Fill in Your Profit And Loss Template

Documents used along the form

The Profit and Loss form is a crucial document for assessing a company's financial performance over a specific period. Alongside this form, several other documents are often utilized to provide a comprehensive view of a business's financial health. Below is a list of related forms and documents that are commonly used in conjunction with the Profit and Loss form.

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand the financial position of the business.

- Cash Flow Statement: This statement outlines the cash inflows and outflows over a period. It highlights how cash is generated and used, providing insight into the liquidity of the business.

- Statement of Changes in Equity: This document details the movement in equity accounts over a reporting period. It includes information on retained earnings, dividends, and additional capital contributions.

- Budget: A budget is a financial plan that estimates future income and expenses. It serves as a guideline for managing finances and helps in setting financial goals.

- Tax Returns: These are official documents filed with tax authorities that report income, expenses, and other tax-related information. They are essential for compliance and financial planning.

- Accounts Receivable Aging Report: This report categorizes a company's accounts receivable based on the length of time an invoice has been outstanding. It helps in managing collections and assessing credit risk.

- Accounts Payable Aging Report: Similar to the receivable report, this document categorizes a company's liabilities based on how long they have been due. It assists in managing cash flow and payment schedules.

- Inventory Report: This report provides details about the inventory levels, including quantities and values. It is vital for tracking stock and managing supply chain operations.

These documents collectively enhance the understanding of a company's financial situation. They are essential for decision-making, strategic planning, and ensuring compliance with financial regulations.

More PDF Templates

Funds Available for My Stay - The form can serve as a significant step towards achieving your educational and career aspirations in Canada.

Puppy Shot Record Printable Free - This form promotes responsible pet ownership.

Form 1098 Mortgage - Partial payments are not applied to your mortgage; they are held separately until paid in full.

Similar forms

The Profit and Loss form, often referred to as the income statement, is crucial for understanding a business's financial performance over a specific period. It shares similarities with the Balance Sheet, which provides a snapshot of a company's assets, liabilities, and equity at a particular moment in time. While the Profit and Loss form focuses on revenue and expenses, the Balance Sheet complements it by showing how those revenues and expenses affect the overall financial position of the business. Together, they give a comprehensive view of financial health.

Another document closely related to the Profit and Loss form is the Cash Flow Statement. This statement details the inflows and outflows of cash within a business during a specific period. While the Profit and Loss form reports on profitability, the Cash Flow Statement highlights liquidity, showing how cash is generated and used. Both documents are essential for assessing a company’s financial stability, but they do so from different perspectives.

The Budget is another document that aligns with the Profit and Loss form. A budget is a financial plan that outlines expected revenues and expenditures over a future period. It serves as a benchmark against which actual performance, as shown in the Profit and Loss form, can be measured. By comparing the two, businesses can evaluate their financial discipline and make necessary adjustments to stay on track.

The Statement of Retained Earnings also bears similarities to the Profit and Loss form. This statement outlines changes in retained earnings over a specific period, detailing how profits or losses from the Profit and Loss form are reinvested in the business or distributed to shareholders. It helps stakeholders understand how profits are utilized, thus providing a broader context for financial decision-making.

The Trial Balance is another important document that relates to the Profit and Loss form. This internal report lists all the balances of the general ledger accounts at a specific point in time. It serves as a preliminary check to ensure that total debits equal total credits before preparing the Profit and Loss form. While the Trial Balance is more of an accounting tool, it lays the groundwork for accurate financial reporting.

The Statement of Comprehensive Income is similar to the Profit and Loss form but includes additional items that affect equity. This document accounts for all income and expenses, including those not typically reported on the Profit and Loss form, such as unrealized gains and losses. It provides a more extensive view of a company’s financial performance, capturing elements that might impact long-term financial health.

Finally, the Financial Forecast is akin to the Profit and Loss form in that it projects future revenues and expenses based on historical data and market trends. While the Profit and Loss form reflects past performance, the Financial Forecast aims to predict future outcomes, helping businesses plan strategically. Both documents are essential for financial planning and decision-making, enabling businesses to set realistic goals and measure progress.

Steps to Filling Out Profit And Loss

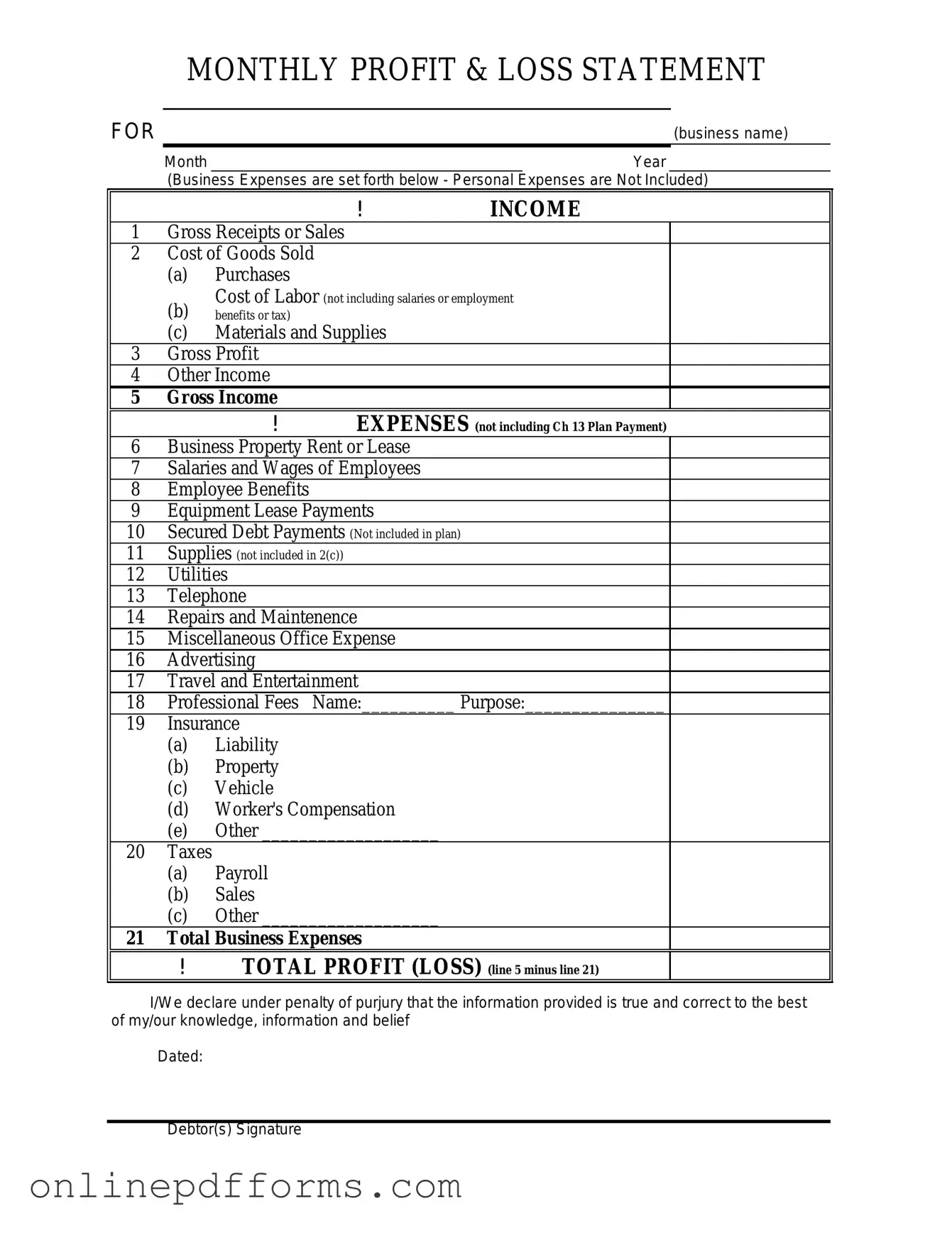

Completing the Profit and Loss form is a straightforward process that requires careful attention to detail. Following the steps outlined below will help ensure that all necessary information is accurately captured.

- Gather all relevant financial documents, including sales records, expense receipts, and bank statements.

- Begin by entering the reporting period for which you are completing the form. This could be monthly, quarterly, or annually.

- List all sources of revenue. Include sales income, service income, and any other income streams.

- Calculate the total revenue by adding all income sources together.

- Identify and list all operating expenses. This may include rent, utilities, salaries, and materials.

- Sum the total operating expenses to determine the overall cost incurred during the reporting period.

- Subtract the total expenses from the total revenue to find the net profit or loss.

- Review all entries for accuracy and completeness before finalizing the form.

- Submit the completed form to the relevant parties or keep it for your records, as needed.