ownership without providing the buyer with extensive protections, making it essential for buyers to conduct thorough due diligence before proceeding.

The grant deed, commonly used in some states, offers a middle ground between a quitclaim deed and a warranty deed. It guarantees that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances created during the seller’s ownership. While it does not provide the same level of assurance as a warranty deed, it offers more protection than a quitclaim deed. Buyers often favor grant deeds when they seek a balance between simplicity and some degree of assurance regarding the title.

A deed of trust, while serving a different purpose, is also relevant in the context of property transactions. This document involves three parties: the borrower, the lender, and the trustee. It secures a loan by transferring the property title to a trustee until the borrower repays the loan. Unlike a quitclaim deed, which simply transfers ownership, a deed of trust is a financial instrument that facilitates the borrowing process. However, both documents are essential in real estate transactions and serve distinct roles in property ownership and financing.

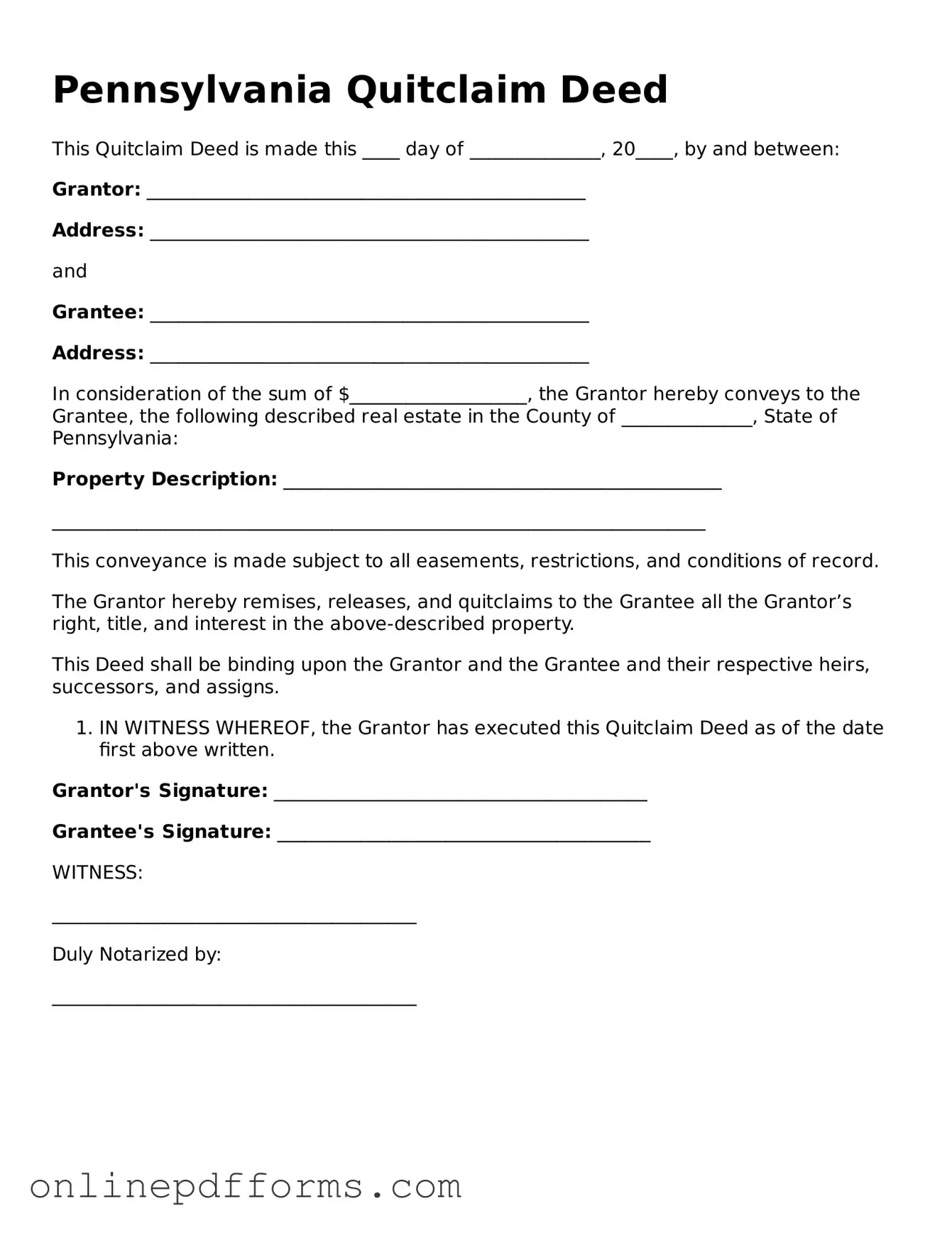

Steps to Filling Out Pennsylvania Quitclaim Deed

Once you have the Pennsylvania Quitclaim Deed form, it’s essential to complete it accurately to ensure a smooth transfer of property. Follow these steps to fill out the form correctly.

- Obtain the Form: Download the Pennsylvania Quitclaim Deed form from a reliable source or acquire a physical copy.

- Identify the Grantor: Write the full name and address of the person transferring the property. This is the individual or entity that currently holds the title.

- Identify the Grantee: Enter the full name and address of the person or entity receiving the property. Ensure the name is spelled correctly.

- Describe the Property: Provide a detailed description of the property being transferred. Include the property address and any relevant legal descriptions, such as lot number or parcel number.

- Include Consideration: State the amount of consideration being exchanged for the property. This is often a nominal amount, such as $1, if the transfer is a gift.

- Sign the Form: The grantor must sign the form in the presence of a notary public. The notary will then sign and seal the document.

- File the Deed: After notarization, file the completed Quitclaim Deed with the appropriate county office to make the transfer official.