Legal Quitclaim Deed Form

Quitclaim DeedTemplates for Specific States

Documents used along the form

A Quitclaim Deed is often used in real estate transactions to transfer ownership of property without guaranteeing that the title is clear. Along with this form, several other documents may be required to ensure a smooth transfer of property rights. Here’s a list of some commonly associated forms and documents.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. It protects the buyer from future claims against the property.

- Title Search Report: A report that examines public records to confirm the property’s ownership history and any liens or encumbrances that may exist. This helps ensure the buyer is aware of any issues before the transaction is completed.

- Property Transfer Tax Form: This form is often required by state or local authorities to report the transfer of property and calculate any taxes owed on the transaction.

- Affidavit of Title: A sworn statement by the seller affirming that they hold clear title to the property and disclosing any known issues that could affect ownership.

- Closing Statement: This document outlines all financial aspects of the transaction, including purchase price, closing costs, and any credits or debits for both the buyer and seller.

- Power of Attorney: If the seller is unable to be present for the closing, this document allows another person to act on their behalf to complete the transaction.

- North Carolina Trailer Bill of Sale: This form is essential for documenting the sale of trailers in North Carolina. It is advisable to use standardized forms like Auto Bill of Sale Forms to ensure compliance with state regulations and to protect both the buyer and seller.

- Notice of Transfer: This document notifies local authorities of the change in property ownership, which may be required for tax assessment purposes.

Understanding these documents can help both buyers and sellers navigate the complexities of property transactions more effectively. Ensuring that all necessary forms are completed and submitted can facilitate a smoother transfer process and protect the interests of all parties involved.

Consider More Types of Quitclaim Deed Forms

How to File a Lady Bird Deed in Michigan - A Lady Bird Deed does not require the grantee to survive the owner, offering unique advantages in estate planning.

When engaging in the sale of an all-terrain vehicle, it is essential to utilize the proper documentation to facilitate a smooth transaction. The Connecticut ATV Bill of Sale form is particularly significant as it not only serves as proof of purchase for both parties but also ensures that the transfer of ownership is legally recognized. For those looking to buy or sell an ATV, having the right documentation is crucial, and you can find the necessary Vehicle Bill of Sale Forms to streamline the process.

California Corrective Deed - Even minor discrepancies can create significant issues; a Corrective Deed resolves them.

Similar forms

A warranty deed is a document used to transfer ownership of real property. Unlike a quitclaim deed, a warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This type of deed offers protection to the buyer, as it ensures that there are no undisclosed liens or claims against the property. In essence, a warranty deed assures the buyer of their ownership rights, whereas a quitclaim deed does not provide such assurances.

A grant deed is similar to a warranty deed in that it transfers ownership of real property. However, a grant deed typically contains fewer guarantees than a warranty deed. It assures the buyer that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances. While a grant deed offers some level of protection, it does not provide the same comprehensive coverage as a warranty deed.

A bargain and sale deed conveys property without warranties against encumbrances. This type of deed implies that the seller has ownership rights but does not guarantee that the title is free from defects. While a bargain and sale deed is similar to a quitclaim deed in terms of limited assurances, it does suggest that the seller has some interest in the property, which may provide a slight advantage to the buyer.

An executor’s deed is utilized when a property owner passes away and their estate is being settled. This type of deed transfers property from the deceased’s estate to the heirs or beneficiaries. Although an executor’s deed does not guarantee clear title, it is somewhat similar to a quitclaim deed in that it conveys ownership without extensive warranties. The key difference lies in the context of the transfer, as an executor’s deed is tied to the probate process.

A trustee’s deed is used when a property is transferred by a trustee, often in the context of a trust or foreclosure. This document conveys ownership without guarantees regarding the title. Like a quitclaim deed, a trustee’s deed does not provide assurances about potential claims or liens against the property. It serves as a straightforward means of transferring property, typically in situations where the trustee is acting on behalf of the trust or the lender.

Understanding the complexities of property transactions often requires familiarity with various legal documents, including the USCIS I-864 form, which is essential for those sponsoring immigrants. This important form ensures that sponsors can provide financial support, thereby preventing dependance on government assistance. For more information, you can refer to the https://pdftemplates.info/uscis-i-864-form, which outlines its significance in the sponsorship process.

Finally, a deed in lieu of foreclosure is a document that allows a homeowner to transfer their property to the lender to avoid foreclosure. This type of deed is similar to a quitclaim deed in that it conveys ownership without warranties. However, it is specifically used in situations where the homeowner is unable to keep up with mortgage payments. The lender accepts the deed in exchange for canceling the mortgage, allowing the homeowner to avoid the lengthy foreclosure process.

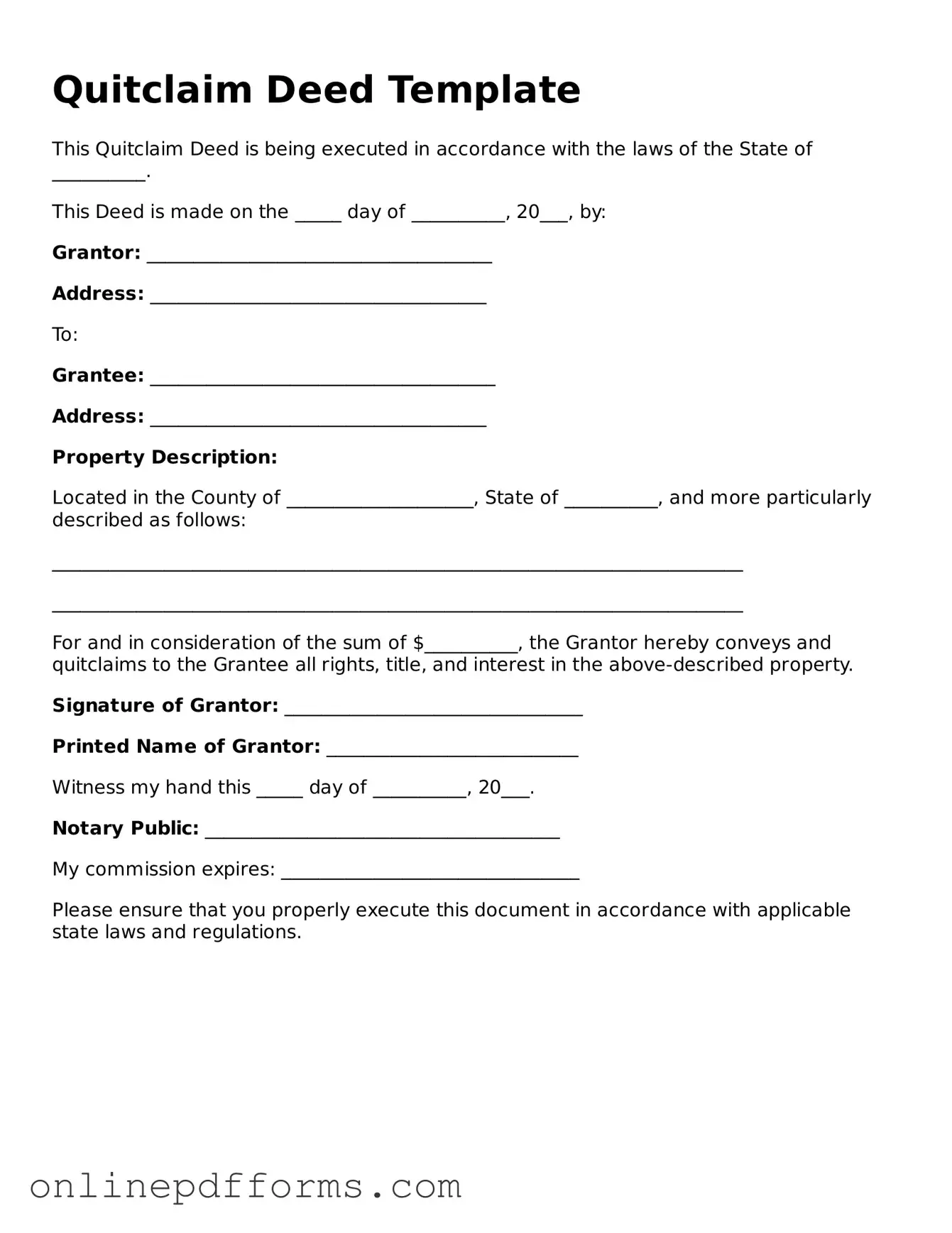

Steps to Filling Out Quitclaim Deed

Once you have the Quitclaim Deed form in hand, it's time to start filling it out. This form is essential for transferring property rights, and accuracy is crucial to ensure a smooth process. Follow the steps below carefully to complete the form correctly.

- Obtain the Quitclaim Deed form: You can find this form online, at your local county clerk's office, or from a real estate attorney.

- Identify the Grantor: Fill in the name of the person transferring the property rights. This is the individual or entity who currently owns the property.

- Identify the Grantee: Enter the name of the person or entity receiving the property rights. Ensure the name is spelled correctly.

- Provide a legal description of the property: Include the full address and a legal description. The legal description can usually be found on the property deed or tax records.

- Include the date: Write the date on which the transfer is taking place. This is important for record-keeping purposes.

- Sign the form: The Grantor must sign the Quitclaim Deed in the presence of a notary public. Ensure that the signature is clear and matches the name provided earlier.

- Notarize the document: The notary public will verify the identity of the Grantor and witness the signing of the form. The notary will then affix their seal to the document.

- Record the Quitclaim Deed: After notarization, take the completed form to the county recorder's office. This step is necessary to make the transfer official.

After completing these steps, the Quitclaim Deed will be ready for filing. Keep a copy for your records, and ensure that the Grantee receives their copy as well. This process solidifies the transfer of property rights and is a vital part of real estate transactions.