Blank Pennsylvania Real Estate Purchase Agreement Form

Documents used along the form

When entering into a real estate transaction in Pennsylvania, several key documents accompany the Real Estate Purchase Agreement. Each document serves a specific purpose and helps ensure a smooth process. Below are five essential forms often used alongside the purchase agreement.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues with the property. It provides potential buyers with important information about the property's condition.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the risks of lead paint. It ensures that buyers are aware of potential hazards before completing the purchase.

- Medical Power of Attorney: This essential document allows individuals to designate another party to make medical decisions when they are unable, ensuring that healthcare preferences are respected. For further details, refer to our complete Medical Power of Attorney guide.

- Financing Addendum: This addendum outlines the terms of any financing arrangements. It specifies how the buyer plans to pay for the property, including details about loans or other financing methods.

- Inspection Contingency: This document allows buyers to have the property inspected before finalizing the purchase. It protects buyers by giving them the option to negotiate repairs or withdraw their offer based on the inspection results.

- Title Insurance Policy: This policy protects the buyer against any future claims on the property. It ensures that the title is clear and that the buyer has legal ownership without any disputes.

Understanding these documents is crucial for both buyers and sellers. They help clarify responsibilities and protect the interests of all parties involved in the transaction.

Other Popular State-specific Real Estate Purchase Agreement Templates

Purchasing Agreement - Closing costs and who bears them are often clarified in this purchase agreement.

Trec Texas - Sale conditions, such as appraisal requirements, can be documented.

When engaging in a vehicle sale, it is important to use the New York Motor Vehicle Bill of Sale form to ensure a smooth transfer of ownership. This form not only provides vital details about the transaction but also protects both parties involved. To find suitable templates for this process, you can refer to Auto Bill of Sale Forms, which can guide you in completing the necessary paperwork efficiently.

Home Contract Template - Parties may need to sign the agreement to formalize their commitment to the sale.

Similar forms

The Pennsylvania Real Estate Purchase Agreement form shares similarities with the Residential Purchase Agreement commonly used across many states. Both documents serve as binding contracts between buyers and sellers, outlining the terms of the sale, including purchase price, contingencies, and timelines. They aim to protect the interests of both parties while ensuring a clear understanding of the transaction. Like the Pennsylvania form, the Residential Purchase Agreement typically includes provisions for earnest money deposits and disclosures related to property conditions.

Another document that resembles the Pennsylvania Real Estate Purchase Agreement is the Commercial Purchase Agreement. While the latter is tailored for commercial properties, both agreements establish the framework for a real estate transaction. They include essential details such as property descriptions, financing contingencies, and closing procedures. The primary distinction lies in the specific terms and conditions that apply to commercial transactions, which may involve zoning laws and business-related considerations.

The Lease Purchase Agreement also bears similarities to the Pennsylvania Real Estate Purchase Agreement. This document allows a tenant to lease a property with the option to buy it later. Both agreements outline the terms of the sale and the responsibilities of each party. However, the Lease Purchase Agreement introduces elements of tenancy, including rental payments and maintenance obligations, which are not typically present in a standard purchase agreement.

Akin to the Pennsylvania Real Estate Purchase Agreement is the Option to Purchase Agreement. This document grants a buyer the right, but not the obligation, to purchase a property within a specified time frame. Both agreements establish purchase price and terms, but the Option to Purchase Agreement provides flexibility for the buyer, allowing them to decide whether to proceed with the purchase without committing upfront.

The Joint Venture Agreement can also be compared to the Pennsylvania Real Estate Purchase Agreement, particularly when multiple parties collaborate to acquire property. Both documents outline the roles and responsibilities of each party involved in the transaction. However, the Joint Venture Agreement focuses more on the partnership aspect, detailing how profits, losses, and decision-making responsibilities will be shared among the parties, whereas the purchase agreement centers on the sale itself.

The Seller Financing Agreement resembles the Pennsylvania Real Estate Purchase Agreement in that it outlines the terms of a property sale where the seller provides financing to the buyer. Both documents specify the purchase price, payment terms, and any contingencies. The key difference is that the Seller Financing Agreement includes additional provisions related to the loan, such as interest rates and repayment schedules, which are not typically found in a standard purchase agreement.

The Real Estate Listing Agreement is another document that shares characteristics with the Pennsylvania Real Estate Purchase Agreement. While the former is used by sellers to engage a real estate agent for marketing their property, both agreements outline essential terms related to the sale. They include information about the property, pricing, and the responsibilities of the parties involved. However, the Listing Agreement focuses more on the marketing and sale process rather than the actual transaction details.

When dealing with real property transactions, it's important to consider various legal documents that can simplify the processes involved. One such document is the Texas Quitclaim Deed, which allows for the transfer of property ownership without any warranties regarding the title's quality. To understand how to effectively use this vital form, you can find helpful resources at pdftemplates.info/texas-quitclaim-deed-form, ensuring you handle ownership transitions smoothly.

Lastly, the Real Estate Disclosure Statement is similar in that it provides crucial information regarding the property being sold. While the Pennsylvania Real Estate Purchase Agreement outlines the terms of the sale, the Disclosure Statement informs the buyer about the property's condition, any known defects, and legal obligations. Both documents are essential in ensuring that buyers are well-informed before making a purchase, but they serve different purposes within the overall transaction process.

Steps to Filling Out Pennsylvania Real Estate Purchase Agreement

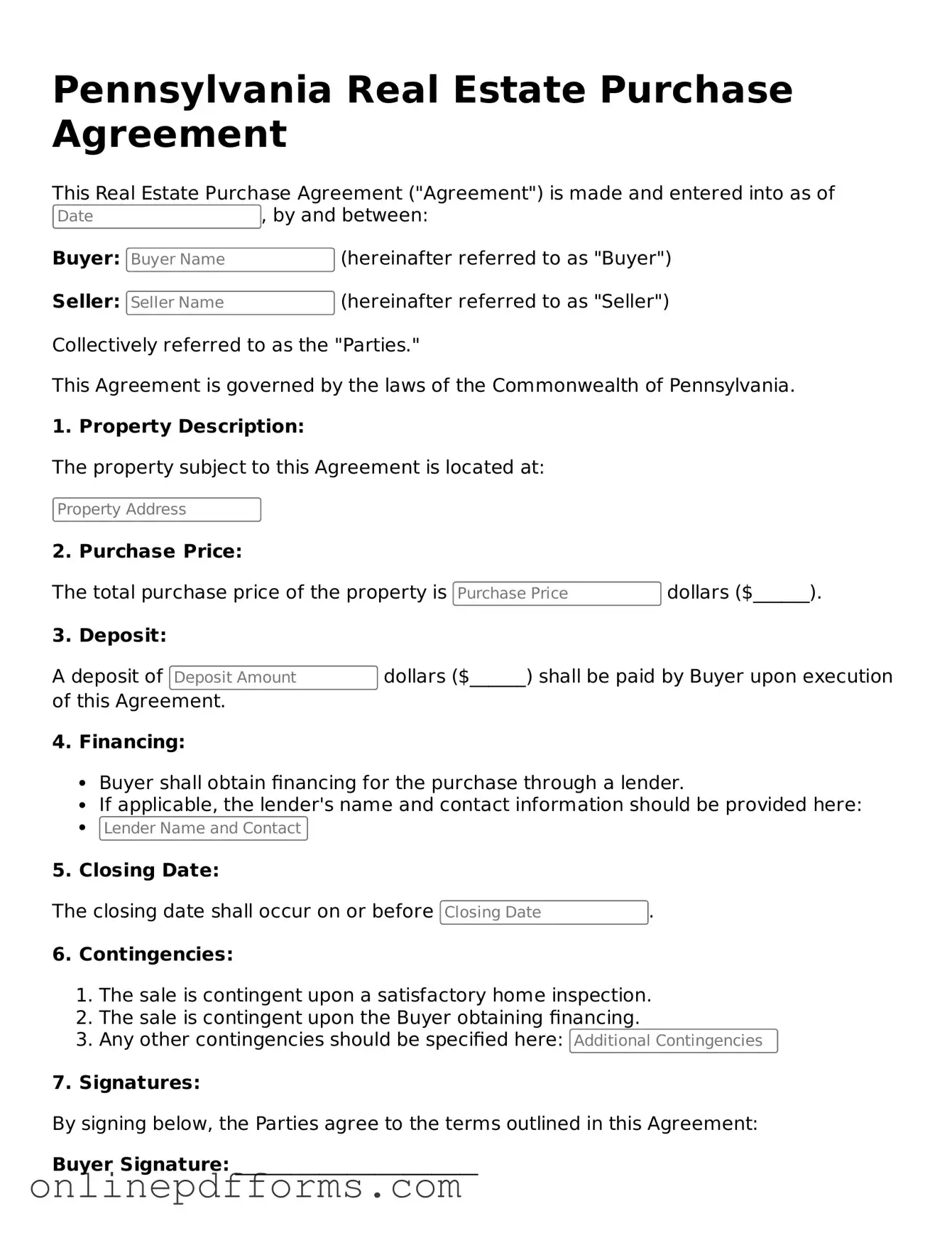

Once you have the Pennsylvania Real Estate Purchase Agreement form in front of you, it's time to fill it out. This form is essential for finalizing a real estate transaction. Take your time to ensure all information is accurate and complete. Here’s a straightforward guide to help you through the process.

- Begin by entering the date at the top of the form.

- Provide the names of the buyer(s) and seller(s). Ensure the names are spelled correctly.

- Fill in the property address. Include the street address, city, state, and ZIP code.

- Specify the purchase price. Clearly state the total amount the buyer agrees to pay for the property.

- Indicate the amount of the earnest money deposit. This shows the buyer's commitment to the purchase.

- Complete the section regarding financing. State whether the buyer will use a mortgage or pay in cash.

- Detail any contingencies. These are conditions that must be met for the sale to proceed.

- Include the closing date. This is when the sale will be finalized.

- Sign the form. Both buyer(s) and seller(s) must provide their signatures.

- Date the signatures. Make sure to put the date next to each signature.

After completing the form, review it carefully. Any errors or missing information could delay the transaction. Once everything is accurate, you can move forward with the next steps in the buying or selling process.