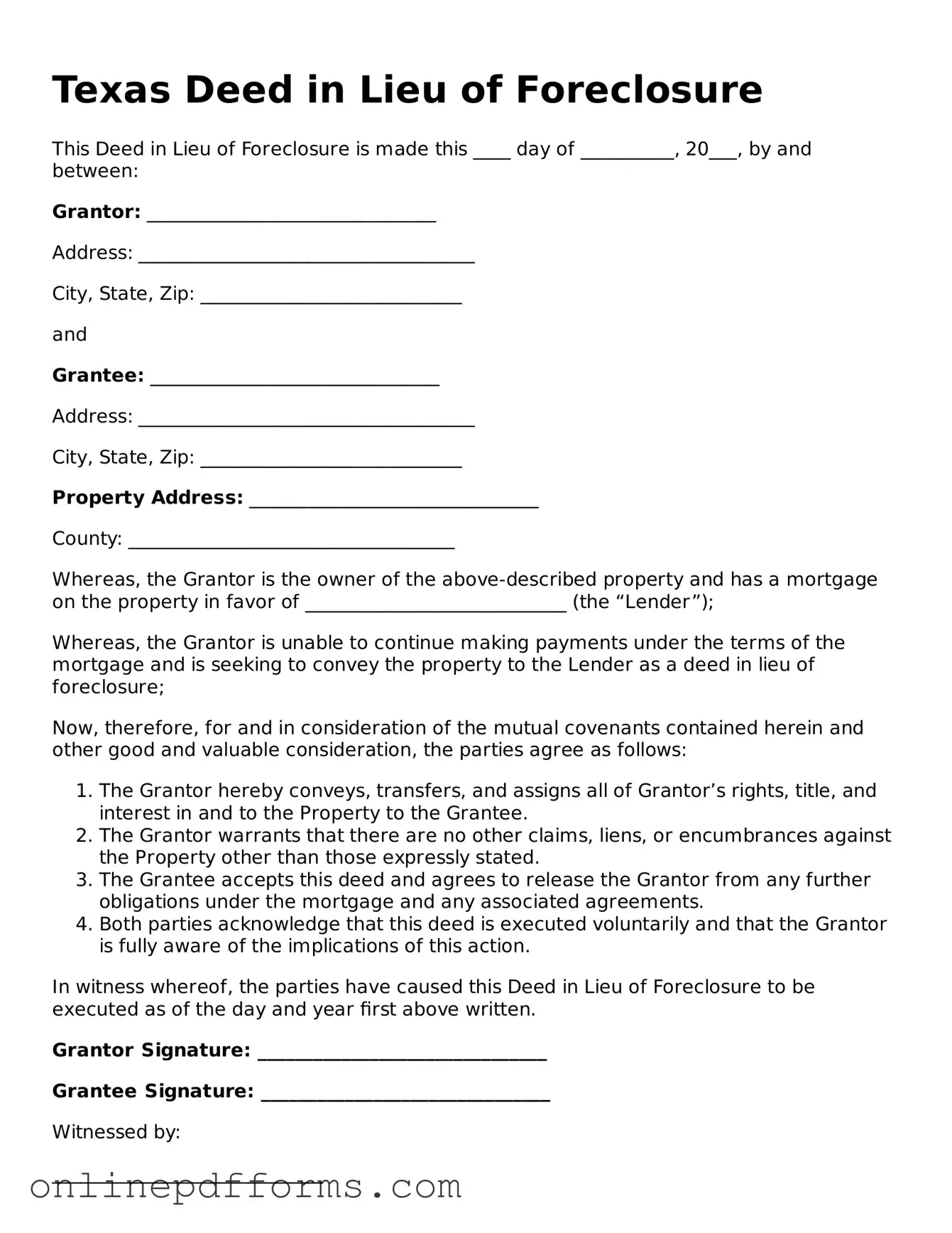

Blank Texas Deed in Lieu of Foreclosure Form

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender, often to avoid the lengthy and costly process of foreclosure. When engaging in this process, several other forms and documents may also be necessary to ensure a smooth transition. Below is a list of commonly used documents that accompany the Texas Deed in Lieu of Foreclosure.

- Notice of Default: This document informs the homeowner that they have defaulted on their mortgage payments. It typically outlines the amount owed and the steps the lender may take if the default is not resolved.

- Loan Modification Agreement: This agreement may be offered by the lender to modify the terms of the existing loan, such as adjusting the interest rate or extending the repayment period, to make it more manageable for the homeowner.

- RV Bill of Sale: This document is critical for ensuring a legal record of the sale in Texas; to learn more, visit https://pdftemplates.info/texas-rv-bill-of-sale-form.

- Release of Liability: This document releases the homeowner from any further obligation on the mortgage after the Deed in Lieu is executed, ensuring they are not held responsible for any remaining debt.

- Property Condition Disclosure: This form requires the homeowner to disclose any known issues or defects with the property. Transparency in this document helps protect both parties in the transaction.

- Affidavit of Title: This sworn statement confirms the homeowner's ownership of the property and asserts that there are no undisclosed liens or claims against it, providing assurance to the lender.

- Title Insurance Policy: This policy protects the lender against any claims to the title of the property that may arise after the transfer, ensuring that the lender has clear ownership.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any costs or fees associated with the Deed in Lieu process, providing a clear picture of the financial implications for the homeowner.

- Borrower’s Financial Statement: This statement provides the lender with an overview of the homeowner's financial situation, including income, expenses, and debts, which may help in negotiating the terms of the Deed in Lieu.

- Power of Attorney: In some cases, homeowners may designate someone else to act on their behalf in executing the Deed in Lieu. This document grants that authority, allowing for a smoother process.

Understanding these documents is essential for homeowners considering a Deed in Lieu of Foreclosure. Each plays a crucial role in protecting the interests of both the homeowner and the lender, facilitating a more efficient and transparent transaction. Proper preparation and awareness of these forms can significantly ease the burdens associated with financial distress and property transfer.

Other Popular State-specific Deed in Lieu of Foreclosure Templates

Foreclosure Vs Deed in Lieu - The lender may forgive any outstanding mortgage balance as part of the agreement.

When engaging in the sale or purchase of an RV, it is crucial to utilize an RV Bill of Sale form, as it serves as a formal record of the transaction. This document not only captures vital details like the purchase price and the RV's description but also establishes the date of sale, thereby protecting the rights of both buyer and seller. For those looking to streamline this process, Auto Bill of Sale Forms can be an invaluable resource, ensuring that all necessary information is accurately documented.

California Pre-foreclosure Property Transfer - This option can free up financial resources for borrowers to focus on rebuilding their credit and finances.

Similar forms

The Texas Deed in Lieu of Foreclosure form is similar to a mortgage release document. A mortgage release is a legal document that confirms a borrower has paid off their mortgage, releasing them from any further obligation. Like the Deed in Lieu, it signifies the end of a borrower's financial responsibility regarding the property. Both documents aim to clear the borrower’s title and allow them to move forward without the burden of the mortgage debt.

Another related document is the short sale agreement. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the property is sold. This process can help the borrower avoid foreclosure, similar to how a Deed in Lieu allows for a smoother transition away from property ownership. Both options require lender approval and provide a way for the borrower to mitigate the negative impact on their credit score.

The foreclosure notice also bears similarity to the Deed in Lieu of Foreclosure. A foreclosure notice is issued when a borrower is significantly behind on mortgage payments, indicating that the lender intends to take possession of the property. While the Deed in Lieu serves as a proactive measure to avoid foreclosure, both documents highlight the borrower’s financial distress and the lender's right to reclaim the property.

A quitclaim deed is another document that shares characteristics with the Deed in Lieu of Foreclosure. A quitclaim deed transfers any interest the grantor has in a property without guaranteeing that the title is clear. Like the Deed in Lieu, it allows for the transfer of property ownership, but it does not involve the same level of negotiation or lender involvement. Both documents can facilitate the transfer of property ownership but in different contexts.

For those navigating complex financial situations in Arizona, it's essential to understand the various documents available that can help mitigate the risks of foreclosure, much like the Independent Contractor Agreement form which can streamline contractor-client relationships in a professional setting. For more information and resources on related agreements, visit the following link: https://arizonaformspdf.com.

Lastly, a loan modification agreement is comparable to the Deed in Lieu of Foreclosure. A loan modification alters the terms of an existing mortgage to make it more manageable for the borrower. While the Deed in Lieu allows the borrower to relinquish ownership, a loan modification seeks to keep them in their home. Both documents are tools for borrowers facing financial difficulties, offering different pathways to address their situations.

Steps to Filling Out Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, the next step is to ensure that all parties involved understand the implications of the document. Once signed, the deed should be filed with the appropriate county clerk's office to officially transfer ownership of the property. Here are the steps to fill out the form accurately:

- Begin by entering the date at the top of the form.

- Provide the name of the grantor, which is the individual or entity transferring the property.

- List the address of the property being transferred, including the city, county, and zip code.

- Include the name of the grantee, who is the individual or entity receiving the property.

- Clearly describe the property in detail, including any legal descriptions or parcel numbers if available.

- State the reason for the transfer, typically indicating it is a deed in lieu of foreclosure.

- Sign the document in the presence of a notary public. Ensure the notary fills out their section properly.

- Make copies of the completed form for your records and for the grantee.

- Submit the original signed deed to the county clerk's office where the property is located for recording.