Blank Texas Deed Form

Documents used along the form

When completing a property transaction in Texas, several documents may accompany the Texas Deed form. Each of these documents plays a crucial role in ensuring a smooth transfer of property ownership and compliance with legal requirements.

- Title Insurance Policy: This document protects the buyer from any future claims against the property that may arise from past ownership. It ensures that the title is clear and free of liens or disputes.

- Property Survey: A survey outlines the boundaries of the property. It helps identify any encroachments or easements that may affect the property’s value or usability.

- Closing Disclosure: This form provides detailed information about the final terms and costs of the mortgage. It must be provided to the buyer at least three days before closing.

- Bill of Sale: This document is used to transfer ownership of personal property associated with the real estate transaction, such as appliances or furniture.

- Employment Application: For those considering a career at Trader Joe's, the https://pdftemplates.info/trader-joe-s-application-form/ is an essential form that gathers necessary details about applicants, including their experience and availability.

- Affidavit of Heirship: In cases where the property is inherited, this affidavit helps establish the rightful heirs and their ownership rights without the need for probate.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including signing documents related to the property transaction.

- Loan Agreement: If financing is involved, this document outlines the terms of the loan, including interest rates, repayment schedules, and obligations of both parties.

- Notice of Foreclosure: In situations involving foreclosure, this document informs interested parties of the pending sale of the property due to unpaid debts.

Understanding these documents can help ensure a successful property transaction in Texas. Each plays a vital role in protecting the interests of all parties involved, facilitating a clear and legal transfer of ownership.

Other Popular State-specific Deed Templates

Grant Deed in California - A Deed confirms the transfer of ownership upon completion.

The Florida Prenuptial Agreement serves as a vital tool for couples looking to clarify their financial responsibilities ahead of marriage. By understanding the importance of this agreement, individuals can ensure their interests are protected. For a deeper insight into this essential document, you might consider exploring a thorough guide on the Prenuptial Agreement features available at this link.

New York State Deed Form - A significant document during the closing process of real estate sales.

How Long Does It Take to Record a Deed in Florida - Deeds typically include the names of the buyer and seller, a description of the property, and the details of the transaction.

What Does a House Deed Look Like in Pa - A deed can also serve as evidence in legal proceedings regarding property disputes.

Similar forms

The Texas Deed form shares similarities with the Warranty Deed, which serves as a legal instrument to transfer property ownership. A Warranty Deed guarantees that the seller has clear title to the property and provides assurances against any claims or encumbrances. Both documents require the signatures of the parties involved and are often accompanied by a notary's acknowledgment. The primary difference lies in the level of protection offered; a Warranty Deed provides more security for the buyer, while a Texas Deed may not include such guarantees.

Another document akin to the Texas Deed is the Quitclaim Deed. This form also facilitates the transfer of property but does so without any warranties regarding the title. The seller relinquishes any interest they may have in the property, but there are no guarantees about the quality of that interest. Like the Texas Deed, a Quitclaim Deed must be signed and notarized. However, it is often used in situations where the parties know each other well, such as transferring property between family members.

When dealing with the sale of trailers, it is crucial to have the appropriate documentation in place to ensure a smooth transaction. The Illinois Trailer Bill of Sale form is essential for this purpose, as it establishes a legal record of the sale and protects the interests of both buyer and seller. To explore more about similar documents, you may find valuable resources like Auto Bill of Sale Forms helpful in navigating the specifics of these important transactions.

The Special Warranty Deed is another document that resembles the Texas Deed. This type of deed provides a limited warranty, ensuring that the seller has not encumbered the property during their ownership. Unlike a full Warranty Deed, it does not guarantee against any issues that may have existed prior to the seller's ownership. The structure of both documents requires signatures and notarization, making them legally binding in the same manner.

A Bill of Sale, while primarily used for personal property, shares some common features with the Texas Deed. Both documents serve to transfer ownership from one party to another. A Bill of Sale outlines the specifics of the transaction, including a description of the property and the agreed-upon price. However, unlike the Texas Deed, it does not involve real estate and is typically less formal in its execution.

The Deed of Trust is another document that bears resemblance to the Texas Deed, particularly in real estate transactions. This legal instrument secures a loan by placing a lien on the property being purchased. It involves three parties: the borrower, the lender, and a trustee. While the Texas Deed transfers ownership, the Deed of Trust creates a security interest in that ownership until the loan is repaid. Both documents require signatures and are often recorded in public records.

The Affidavit of Heirship is similar to the Texas Deed in that it deals with property ownership but is specifically used in situations where the owner has passed away without a will. This document establishes the heirs' rights to the property. While the Texas Deed transfers ownership, the Affidavit of Heirship identifies who is entitled to inherit the property. Both documents must be notarized and can be recorded to provide legal recognition of ownership.

The Lease Agreement, although primarily a rental contract, shares some similarities with the Texas Deed. Both documents establish rights related to property ownership. A Lease Agreement outlines the terms under which a tenant can occupy a property, whereas a Texas Deed conveys permanent ownership. Both require signatures and can be legally enforced, but they differ significantly in duration and intent.

The Easement Agreement also parallels the Texas Deed in that it relates to property rights. An Easement grants one party the right to use a portion of another's property for a specific purpose, such as access to a roadway. Like the Texas Deed, it must be properly documented and signed. However, unlike the Texas Deed, an Easement does not transfer ownership; it merely allows for use while retaining ownership with the original property holder.

The Real Estate Purchase Agreement is another document that closely aligns with the Texas Deed. This agreement outlines the terms of the sale of a property, including the price, contingencies, and closing date. Once the terms are agreed upon, the Texas Deed is executed to finalize the transfer of ownership. Both documents work in tandem to ensure that the transaction is legally binding and properly executed.

Lastly, the Property Transfer Affidavit is similar to the Texas Deed in that it is used to report changes in property ownership. This document is often filed with local tax authorities to update records. While the Texas Deed serves as the primary legal document for transferring ownership, the Property Transfer Affidavit ensures that governmental records reflect the change. Both require accurate information and signatures, making them essential in the property transfer process.

Steps to Filling Out Texas Deed

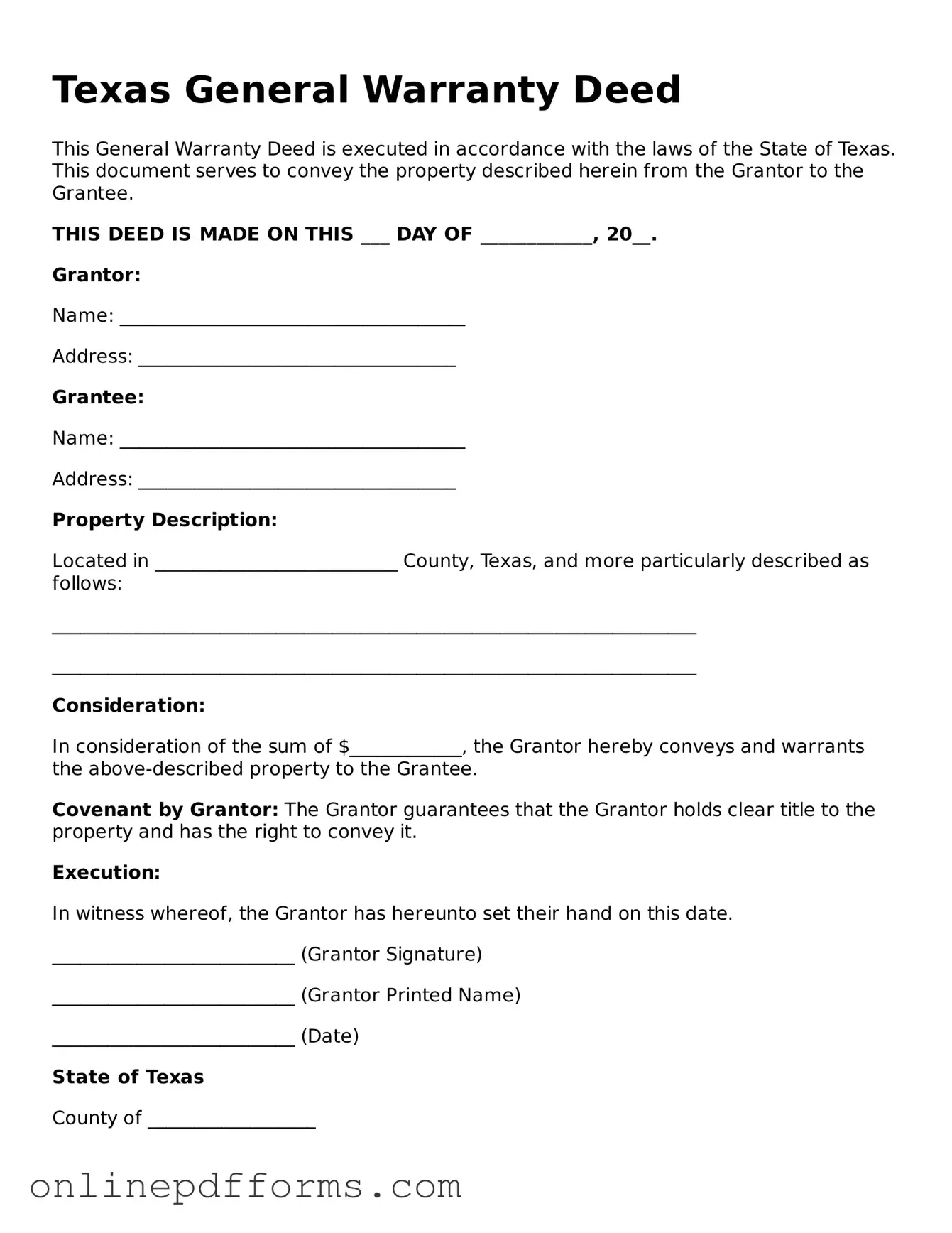

Once you have the Texas Deed form in hand, it’s time to fill it out carefully. This document is essential for transferring property ownership, so accuracy is key. After completing the form, you will need to sign it in front of a notary public and then file it with the county clerk's office where the property is located.

- Begin by entering the date at the top of the form.

- Fill in the name of the grantor (the person transferring the property) in the designated space.

- Provide the address of the grantor below their name.

- Next, enter the name of the grantee (the person receiving the property).

- Include the address of the grantee under their name.

- In the section labeled "Consideration," state the amount paid for the property. This is often a nominal amount, such as $10, unless a larger sum is involved.

- Clearly describe the property being transferred. Include details like the legal description, parcel number, or any other identifying information.

- Check the appropriate box to indicate whether the transfer includes any warranties or is being made “as is.”

- Sign the form in the presence of a notary public. Make sure to use the same name as listed as the grantor.

- Have the notary public complete their section, including their signature and seal.

- Finally, take the completed form to the county clerk's office to file it officially.