Fill in Your Sample Tax Return Transcript Template

Documents used along the form

The Sample Tax Return Transcript form provides a detailed overview of an individual's tax return information for a specific tax year. However, there are several other forms and documents that are often used in conjunction with this transcript to provide a more comprehensive view of a taxpayer's financial situation. Below are some commonly used forms that complement the Sample Tax Return Transcript.

- Form 1040: This is the standard individual income tax return form used by taxpayers to report their annual income. It includes sections for income, deductions, and credits, ultimately determining the taxpayer's overall tax liability.

- Schedule C: This form is used by self-employed individuals to report income and expenses from their business. It details gross receipts, costs, and net profit or loss, providing insight into the financial performance of the business.

- Form W-2: Employers provide this form to employees, summarizing their annual earnings and the taxes withheld from their paychecks. It is essential for accurately reporting income on the tax return.

- Form 1099: This form is issued to report various types of income other than wages, salaries, or tips. For example, freelancers and independent contractors receive a 1099 for their services, which must be reported on their tax returns.

Understanding these forms can help taxpayers navigate their financial responsibilities more effectively. Each document serves a unique purpose, contributing to a clearer picture of one's financial situation and tax obligations.

More PDF Templates

Notice of Motion Child Support California - Failure to comply with vaccination requirements may impact school attendance.

Guardianship Paperwork - It is designed to be adaptable to accommodate different family situations.

Similar forms

The IRS Form 1040 serves as the primary individual income tax return used by U.S. taxpayers. Like the Sample Tax Return Transcript, it provides detailed information about a taxpayer's income, deductions, and credits for a specific tax year. The Form 1040 reflects all sources of income, including wages, dividends, and self-employment earnings. Both documents summarize financial information, enabling taxpayers to understand their tax obligations and potential refunds.

The IRS Form 1099 is another important document that reports various types of income other than wages, salaries, or tips. This form is similar to the Sample Tax Return Transcript in that it provides detailed information about income received during the tax year. For example, a Form 1099-MISC may report income earned as an independent contractor, while the Sample Tax Return Transcript consolidates this information into a comprehensive summary for tax filing purposes.

The W-2 form is a wage and tax statement provided by employers to their employees. It details the income earned and taxes withheld throughout the year. Similar to the Sample Tax Return Transcript, the W-2 serves to inform the taxpayer about their earnings and tax responsibilities. Both documents are essential for accurately reporting income and ensuring compliance with tax laws.

The IRS Form 4506-T allows taxpayers to request a transcript of their tax return, which can be similar in purpose to the Sample Tax Return Transcript. While the Sample Tax Return Transcript provides a summary of the return filed, Form 4506-T is a request for that summary. This form is often used when applying for loans or mortgages, ensuring that the financial information is verifiable and accurate.

The Schedule C form is used by sole proprietors to report income and expenses from their business. It is similar to the Sample Tax Return Transcript in that it provides a detailed account of business earnings and deductions. Both documents help taxpayers understand their financial situation and tax obligations related to self-employment income.

The IRS Form 8862 is used to claim the Earned Income Tax Credit (EITC) after a prior denial. This form, like the Sample Tax Return Transcript, requires detailed income reporting to establish eligibility for tax credits. Both documents play a crucial role in determining tax benefits and ensuring compliance with IRS regulations.

The IRS Form 8880 allows taxpayers to claim a credit for contributions to retirement savings accounts. Similar to the Sample Tax Return Transcript, it requires detailed financial information to determine eligibility for tax credits. Both documents assist taxpayers in maximizing their tax benefits while ensuring accurate reporting of income and contributions.

The IRS Form 1040X is used to amend a previously filed tax return. This form shares similarities with the Sample Tax Return Transcript as it requires a detailed account of income, deductions, and credits. Both documents are essential for correcting errors and ensuring that the taxpayer's financial records are accurate and up to date.

The IRS Form 8862 is utilized to claim the Child Tax Credit after a previous denial. This form, like the Sample Tax Return Transcript, requires detailed income information to establish eligibility for tax credits. Both documents serve to help taxpayers understand their financial situation and ensure they receive the credits they are entitled to.

The IRS Form 1045 is used to apply for a quick refund of taxes due to a net operating loss. This form is similar to the Sample Tax Return Transcript in that it provides a summary of financial information for the tax year. Both documents are important for taxpayers seeking to understand their tax liabilities and potential refunds in light of financial losses.

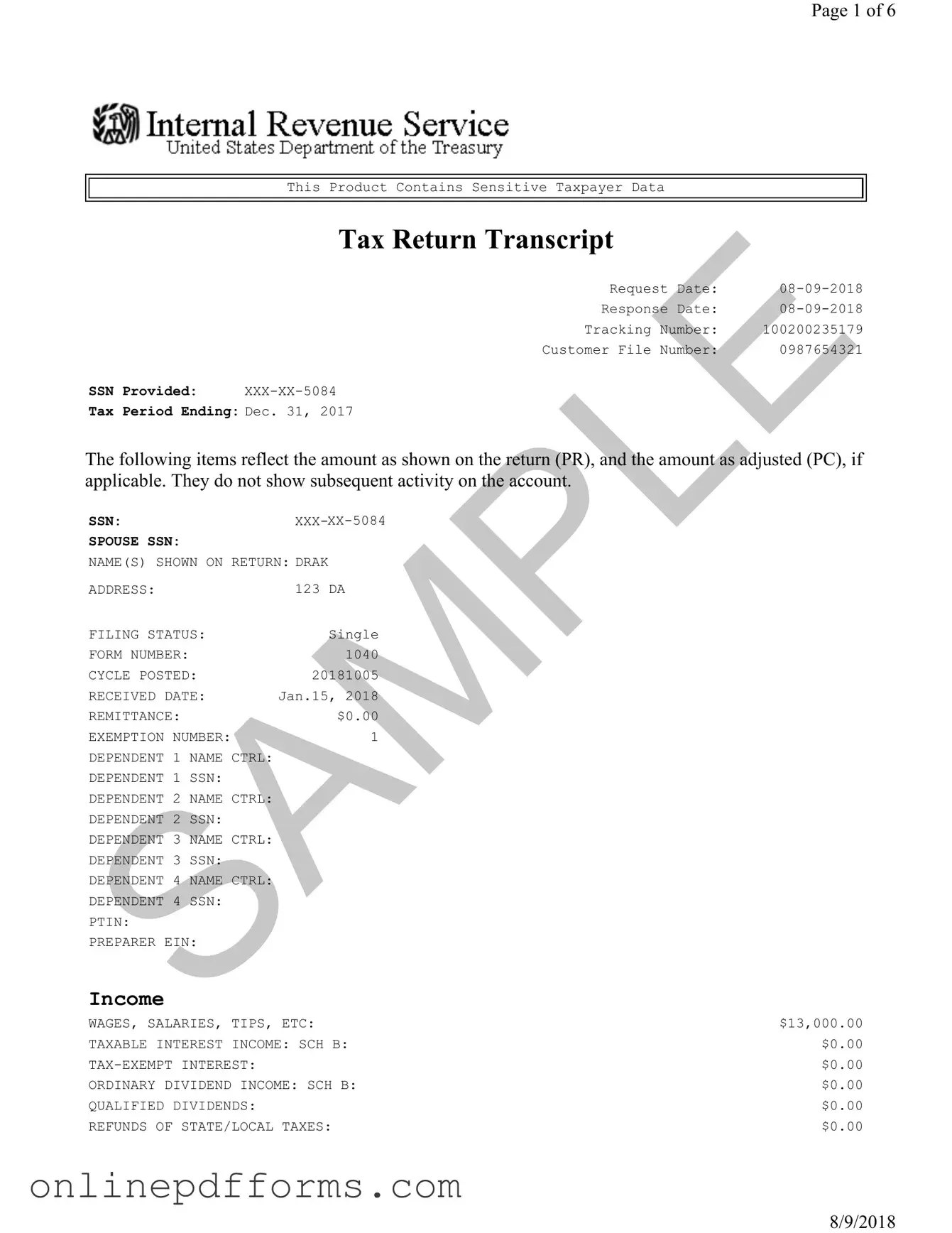

Steps to Filling Out Sample Tax Return Transcript

Completing the Sample Tax Return Transcript form requires careful attention to detail. Each section must be filled out accurately to ensure that all relevant information is captured. Follow these steps to complete the form correctly.

- Begin by entering the Request Date at the top of the form. This is the date you are filling out the form.

- Next, fill in the Response Date. This is usually the same as the request date.

- Locate the Tracking Number and enter it in the designated space.

- Input your Customer File Number as provided.

- Enter your Social Security Number (SSN) in the appropriate field. Make sure to follow the format XXX-XX-XXXX.

- Fill in the Tax Period Ending date, which is the last day of the tax year being reported.

- Provide your Name(s) Shown on Return. This should match the name on your tax return.

- Enter your Address as it appears on your tax return.

- Indicate your Filing Status, such as Single, Married Filing Jointly, etc.

- Fill in the Form Number that corresponds to your tax return, typically 1040.

- Provide the Cycle Posted date. This is usually assigned by the IRS.

- Input the Received Date, which is when the IRS received your tax return.

- Enter the Remittance amount, if applicable. If no payment was made, enter $0.00.

- List the Exemption Number and any dependents' information as required.

- Complete the income section by filling in amounts for wages, salaries, tips, and any other income sources listed.

- Provide information on any adjustments to income, including educator expenses or self-employment tax deductions.

- Fill in the tax and credits section, including standard deductions and any applicable credits.

- Complete the payments section, detailing any federal income tax withheld and estimated tax payments made.

- Finally, indicate the Amount You Owe or any refund expected at the end of the form.

Once you have filled out the form, review all entries for accuracy. It's important to ensure that every detail is correct before submission. This will help avoid delays or issues with your tax records.