Legal Promissory Note for a Car Form

Documents used along the form

When dealing with a car purchase, a Promissory Note is often accompanied by several other important documents. Each of these forms plays a crucial role in ensuring a smooth transaction and protecting the interests of both the buyer and the seller. Here’s a list of documents that you may encounter alongside a Promissory Note for a car.

- Bill of Sale: This document serves as proof of the transaction. It includes details about the vehicle, the sale price, and the parties involved. It is essential for transferring ownership.

- Title Transfer Document: This form is necessary for officially transferring the vehicle's title from the seller to the buyer. It ensures that the buyer is recognized as the new owner.

- Vehicle History Report: A report that provides information about the car's past, including any accidents, repairs, or title issues. This helps buyers make informed decisions.

- Loan Agreement: If financing is involved, this document outlines the terms of the loan, including interest rates, payment schedules, and consequences of default.

- Odometer Disclosure Statement: This statement verifies the car's mileage at the time of sale. It protects against fraud related to odometer tampering.

- Promissory Note Form: A crucial document in car financing, the Promissory Note outlines the borrower's promise to repay the lender. To ensure that you have the correct document, you can open the form for proper completion.

- Insurance Verification: Proof of insurance coverage is often required before completing the sale. This document ensures that the vehicle is insured under the buyer’s name.

- Sales Contract: A comprehensive agreement that details the terms of the sale, including payment methods, warranties, and any contingencies.

- Power of Attorney: In some cases, this document allows one party to act on behalf of another in the transaction. It can simplify the process if the buyer or seller cannot be present.

- Inspection Report: If the vehicle has been inspected, this report provides details about its condition. It can help the buyer understand any potential issues before purchase.

Having these documents ready can streamline the car buying process and provide clarity for both parties. Always ensure that you understand each form before signing to protect your interests.

Consider More Types of Promissory Note for a Car Forms

Satisfaction of Promissory Note - Consider including any additional agreements reached during the release process.

If you're in need of a reliable way to document a loan agreement, the customizable solution for your Texas Promissory Note is readily available. Access this valuable resource to ensure all terms are set clearly and legally binding. Begin your process with the integrated tools found within our dedicated Texas Promissory Note form guide.

Similar forms

A car loan agreement shares similarities with a promissory note for a car. Both documents serve as formal contracts between a borrower and a lender. In a car loan agreement, the borrower commits to repaying the loan amount, typically with interest, over a specified period. Like a promissory note, this agreement outlines the terms of repayment, including the schedule and any consequences for defaulting. Both documents aim to protect the interests of the lender while ensuring that the borrower understands their obligations.

In considering various formal financial agreements, it is important to recognize the nuances that differentiate a Promissory Note, such as those found at californiapdf.com/, from other documentation like Loan Agreements or Rental Agreements. Each contract serves specific purposes and outlines distinct terms, ensuring protection and clarity for both borrowers and lenders in their respective transactions.

A lease agreement is another document that resembles a promissory note for a car, particularly in the context of vehicle leasing. In a lease agreement, the lessee (the person leasing the car) agrees to make regular payments to the lessor (the owner of the car) for the use of the vehicle over a predetermined time. Similar to a promissory note, the lease outlines payment terms, duration, and responsibilities regarding maintenance and insurance. Both documents create a binding relationship that requires the lessee to fulfill their financial commitments.

A personal loan agreement also bears resemblance to a promissory note for a car. This document is used when an individual borrows money from another individual or financial institution for various purposes, including purchasing a vehicle. Like a promissory note, it specifies the loan amount, interest rate, and repayment schedule. Both documents ensure clarity on the borrower’s obligations and the lender’s rights, providing a framework for repayment and addressing potential defaults.

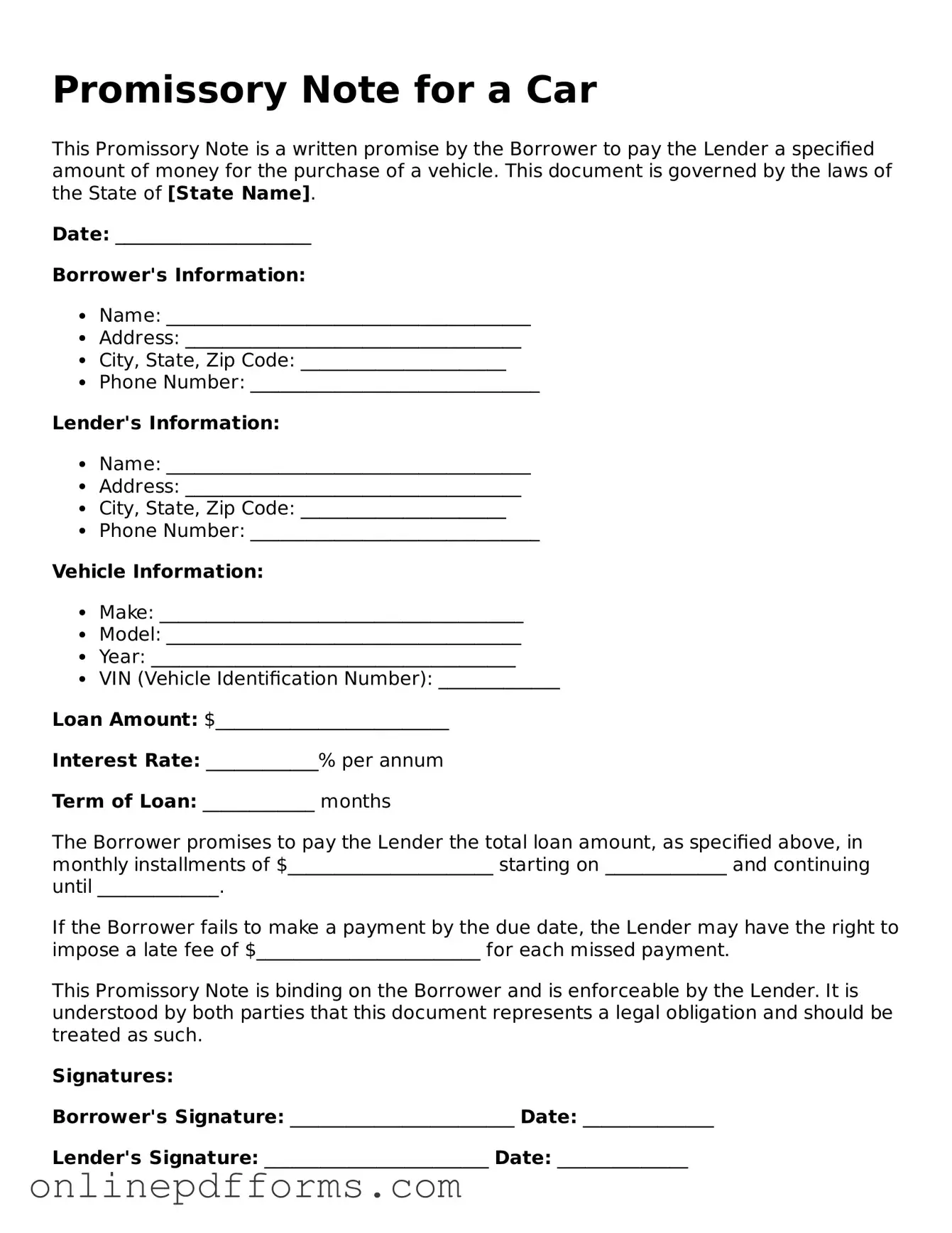

Steps to Filling Out Promissory Note for a Car

Filling out a Promissory Note for a car is an important step in formalizing a loan agreement. Once you complete the form, you’ll be ready to sign and date it, ensuring both parties understand the terms of the loan.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, write the name of the borrower. This should be the individual or entity taking out the loan.

- Then, provide the lender’s name. This is the person or institution providing the loan.

- Specify the amount of the loan in numerical form and then spell it out in words to avoid any confusion.

- Indicate the interest rate. This should be clearly stated as a percentage.

- Detail the repayment schedule. Include how often payments will be made (monthly, bi-weekly, etc.) and the total number of payments.

- Include any late fees or penalties for missed payments. Clearly outline the terms.

- Finally, both the borrower and lender should sign and date the form at the designated areas. Make sure to keep a copy for your records.