Blank Pennsylvania Transfer-on-Death Deed Form

Documents used along the form

The Pennsylvania Transfer-on-Death Deed form allows individuals to designate beneficiaries who will receive property upon their death, bypassing the probate process. When utilizing this form, several other documents may be necessary to ensure proper execution and to clarify intentions. Below is a list of commonly used forms and documents that complement the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed upon their death. It can include provisions for any property not covered by the Transfer-on-Death Deed.

- Beneficiary Designation Forms: Used for financial accounts and insurance policies, these forms specify who will inherit assets directly upon the account holder's death.

- Property Deed: The official record of property ownership. It may need to be referenced or updated when executing a Transfer-on-Death Deed.

- Notice to Quit Form: Essential for landlords, this form formally requests tenants to vacate the property or address lease violations. Ensure proper handling by following the recommended guidelines and open the pdf for further instructions.

- Affidavit of Heirship: This document establishes the heirs of a deceased individual, which may be necessary if there are disputes regarding property ownership.

- Power of Attorney: This legal document allows one person to act on behalf of another in financial or legal matters, which may be relevant if the property owner becomes incapacitated.

- Notice of Death: A formal announcement of an individual's passing, which may be required in certain situations to inform interested parties of the death and subsequent property transfers.

- Tax Forms: Various tax documents may be needed to report the transfer of property and ensure compliance with state and federal tax laws.

- Title Insurance Policy: This policy protects against potential disputes over property ownership and may be important when transferring property through a Transfer-on-Death Deed.

- Estate Inventory: A detailed list of all assets owned by the deceased, which may assist in clarifying the estate's overall value and distribution.

Each of these documents plays a vital role in the estate planning process and can help ensure that the intentions of the property owner are honored. Properly managing these forms can facilitate a smoother transition of assets and reduce potential disputes among beneficiaries.

Other Popular State-specific Transfer-on-Death Deed Templates

Transfer on Death Deed Ohio Pdf - Some states may require additional forms or disclosures when filing a Transfer-on-Death Deed.

Transfer on Death Deed Illinois - This legal document ensures that family members or other chosen beneficiaries inherit property seamlessly.

To facilitate the process of obtaining or renewing your license, you can find more information and access the necessary documents, including the Disciplinary Actions Disclosure in Arizona, at https://arizonaformspdf.com/, ensuring you meet all requirements set forth by the Arizona Department of Real Estate.

Where Can I Get a Tod Form - Using this deed shows foresight in planning for the future, potentially reducing the burden on loved ones.

Ladybird Deed Texas Form - Property owners should ensure their beneficiaries are aware of the deed to prevent confusion after their passing.

Similar forms

The Pennsylvania Transfer-on-Death Deed (TODD) is a unique estate planning tool, but it shares similarities with several other legal documents that facilitate the transfer of property upon death. One such document is the Last Will and Testament. A will outlines how a person's assets should be distributed after their death, appointing an executor to manage the process. Unlike a TODD, which allows for direct transfer without going through probate, a will typically requires court involvement, making the distribution process potentially longer and more complex.

Another comparable document is the Revocable Living Trust. This trust allows individuals to place their assets into a trust during their lifetime, with the stipulation that the assets are managed for their benefit. Upon their death, the assets can be transferred to beneficiaries without the need for probate, similar to a TODD. However, creating a trust generally involves more upfront legal work and costs compared to a simple transfer-on-death deed.

When considering important documents, understanding the nuances of a Medical Power of Attorney form can be crucial. This legal document empowers an individual to appoint an agent for healthcare decisions, creating a clear plan for when one may be unable to voice their preferences. For more information, you can explore the significance of a Medical Power of Attorney document.

The Joint Tenancy with Right of Survivorship is also similar to a TODD. This legal arrangement allows two or more individuals to own property together, ensuring that if one owner passes away, their share automatically transfers to the surviving owner(s). While both documents facilitate a seamless transfer of property, joint tenancy requires co-ownership during the owner's lifetime, whereas a TODD can be executed unilaterally.

Life Estate Deeds are another related option. A life estate deed allows an individual to retain the right to use and occupy property during their lifetime, with the property automatically transferring to a designated beneficiary upon their death. Like a TODD, this deed avoids probate, but it imposes restrictions on the property owner during their lifetime, which is not the case with a TODD.

The Beneficiary Designation form is frequently utilized for financial accounts, such as bank accounts or retirement plans. This form allows individuals to designate beneficiaries who will receive the assets upon their death, bypassing probate. While this document applies primarily to financial assets rather than real estate, the underlying principle of direct transfer to a named beneficiary is a commonality shared with the TODD.

Transfer-on-Death Registration for vehicles is another document that mirrors the TODD's function. In this case, vehicle owners can register a beneficiary who will inherit the vehicle upon the owner's death. Similar to a TODD, this registration simplifies the transfer process and avoids the complexities of probate, though it is specific to motor vehicles rather than real property.

Another document that resembles the TODD is the Payable-on-Death (POD) account agreement. This agreement allows bank account holders to designate a beneficiary who will receive the funds in the account upon the account holder's death. Like the TODD, a POD agreement ensures a straightforward transfer of assets without the need for probate, providing a clear and efficient way to pass on financial resources.

Durable Power of Attorney is also worth mentioning, though it serves a different purpose. This document grants someone the authority to make financial or medical decisions on behalf of another person if they become incapacitated. While it does not directly relate to the transfer of property upon death, it can be part of a comprehensive estate plan that includes a TODD, ensuring that both immediate and future needs are addressed.

Lastly, the Family Settlement Agreement is a document that can come into play after a person's death. It outlines how the deceased's estate will be divided among heirs and can help avoid disputes. While it does not facilitate the transfer of property like a TODD, it serves as a way to clarify intentions and agreements among family members, especially when the deceased did not leave a clear directive.

Steps to Filling Out Pennsylvania Transfer-on-Death Deed

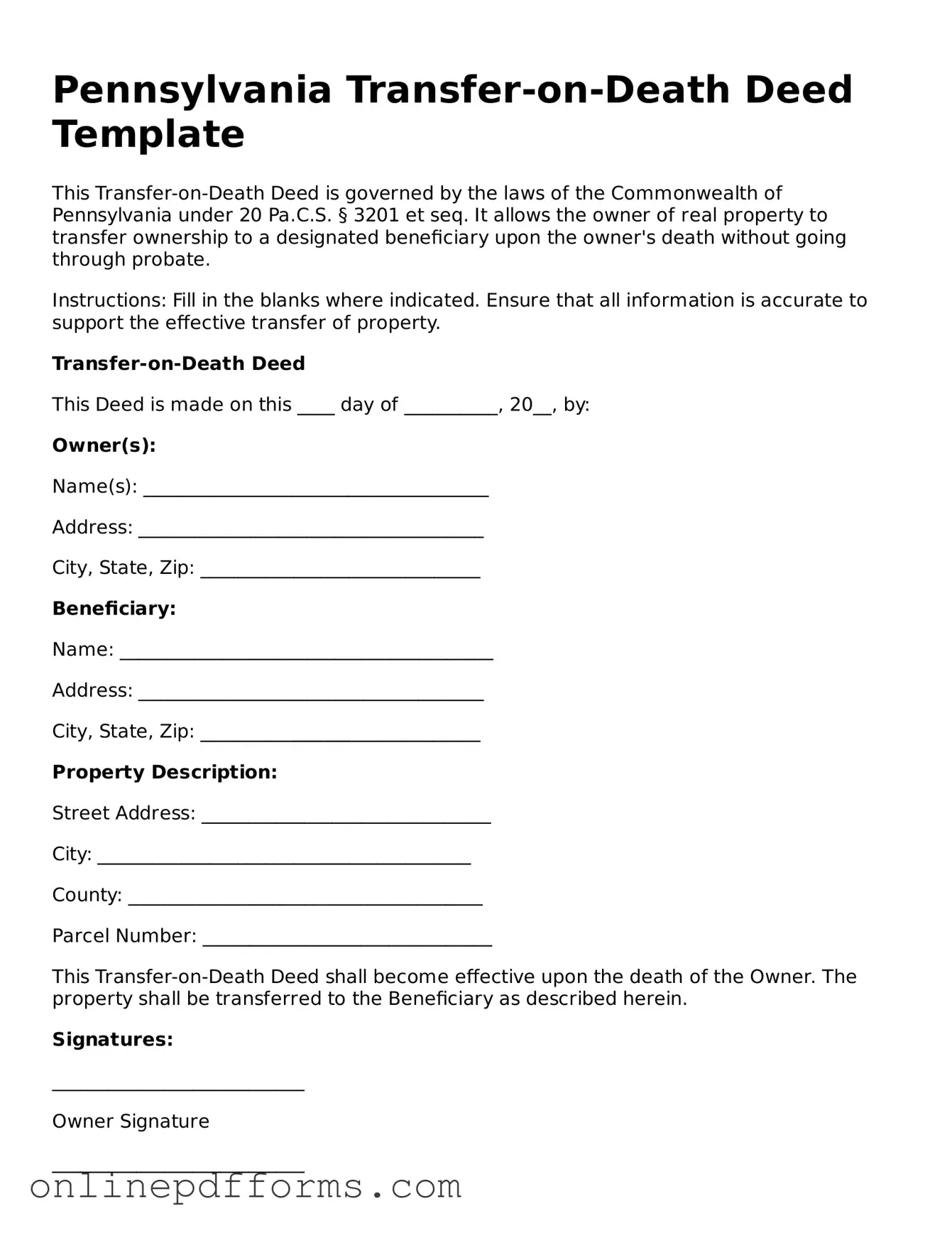

After gathering the necessary information, you will proceed to fill out the Pennsylvania Transfer-on-Death Deed form. This document allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Follow these steps to complete the form accurately.

- Begin by entering your name and address in the designated fields at the top of the form.

- Provide a description of the property you wish to transfer. Include the full address and any relevant details that clearly identify the property.

- Identify the beneficiary by entering their full name and address. Make sure the information is accurate to avoid any future complications.

- Specify the relationship between you and the beneficiary. This could be a family member, friend, or other designated individual.

- Sign the form in the presence of a notary public. Ensure that the notary completes their section, which includes their signature and seal.

- Make copies of the completed and notarized form for your records.

- File the original form with the appropriate county office where the property is located. This step is crucial for the deed to be valid.

Once the form is filed, it will be recorded, and the beneficiary will be notified of their designation. Keep a copy of the filed deed in a safe place for future reference.