Legal Promissory Note Form

Promissory NoteTemplates for Specific States

Documents used along the form

A Promissory Note is a crucial document in lending and borrowing arrangements, outlining the borrower's promise to repay a loan. However, it is often accompanied by other forms and documents that help clarify the terms and provide additional legal protections. Below is a list of commonly used documents that may be associated with a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document details the specific assets that the borrower offers as security. It outlines the lender's rights in the event of default.

- Guaranty Agreement: This document involves a third party agreeing to repay the loan if the borrower defaults. It provides additional assurance to the lender that the loan will be repaid.

- Disclosure Statement: This form provides essential information about the loan, including the annual percentage rate (APR), total cost of the loan, and any fees. It ensures transparency between the parties.

- Amortization Schedule: This document outlines the repayment plan, detailing each payment's principal and interest components over the loan term. It helps borrowers understand their payment obligations.

- Loan Application: This form collects the borrower's financial information, credit history, and other relevant details. It assists lenders in assessing the borrower's creditworthiness.

- Payment Receipt: After each payment is made, a receipt serves as proof of payment. It is important for record-keeping and can be useful in case of disputes.

- Default Notice: If the borrower fails to make payments, this document formally notifies them of the default and outlines the lender's rights to take action.

- Aaa International Driving Permit Application: This essential form allows travelers to legally drive abroad by translating their driver's license. Properly filling out the application ensures a hassle-free experience for those planning to drive internationally, as outlined here: https://fillable-forms.com/blank-aaa-international-driving-permit-application/.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations and confirms that the lender has no claims against them.

These documents work together to ensure that both parties understand their rights and obligations. They provide a framework for the loan, helping to prevent misunderstandings and disputes. Having the right documentation in place can significantly enhance the security of the lending process.

Other Templates:

Living Will Document - A Living Will may differ in name from state to state, such as "Advance Directive" or "Directive to Physicians."

Completing the Texas Trailer Bill of Sale properly is vital for both parties involved in the transaction, ensuring that all necessary details are captured to protect their interests. For further guidance, you can refer to Auto Bill of Sale Forms, which provide additional resources and template options that make the process smoother and more efficient.

Baseball Tryout Evaluation Form - Evaluate the ability to maintain focus during multiple drills.

Organization Meeting Minutes - Include any relevant background information shared.

Promissory Note Document Categories

Similar forms

A loan agreement is similar to a promissory note in that both documents outline the terms of a loan between a lender and a borrower. A loan agreement typically includes detailed information about the loan amount, interest rate, repayment schedule, and any collateral involved. While a promissory note is a simpler document that primarily serves as a promise to repay, a loan agreement provides a more comprehensive framework for the loan relationship, often addressing additional legal obligations and rights of both parties.

For those looking to find a reliable method to assess potential tenants, the California Rental Application form serves as a crucial tool, gathering essential information to evaluate their suitability for a lease. This standardized document requests personal details, employment history, and previous rental experiences, streamlining the selection process while protecting both landlords and applicants. For more information, you can visit californiapdf.com.

A mortgage is another document that shares similarities with a promissory note. In a mortgage, the borrower promises to repay a loan used to purchase real estate, and the property itself serves as collateral. Like a promissory note, a mortgage includes terms regarding the repayment of the loan. However, a mortgage is more complex as it involves specific legal rights related to the property and the lender’s ability to foreclose if the borrower fails to meet the repayment terms.

A personal guarantee is akin to a promissory note in that it involves a commitment to repay a debt. When an individual signs a personal guarantee, they agree to be responsible for another party’s debt if that party defaults. This document provides assurance to the lender, similar to how a promissory note confirms the borrower’s obligation. However, a personal guarantee often extends beyond just the promise to pay, as it may involve the individual’s personal assets in case of default.

An IOU (I Owe You) is a simpler form of acknowledgment of a debt and is closely related to a promissory note. An IOU states that one person owes money to another but typically lacks the detailed terms found in a promissory note. While an IOU can serve as a casual reminder of a debt, a promissory note is a more formalized document that includes specific repayment terms and conditions, providing better protection for the lender.

A credit agreement also shares similarities with a promissory note. This document outlines the terms under which a borrower can access credit from a lender. Like a promissory note, a credit agreement details the repayment obligations, including interest rates and payment schedules. However, credit agreements often cover a broader scope, including terms for ongoing borrowing and may involve multiple transactions over time, whereas a promissory note typically pertains to a single loan.

An installment agreement is another document that resembles a promissory note. This type of agreement allows a borrower to repay a debt in regular installments over a set period. Similar to a promissory note, an installment agreement specifies the amount owed, payment schedule, and interest rate. However, installment agreements often involve a series of payments, making them distinct in their structure and purpose compared to the one-time promise of a promissory note.

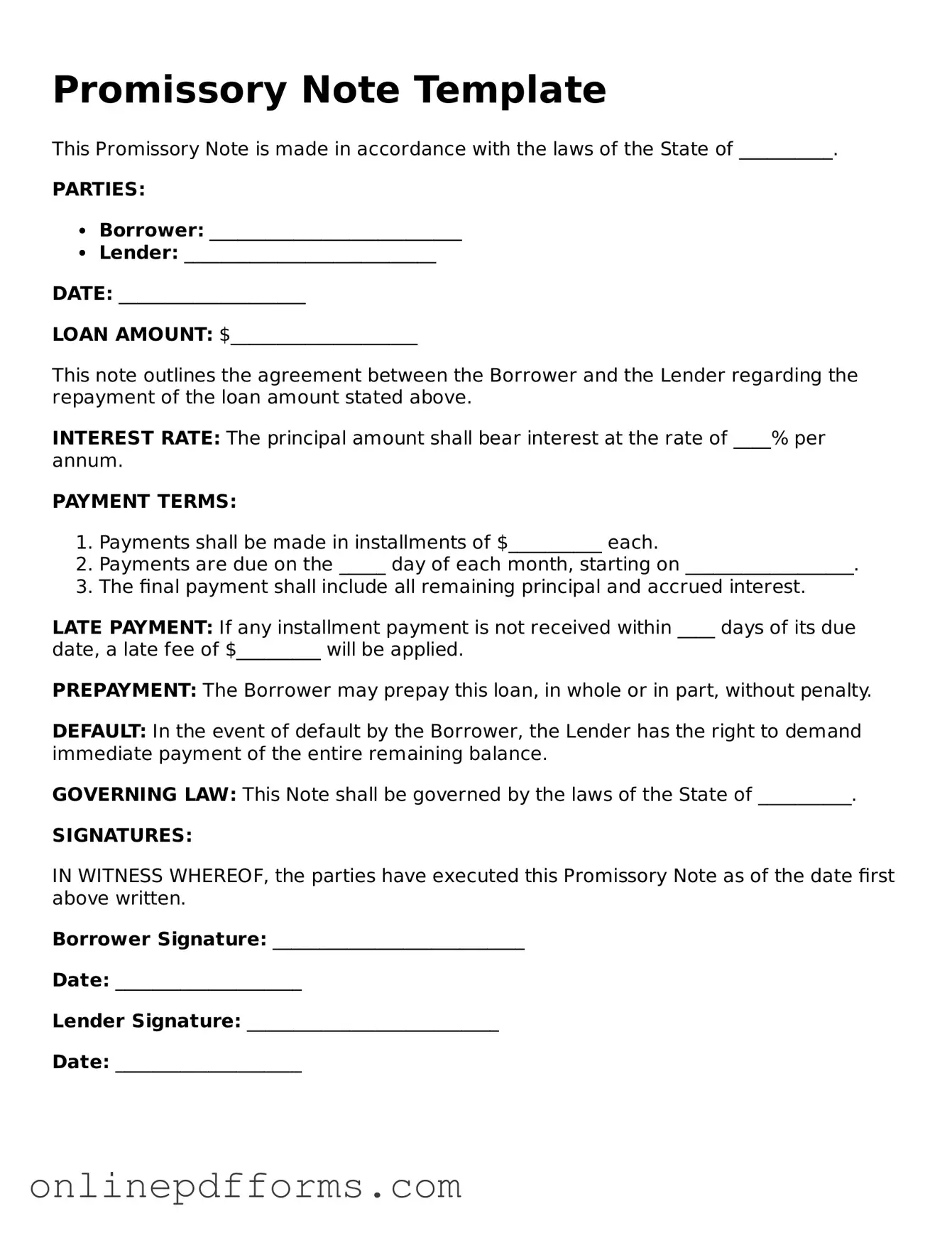

Steps to Filling Out Promissory Note

Once you have the Promissory Note form in hand, you can begin filling it out. This form is essential for documenting the terms of a loan agreement between a borrower and a lender. Carefully follow the steps below to ensure all necessary information is accurately provided.

- Title the Document: At the top of the form, write "Promissory Note" to clearly identify the document.

- Enter the Date: Write the date on which the note is being created.

- Borrower Information: Fill in the full name and address of the borrower. Ensure all details are correct.

- Lender Information: Provide the full name and address of the lender. Double-check for accuracy.

- Loan Amount: Clearly state the total amount of money being borrowed. Use numbers and words for clarity.

- Interest Rate: Specify the interest rate applicable to the loan. Indicate whether it is fixed or variable.

- Payment Terms: Describe how and when payments will be made. Include the frequency of payments (e.g., monthly) and due dates.

- Late Fees: If applicable, outline any penalties for late payments. Be specific about the amount or percentage.

- Signatures: Both the borrower and lender must sign and date the document to make it legally binding.

After completing the form, review it thoroughly to ensure all information is accurate and complete. Both parties should keep a copy for their records. This will help in maintaining clarity and accountability throughout the loan term.