Legal Prenuptial Agreement Form

Prenuptial AgreementTemplates for Specific States

Documents used along the form

A prenuptial agreement, often referred to as a prenup, is a legal document that outlines the division of assets and responsibilities in the event of a divorce. While a prenup is a crucial document for many couples, it is often accompanied by other forms and documents that can provide additional clarity and protection. Below is a list of some common forms and documents that might be used alongside a prenuptial agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It serves to outline the financial arrangements and responsibilities of each spouse, especially if circumstances change during the marriage.

- Hold Harmless Agreement: This essential document outlines the responsibilities and protections for parties involved in potentially high-risk activities. For more details, please refer to the Hold Harmless Agreement form.

- Financial Disclosure Statement: This form requires both parties to disclose their financial information, including assets, debts, and income. Transparency is key in ensuring that both partners understand each other's financial situation before entering into a prenup.

- Marital Settlement Agreement: This document is typically used during divorce proceedings. It outlines the terms of the separation, including asset division, alimony, and child custody arrangements, ensuring that both parties agree to the terms of their divorce.

- Power of Attorney: A power of attorney grants one spouse the authority to make financial or medical decisions on behalf of the other in case they become incapacitated. This document can be particularly important for couples who wish to ensure that their partner can manage their affairs if needed.

- Will: A will outlines how a person's assets will be distributed upon their death. Couples often update their wills to reflect their marital status and ensure that their wishes regarding asset distribution are clear and legally binding.

Understanding these documents can help couples navigate their financial and legal responsibilities more effectively. Each form serves a specific purpose and can provide peace of mind as partners prepare for their future together.

Other Templates:

Broward County Animal Care and Adoption - The certificate must be filled out clearly to ensure accurate record-keeping.

Employer's Quarterly Federal Tax Return - This quarterly tax form helps businesses report Social Security and Medicare taxes owed.

When dealing with the transfer of ownership for a trailer in Maryland, it is essential to utilize the appropriate documentation, such as the Maryland Trailer Bill of Sale form. This form is vital for ensuring transparency in the transaction and providing a clear record of the sale. To further assist buyers and sellers, resources like Auto Bill of Sale Forms offer guidance and templates that simplify the process, ensuring that both parties are protected and informed throughout the transaction.

Blank Promissory Note - These notes are often quicker and less formal than traditional loan contracts.

Similar forms

A Cohabitation Agreement is similar to a Prenuptial Agreement in that it outlines the rights and responsibilities of individuals living together before marriage. This document is particularly useful for couples who want to clarify financial matters, property ownership, and other important aspects of their relationship without the legal implications of marriage. Like a prenuptial agreement, it can help prevent disputes and provide a clear framework for the couple's living arrangements and expectations.

When looking to rent a property, potential tenants are often required to submit a detailed form that includes essential information. This Florida rental application process allows landlords to evaluate applicants by reviewing their rental history, employment details, and personal backgrounds, ensuring a thorough assessment before making rental decisions.

A Postnuptial Agreement shares similarities with a Prenuptial Agreement, as both documents are designed to manage financial and property issues within a marriage. However, while a prenuptial agreement is created before marriage, a postnuptial agreement is established after the couple has tied the knot. This type of agreement can be beneficial if circumstances change during the marriage, allowing couples to revisit and redefine their financial arrangements and responsibilities.

A Will, while primarily focused on the distribution of assets after death, can also bear similarities to a Prenuptial Agreement in terms of asset management. Both documents allow individuals to express their wishes regarding property and financial matters. A prenuptial agreement lays out terms for asset division during a divorce, while a will specifies how assets should be handled upon one’s passing. Both documents aim to reduce conflict and ensure that individuals' intentions are respected.

Lastly, a Trust Agreement can be compared to a Prenuptial Agreement in that both deal with the management and distribution of assets. A trust allows individuals to place their assets in a legal entity that can be managed by a trustee for the benefit of designated beneficiaries. Similarly, a prenuptial agreement defines how assets will be treated during a marriage and in the event of divorce. Both documents serve to protect individuals’ interests and provide clarity regarding their financial affairs.

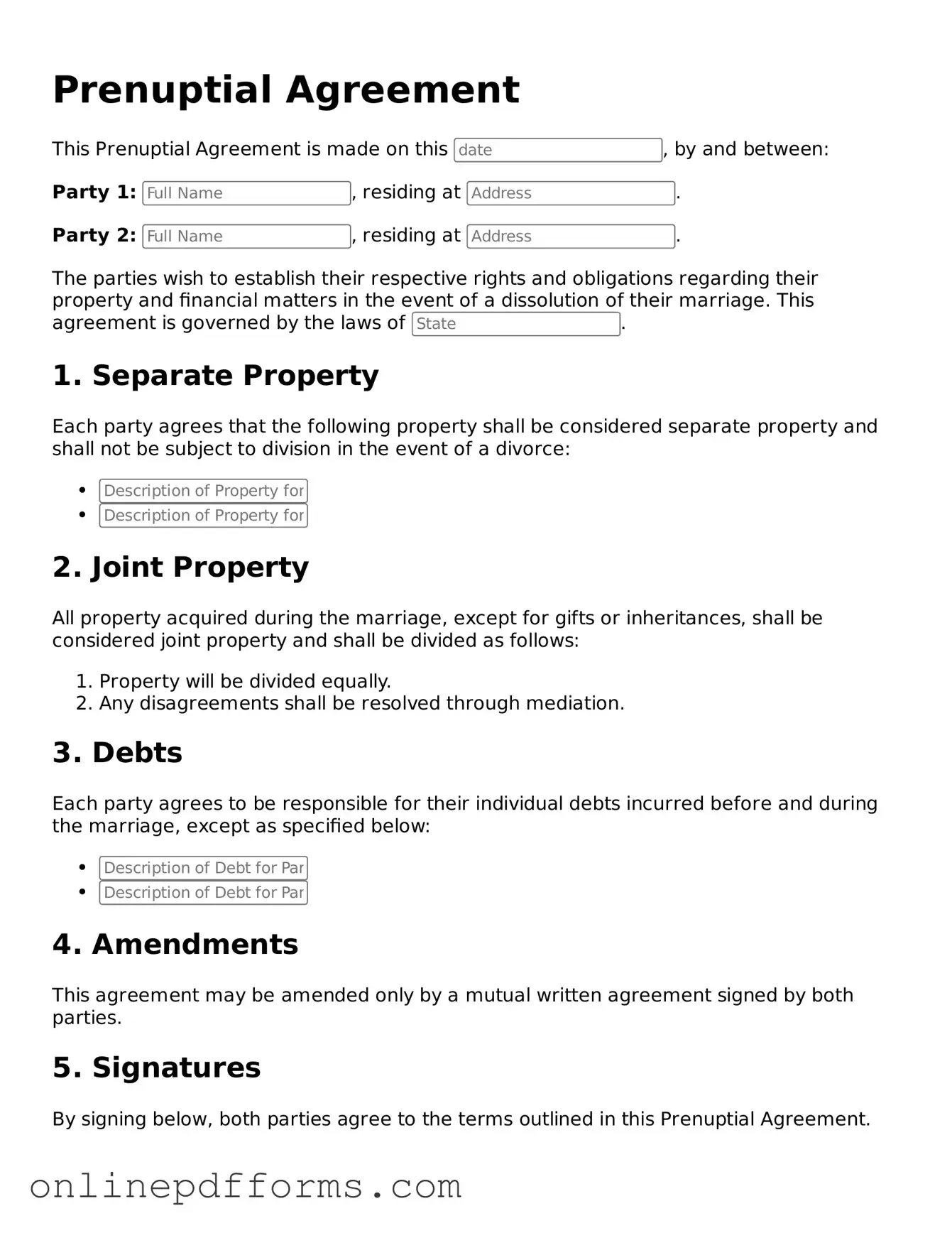

Steps to Filling Out Prenuptial Agreement

Filling out a Prenuptial Agreement form is an important step for couples considering marriage. This document helps clarify financial rights and responsibilities before tying the knot. Below are the steps to guide you through the process of completing the form.

- Begin by gathering personal information for both parties, including full names, addresses, and contact details.

- Clearly state the date of the marriage and the intended location.

- List all assets owned by each party, including real estate, bank accounts, investments, and personal property.

- Detail any debts each party has, such as loans, credit card balances, or mortgages.

- Discuss and outline how you want to handle future income, property acquired during the marriage, and any potential inheritances.

- Include provisions for spousal support or alimony, if applicable, detailing any agreements made.

- Consider including terms for dispute resolution, such as mediation or arbitration, should disagreements arise.

- Both parties should review the agreement thoroughly and discuss any necessary changes.

- Sign the document in the presence of a notary public to ensure its validity.

Once the form is completed and signed, it is advisable to keep copies for both parties. Consulting with a legal expert can also provide additional peace of mind and ensure that the agreement meets all legal requirements.