Legal Single-Member Operating Agreement Form

Documents used along the form

A Single-Member Operating Agreement is an essential document for individuals operating a limited liability company (LLC) alone. It outlines the structure and management of the LLC, detailing the rights and responsibilities of the owner. Along with this agreement, several other forms and documents may be utilized to ensure compliance and proper operation of the business. Below is a list of these documents, each serving a specific purpose.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the name, address, and purpose of the business.

- Employer Identification Number (EIN): An EIN is obtained from the Internal Revenue Service (IRS) and is necessary for tax purposes. It allows the LLC to hire employees and open a business bank account.

- Business License: Depending on the location and nature of the business, a local or state business license may be required to legally operate.

- Operating Agreement Amendments: If changes are needed in the future, amendments to the operating agreement can be drafted to reflect new terms or conditions.

- Membership Certificates: While not always necessary, these certificates can serve as proof of ownership for the single member and may be useful for record-keeping.

- Bank Account Resolution: This document authorizes the opening of a business bank account in the name of the LLC, ensuring that the owner can manage the company’s finances effectively.

- Operating Agreement: This foundational document is essential for outlining the operational procedures and management structure of your LLC, ensuring clarity and preventing disputes. You can find a template for this form at mypdfform.com/blank-new-york-operating-agreement.

- Meeting Minutes: Even as a single-member LLC, documenting decisions and actions through meeting minutes can provide a clear record for future reference.

- Tax Filings: Various tax forms will need to be filed with federal and state authorities to maintain compliance and report the LLC's income.

Understanding these additional documents can help ensure that the LLC operates smoothly and remains compliant with legal requirements. Each document plays a crucial role in the overall management and legitimacy of the business, contributing to its success and protection.

Similar forms

A Single-Member Operating Agreement is similar to a Partnership Agreement in that both documents outline the terms and conditions of a business arrangement. While a Partnership Agreement is designed for multiple owners, a Single-Member Operating Agreement serves a sole owner. Both documents detail the management structure, decision-making processes, and distribution of profits. They provide a framework for how the business will operate, ensuring clarity and reducing the potential for disputes, even if only one person is involved.

Another document that shares similarities is the Bylaws of a Corporation. Bylaws govern the internal management of a corporation, much like an Operating Agreement does for an LLC. Both documents establish rules for governance, including how meetings are conducted, how decisions are made, and how records are kept. While Bylaws are specific to corporations, the fundamental purpose of both documents is to provide a clear structure for the organization, ensuring smooth operations and compliance with legal requirements.

The Single-Member Operating Agreement is crucial for defining the management structure and responsibilities of a sole owner in an LLC. It not only clarifies operational processes but also distinguishes the rights of the owner from those of other business structures. To gain further insights into creating a structured agreement, you may refer to Georgia PDF, which provides comprehensive resources for drafting your own operating agreement.

The Business Plan also bears resemblance to a Single-Member Operating Agreement. While a Business Plan focuses on the strategic direction and financial projections of a business, it often includes elements related to management and operations. Both documents serve as guides for the owner, helping to clarify goals and operational strategies. A well-prepared Business Plan can complement an Operating Agreement by providing a roadmap for how the business will function and grow over time.

A Shareholder Agreement is another document that aligns closely with a Single-Member Operating Agreement. Although typically used in corporations with multiple shareholders, it outlines the rights and responsibilities of each shareholder. In a similar vein, a Single-Member Operating Agreement specifies the rights of the single owner, detailing how decisions are made and how profits are distributed. Both documents aim to protect the interests of the owners and provide a clear framework for governance.

Lastly, a Non-Disclosure Agreement (NDA) can be considered similar in that both documents help to protect the interests of the business. An NDA prevents the sharing of sensitive information, which is crucial for maintaining confidentiality. In the context of a Single-Member Operating Agreement, protecting proprietary information is vital for the success and integrity of the business. Both documents emphasize the importance of safeguarding business interests, albeit in different contexts.

Steps to Filling Out Single-Member Operating Agreement

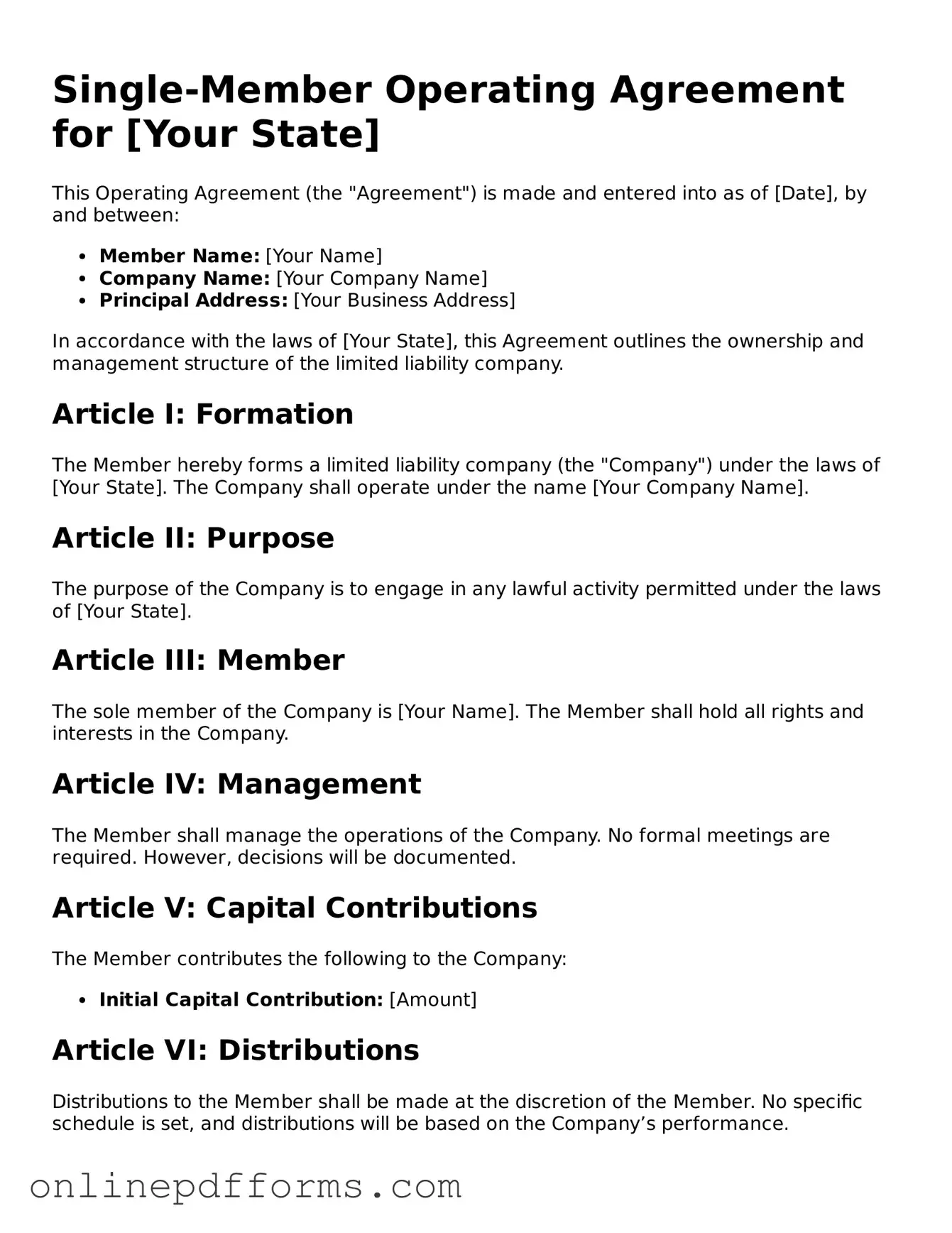

Filling out the Single-Member Operating Agreement form is a straightforward process. This document is essential for establishing the terms of operation for your business. Follow the steps below to ensure you complete the form accurately.

- Begin by entering your name and the name of your business at the top of the form.

- Specify the principal address of your business. This should be the main location where your business operates.

- Clearly state the purpose of your business. Describe what your business does in a few concise sentences.

- Indicate the date when the agreement will take effect. This is typically the date you sign the document.

- Include the details about your ownership interest. As a single member, you will own 100% of the business.

- Outline the management structure. Specify that you will manage the business unless you choose to appoint someone else.

- Describe how profits and losses will be handled. Generally, as the sole owner, you will receive all profits and be responsible for all losses.

- Sign and date the document. Ensure that your signature is clear and matches the name you provided at the beginning.

After completing the form, keep a copy for your records. You may also want to consult with a legal professional to ensure everything is in order.