Legal Real Estate Purchase Agreement Form

Real Estate Purchase AgreementTemplates for Specific States

Documents used along the form

When engaging in a real estate transaction, several important documents accompany the Real Estate Purchase Agreement. Each of these forms serves a specific purpose and helps ensure a smooth process. Understanding these documents can help you navigate the complexities of buying or selling property.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are typically required to disclose information about the condition of the home, which can affect buyer decisions.

- Title Report: A title report verifies the legal ownership of the property and identifies any liens or encumbrances. This document ensures that the seller has the right to sell the property and that the buyer will receive clear title.

- Home Inspection Report: After a property inspection, this report details the condition of the home, including structural, electrical, and plumbing systems. Buyers use this information to make informed decisions about repairs or negotiations.

- Appraisal Report: An appraisal assesses the property's market value, which is crucial for securing financing. Lenders often require this document to ensure that the loan amount is appropriate for the property's worth.

- Vehicle Bill of Sale: This form records the sale and purchase of a motor vehicle and is essential for a lawful transaction in Connecticut. For more details, be sure to check out Vehicle Bill of Sale Forms.

- Loan Estimate: This form provides an overview of the mortgage loan terms, including interest rates, monthly payments, and closing costs. Buyers receive this document shortly after applying for a loan.

- Closing Disclosure: This document outlines the final terms of the loan and details all closing costs. Buyers receive it at least three days before closing, allowing time to review the terms before signing.

- Earnest Money Agreement: This agreement specifies the amount of money the buyer will put down to show their commitment to the purchase. It protects the seller in case the buyer backs out without a valid reason.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as appliances or furniture. It is important to clarify what is included in the transaction.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be properly executed and recorded to be valid.

- Affidavit of Title: This sworn statement confirms that the seller has the right to sell the property and that there are no undisclosed claims against it. It provides additional assurance to the buyer.

Familiarizing yourself with these documents can help you feel more confident throughout the real estate transaction process. Each plays a crucial role in protecting your interests and ensuring a successful transfer of ownership.

Other Templates:

Fake Utility Bill Template Download Free - The processing time for your utility bill may vary based on submission date.

The ADP Pay Stub form is a document that summarizes an employee's earnings and deductions for a specific pay period. It provides essential details such as gross pay, net pay, and tax withholdings, helping employees understand their compensation. For more detailed information or assistance in filling out the ADP Pay Stub form, you can visit pdfdocshub.com/adp-pay-stub-online/.

How Do You File a Mechanics Lien - Used by contractors and suppliers to protect their financial interests.

Real Estate Purchase Agreement Document Categories

Similar forms

The Real Estate Purchase Agreement (REPA) is similar to a Lease Agreement in that both documents outline the terms and conditions under which property is used or transferred. A Lease Agreement specifies the rental terms, duration, and responsibilities of both the landlord and tenant. Like the REPA, it requires signatures from both parties and often includes details about payment amounts, maintenance responsibilities, and penalties for breach of contract. Both documents serve to protect the interests of the parties involved, ensuring that everyone understands their rights and obligations regarding the property.

Another document that shares similarities with the REPA is the Offer to Purchase Agreement. This document is used when a buyer expresses interest in purchasing a property and outlines the proposed terms of the sale. Like the REPA, the Offer to Purchase includes essential details such as the purchase price, contingencies, and timelines for closing. Once both parties agree to the terms, the Offer can evolve into a more formal Real Estate Purchase Agreement, emphasizing the importance of clear communication in real estate transactions.

The Seller’s Disclosure Statement is also comparable to the REPA. This document provides potential buyers with critical information about the property's condition, including any known defects or issues. While the REPA focuses on the transaction itself, the Seller’s Disclosure Statement ensures that buyers are fully informed before making a purchase. Both documents aim to foster transparency and trust between the buyer and seller, reducing the likelihood of disputes after the sale is finalized.

In navigating the complexities of vehicle sales, having the right documentation is crucial, and one such essential document is the Auto Bill of Sale Forms, which facilitates a clear and official record of the ownership transfer, ensuring a seamless transition for both the seller and buyer involved in the transaction.

Lastly, the Title Commitment is another document that relates closely to the REPA. The Title Commitment outlines the terms under which a title insurance policy will be issued and confirms the legal ownership of the property. It provides details about any liens, encumbrances, or other claims against the property. Like the REPA, it is essential for ensuring a smooth transaction and protecting the buyer's investment. Both documents work together to confirm that the buyer is acquiring a clear and marketable title, which is crucial for a successful real estate transaction.

Steps to Filling Out Real Estate Purchase Agreement

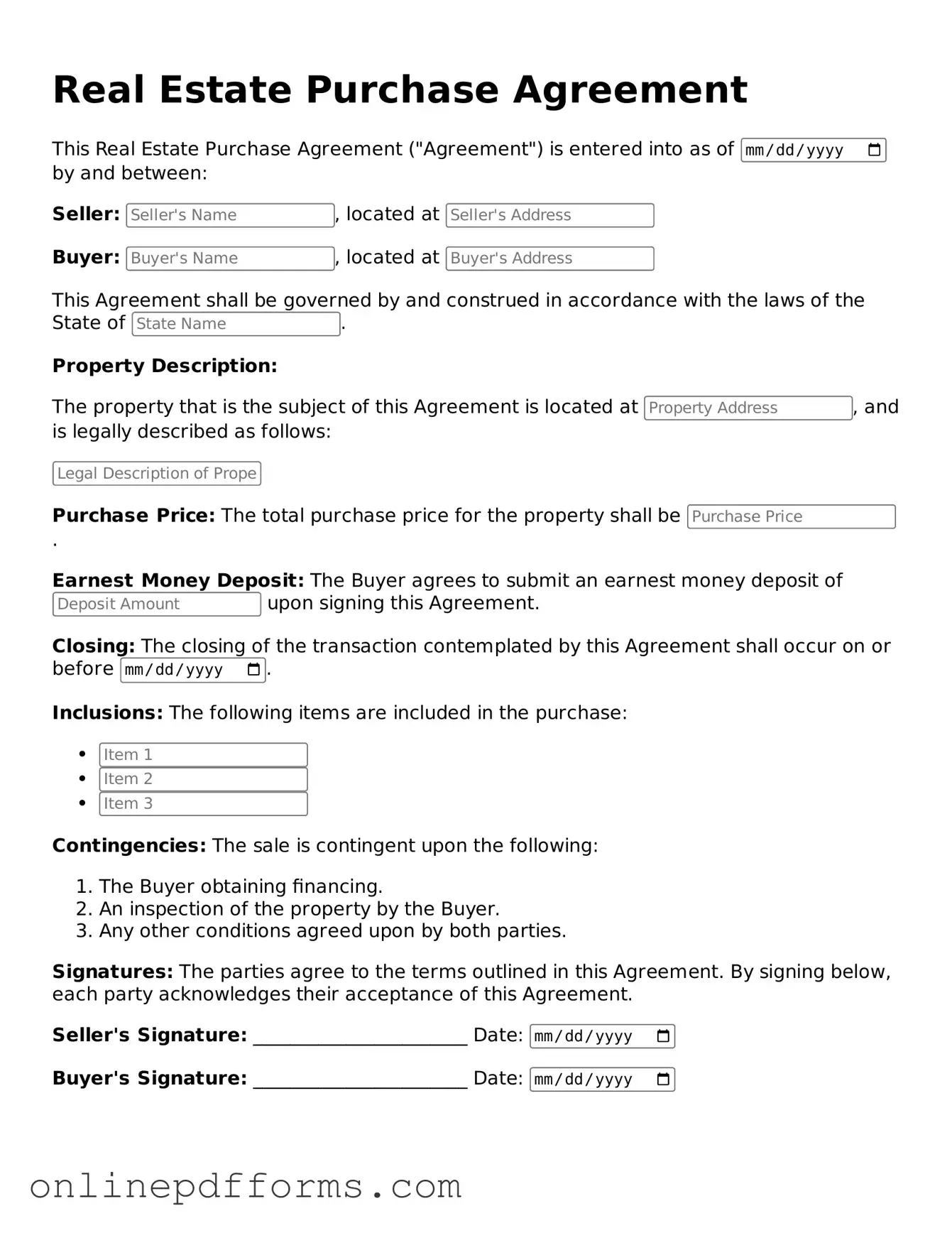

Filling out a Real Estate Purchase Agreement is an important step in the process of buying or selling property. This document outlines the terms of the sale and protects both parties involved. Completing the form accurately is essential to ensure a smooth transaction.

- Start with the date: Write the date on which you are filling out the agreement at the top of the form.

- Identify the parties: Fill in the names and contact information of the buyer(s) and seller(s). Ensure that the names are spelled correctly.

- Property details: Provide the address and legal description of the property being sold. This information can typically be found on the property deed.

- Purchase price: Enter the agreed-upon purchase price for the property. Make sure this amount is clear and accurate.

- Earnest money: Specify the amount of earnest money that the buyer will provide as a deposit. Include details about how this money will be held.

- Financing terms: Describe how the buyer intends to finance the purchase, whether through a mortgage, cash, or other means.

- Closing date: Indicate the proposed closing date for the sale. This is the date when ownership will officially transfer.

- Contingencies: List any contingencies that must be met before the sale can proceed, such as inspections or financing approvals.

- Signatures: Ensure that both the buyer and seller sign and date the agreement. This step is crucial for making the document legally binding.

Once you have completed the form, review it carefully to confirm all information is accurate. Both parties should keep a copy of the signed agreement for their records.