Legal Power of Attorney Form

Power of AttorneyTemplates for Specific States

Documents used along the form

A Power of Attorney (POA) is a powerful document that allows one person to act on behalf of another in legal or financial matters. When creating a POA, it's often beneficial to consider additional forms and documents that can complement its effectiveness. Below is a list of commonly used documents that may accompany a Power of Attorney.

- Advance Healthcare Directive: This document outlines an individual's healthcare preferences and appoints someone to make medical decisions on their behalf if they become unable to do so.

- Living Will: A living will specifies an individual's wishes regarding medical treatment in situations where they are unable to communicate their preferences, particularly at the end of life.

- Durable Power of Attorney: This is a specific type of POA that remains effective even if the principal becomes incapacitated, ensuring that decisions can still be made on their behalf.

- Financial Power of Attorney: This document grants authority to a designated person to manage financial matters, such as banking and property transactions, specifically tailored for financial decisions.

- Trust Agreement: A trust agreement allows an individual to place assets into a trust, managed by a trustee, for the benefit of another person or group, often used for estate planning.

- Will: A will outlines how a person's assets and responsibilities should be handled after their death, including the appointment of guardians for minor children.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance or retirement accounts, upon the individual’s death, ensuring that wishes are honored.

Considering these additional documents can enhance the effectiveness of a Power of Attorney. Each serves a unique purpose and collectively helps ensure that personal, financial, and medical decisions align with your wishes and best interests.

Other Templates:

Booth Rental Contract - This agreement protects both parties from misunderstandings.

Business Purchase Loi - It allows both parties to discuss potential roadblocks early on.

Power of Attorney Document Categories

Similar forms

The Durable Power of Attorney is closely related to the standard Power of Attorney. Both documents allow an individual to appoint someone else to make decisions on their behalf. The key difference lies in durability; the Durable Power of Attorney remains effective even if the principal becomes incapacitated. This ensures that the appointed agent can continue to act in the principal's best interest without interruption.

A Medical Power of Attorney is another document similar to the Power of Attorney. This specific form grants authority to an individual to make healthcare decisions for someone else. It is particularly important when the principal is unable to communicate their wishes regarding medical treatment. This document focuses solely on health-related decisions, unlike the general Power of Attorney, which may cover financial and legal matters as well.

The Living Will is akin to the Power of Attorney but serves a different purpose. While a Power of Attorney allows someone to make decisions on behalf of another, a Living Will outlines an individual's preferences for medical treatment in situations where they cannot express their wishes. This document is crucial for guiding healthcare providers and family members during critical moments.

A Financial Power of Attorney is a specialized form that focuses solely on financial matters. It empowers an agent to manage financial transactions, pay bills, and handle investments on behalf of the principal. This document is essential for individuals who want to ensure their financial affairs are managed according to their wishes, especially during periods of incapacity.

The Healthcare Proxy is similar to the Medical Power of Attorney. It designates an individual to make medical decisions when the principal is unable to do so. Both documents aim to ensure that healthcare choices align with the principal’s values and preferences. However, a Healthcare Proxy may not address all aspects of medical treatment as comprehensively as a Medical Power of Attorney.

The Revocable Trust can also be compared to the Power of Attorney. A Revocable Trust allows individuals to place their assets into a trust, which they can manage during their lifetime. Upon incapacitation or death, the trust provides a clear plan for asset distribution. While the Power of Attorney grants authority to act on behalf of someone, a Revocable Trust directly manages the individual’s assets.

The Guardianship document is related in that it involves decision-making for individuals who cannot care for themselves. A Guardianship is established through court proceedings and appoints someone to make decisions for a minor or an incapacitated adult. Unlike a Power of Attorney, which is voluntarily created, Guardianship is a legal intervention to protect vulnerable individuals.

The Advance Directive encompasses both the Living Will and Medical Power of Attorney, making it a comprehensive document for healthcare decisions. It allows individuals to express their medical preferences and designate an agent to make decisions if they cannot do so. This document ensures that a person's healthcare choices are respected and followed in critical situations.

The Bill of Sale, while different in function, shares similarities with the Power of Attorney in terms of authorization. A Bill of Sale transfers ownership of personal property from one person to another and requires the signature of both parties. This document serves as a legal record of the transaction and demonstrates the authority of the seller to transfer ownership.

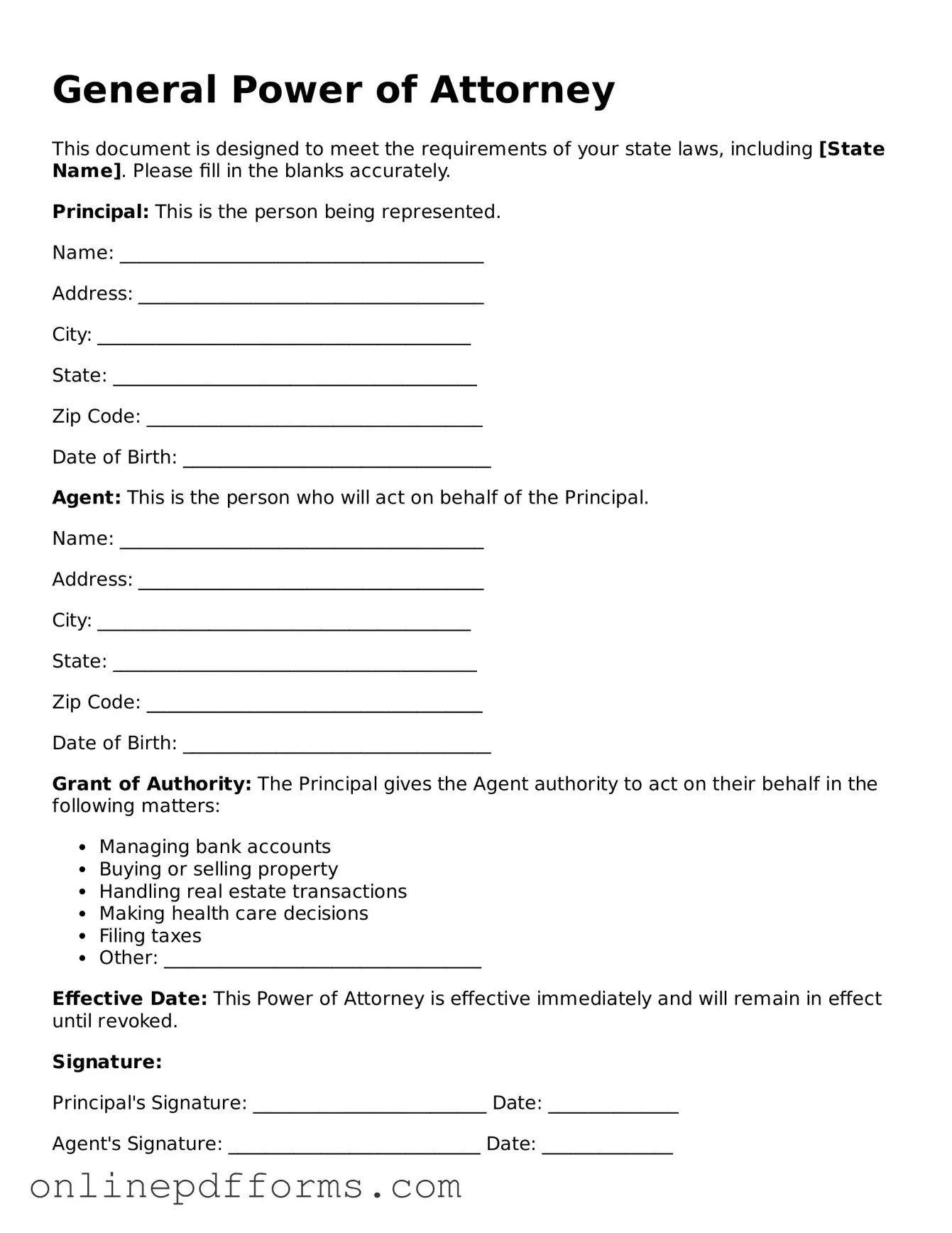

Steps to Filling Out Power of Attorney

Filling out a Power of Attorney form is an important step in designating someone to act on your behalf in legal matters. After completing the form, you will need to ensure that it is properly signed and witnessed, as required by your state’s laws. This will help ensure that your wishes are honored and that the designated individual can act effectively.

- Obtain the Power of Attorney form. You can find this form online, at legal offices, or through state-specific resources.

- Read the instructions carefully. Familiarize yourself with the sections of the form and the responsibilities of the person you are appointing.

- Fill in your personal information. This typically includes your full name, address, and date of birth.

- Identify the person you are granting authority to. Include their full name, address, and relationship to you.

- Specify the powers you are granting. Clearly outline what decisions the appointed person can make on your behalf.

- Set a start date for the Power of Attorney. Decide whether it will be effective immediately or only under certain conditions.

- Include any limitations. If there are specific actions that the appointed person cannot take, list them clearly.

- Sign and date the form. Ensure that your signature is consistent with your legal name.

- Have the form witnessed, if required. Some states require a witness or notarization for the Power of Attorney to be valid.

- Make copies. Keep a copy for yourself and provide copies to the appointed person and any relevant institutions.