Legal Release of Promissory Note Form

Documents used along the form

The Release of Promissory Note form is an important document used to formally acknowledge that a promissory note has been paid off or is no longer enforceable. Along with this form, several other documents often come into play to ensure a smooth transaction and to clarify the terms involved. Below are some commonly used forms and documents that you may encounter in conjunction with the Release of Promissory Note.

- Promissory Note: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and consequences of default. It serves as the original agreement between the borrower and the lender.

- Loan Agreement: This is a comprehensive contract that details all terms and conditions related to the loan. It may include clauses about collateral, late fees, and other obligations of both parties.

- Georgia Promissory Note: A legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. For more information, visit https://georgiapdf.com/.

- Payment Receipt: This document serves as proof that the borrower has made the final payment on the loan. It typically includes the amount paid, the date of payment, and any remaining balance, if applicable.

- Release of Lien: If the loan was secured by collateral, this document is necessary to release the lender's claim on the asset once the loan is paid off. It provides legal confirmation that the borrower now owns the collateral free and clear.

Understanding these documents can help ensure that all parties are clear on their rights and obligations. Always consider consulting with a professional if you have questions about any specific document or the overall process.

Consider More Types of Release of Promissory Note Forms

Can I Buy a Car With a Promissory Note - Describes the terms under which the loan is granted and the responsibilities incurred.

For individuals and businesses in need of a clear agreement regarding loans, the Florida Promissory Note form can be an essential tool. By detailing key elements such as the loan amount, interest rate, and repayment schedule, it helps parties avoid misunderstandings. To access a template for this important legal document, you can visit floridaforms.net/blank-promissory-note-form/, ensuring that your loan agreements are properly documented and enforceable in Florida.

Similar forms

The Release of Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. However, while a Loan Agreement establishes the initial terms of the loan, the Release of Promissory Note signifies the completion of the obligation, confirming that the borrower has fulfilled their repayment duties.

Another document that resembles the Release of Promissory Note is the Satisfaction of Mortgage. This form indicates that a mortgage has been paid in full, releasing the borrower from the obligation. Similar to the Release of Promissory Note, it serves as proof that a financial obligation has been satisfied and protects the borrower from future claims on the property.

The Deed of Release is also comparable. This document is used to release a lien or claim on a property. Like the Release of Promissory Note, it signifies the end of a financial obligation. Both documents provide necessary legal assurance that the borrower is no longer encumbered by the debt.

In the context of securing loans and financial obligations, it is essential to utilize various forms to clarify agreements, such as the Release of Promissory Note which ensures both parties are aware of their rights and responsibilities. To further enhance your understanding of these legal documents, consider exploring resources like California PDF Forms, which provide templates and information regarding promissory notes and similar agreements that safeguard your interests in any lending scenario.

A Bill of Sale is another related document. This form transfers ownership of personal property from one party to another. While a Bill of Sale focuses on the transfer of ownership, the Release of Promissory Note confirms the completion of a financial agreement. Both documents serve to finalize transactions and provide legal protection to the parties involved.

The Certificate of Satisfaction is similar in function to the Release of Promissory Note. It serves as official confirmation that a debt has been paid. This document provides evidence to third parties that the borrower has fulfilled their obligations, similar to how the Release of Promissory Note confirms that the borrower has repaid their debt in full.

A Release of Lien is another document that functions similarly. This form is used to remove a lien from a property once the debt has been satisfied. Like the Release of Promissory Note, it indicates that the debtor has met their obligations, thereby clearing the title of any claims from creditors.

Lastly, the Final Accounting Statement can be compared to the Release of Promissory Note. This document summarizes the financial transactions between parties, detailing amounts paid and outstanding balances. While the Final Accounting Statement provides a snapshot of the financial relationship, the Release of Promissory Note confirms that the borrower has completed their obligations, marking the end of that financial relationship.

Steps to Filling Out Release of Promissory Note

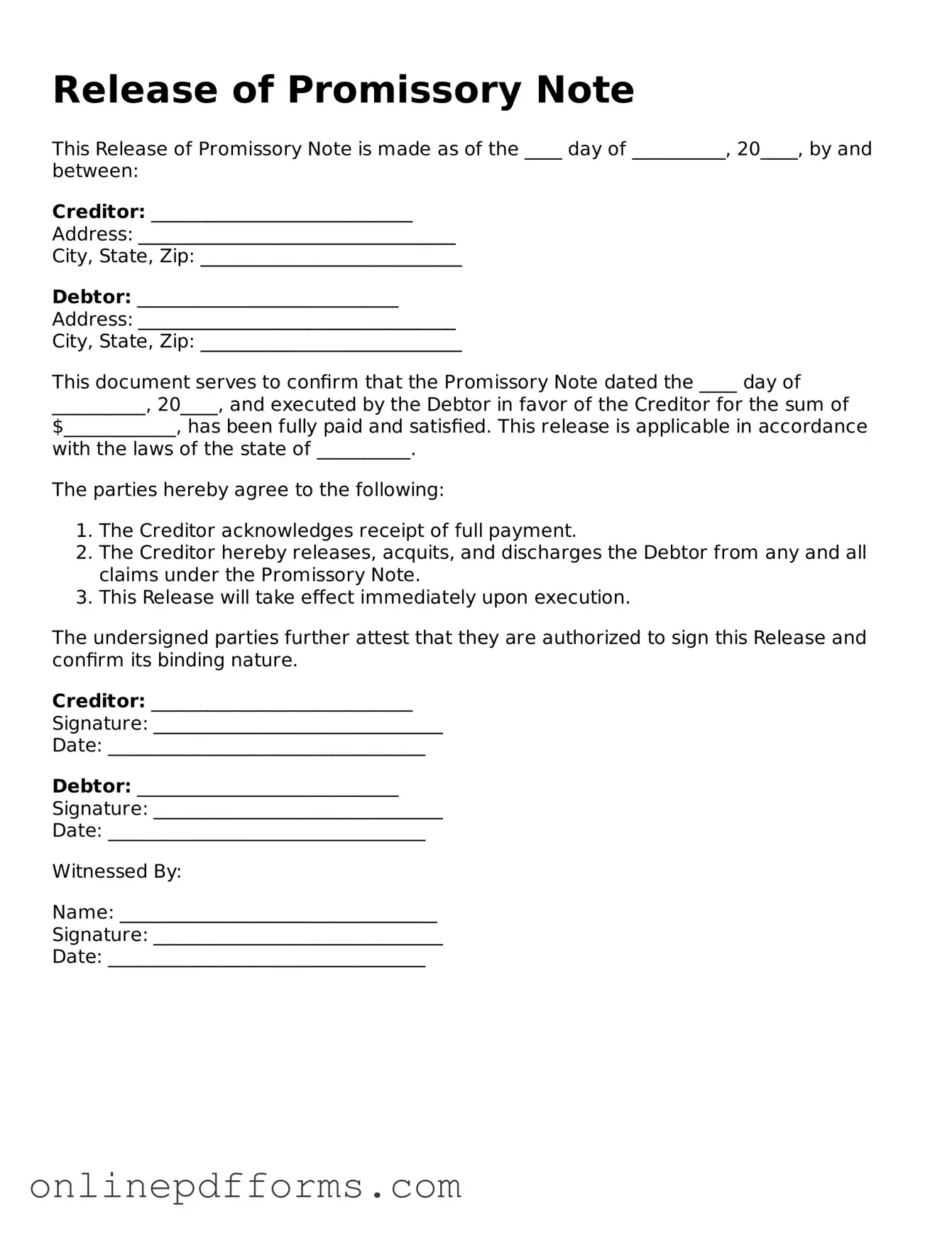

After you complete the Release of Promissory Note form, you will need to ensure that all parties involved receive a copy for their records. This helps maintain clear communication and confirms that the obligations have been satisfied.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, provide the name of the borrower. Ensure the name is spelled correctly.

- In the following section, write the name of the lender. Double-check for accuracy.

- Indicate the amount of the original promissory note. This should match the amount agreed upon in the original document.

- Clearly state that the promissory note is being released. You may use a simple statement like "This note is hereby released."

- Both the borrower and the lender should sign the form. Make sure each signature is dated.

- Finally, provide any additional information required, such as addresses or contact details, if prompted.