Blank Texas Durable Power of Attorney Form

Documents used along the form

When creating a Texas Durable Power of Attorney, it is often beneficial to consider additional documents that can complement this important legal instrument. These forms help ensure that your wishes are clearly outlined and legally binding, providing peace of mind for both you and your loved ones.

- Medical Power of Attorney: This document designates a person to make medical decisions on your behalf if you become unable to do so. It ensures that your healthcare preferences are honored, especially in critical situations.

- Living Will: A living will outlines your preferences regarding end-of-life medical treatment. This document specifies what types of medical care you want or do not want, providing guidance to your loved ones and healthcare providers.

- HIPAA Release Form: This form allows you to grant permission for specific individuals to access your medical records and health information. It ensures that your designated agents can make informed decisions regarding your care.

- Will: A will is a legal document that outlines how your assets should be distributed after your death. It can also name guardians for minor children, ensuring that your wishes are respected in matters of estate and family care.

By considering these additional forms, you can create a comprehensive plan that addresses both your financial and healthcare needs. This proactive approach can provide clarity and support for your loved ones during challenging times.

Other Popular State-specific Durable Power of Attorney Templates

Printable Financial Power of Attorney - This document is a vital part of an overall estate plan, contributing to your future security.

Free Durable Power of Attorney Form Ohio - A Durable Power of Attorney can be revoked or altered when necessary, as your situation changes.

Durable Power of Attorney Florida Pdf - This form is a proactive step in managing your future wellbeing.

Does Durable Power of Attorney Cover Medical - This form can serve as a critical component of your overall estate planning strategy.

Similar forms

The Texas Medical Power of Attorney is similar to the Durable Power of Attorney in that both allow individuals to designate someone to make decisions on their behalf. However, the Medical Power of Attorney specifically focuses on health care decisions. This document becomes crucial when a person is unable to communicate their medical preferences due to illness or injury. It ensures that the appointed agent can make informed choices regarding medical treatment, aligning with the individual’s values and wishes.

The Living Will, also known as an Advance Directive, shares similarities with the Durable Power of Attorney by outlining an individual's preferences regarding medical treatment. While the Durable Power of Attorney grants authority to an agent to make decisions, a Living Will provides specific instructions about the types of medical interventions a person does or does not want in end-of-life situations. This document serves as a guide for healthcare providers and loved ones when critical decisions must be made.

The Financial Power of Attorney is another document that parallels the Durable Power of Attorney. Both forms empower an agent to act on behalf of the principal, but the Financial Power of Attorney focuses solely on financial matters. This includes managing bank accounts, paying bills, and making investment decisions. It is particularly useful when the principal is incapacitated or unavailable to handle their financial affairs.

The Guardianship document is similar in that it involves appointing someone to make decisions for another person, but it is typically used in more complex situations. Guardianship is a legal process where a court appoints an individual to make decisions for someone who is unable to care for themselves. Unlike the Durable Power of Attorney, which is created voluntarily and can be revoked, guardianship requires a court’s approval and can be more difficult to terminate.

The Trust document also shares characteristics with the Durable Power of Attorney, particularly in the context of asset management. A Trust allows an individual to transfer assets to a trustee, who then manages those assets for the benefit of the beneficiaries. While a Durable Power of Attorney grants authority to make decisions while the principal is alive, a Trust can manage assets both during the individual’s lifetime and after their death, ensuring a smoother transition of wealth.

The Healthcare Proxy is another document that resembles the Durable Power of Attorney, specifically in its function to appoint someone to make healthcare decisions. Like the Medical Power of Attorney, the Healthcare Proxy allows an individual to designate a trusted person to make medical decisions on their behalf if they become incapacitated. This document emphasizes the importance of choosing someone who understands the individual’s healthcare preferences and values.

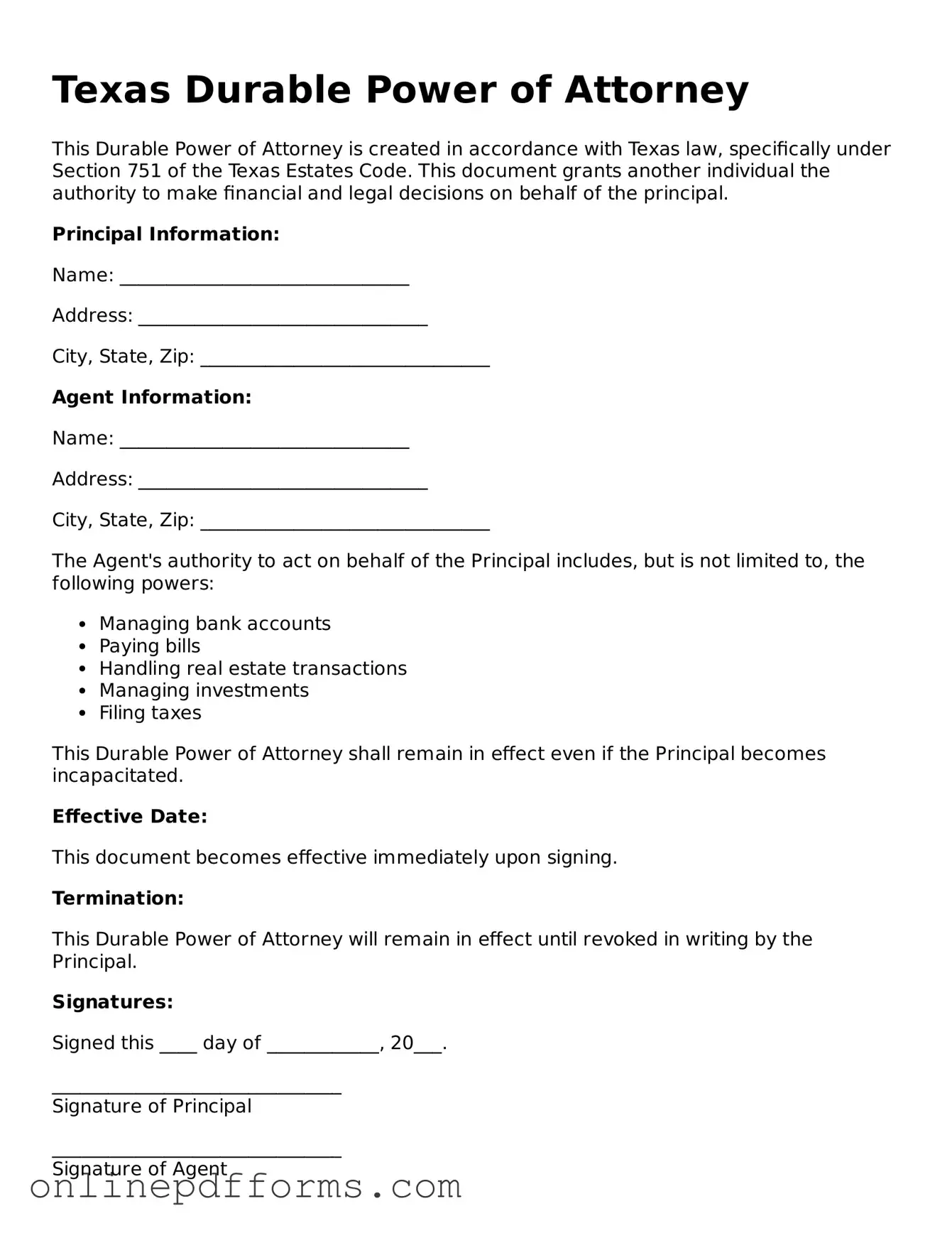

Steps to Filling Out Texas Durable Power of Attorney

Filling out the Texas Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes, especially if you become unable to make decisions for yourself. Once you have completed the form, you will need to have it signed and notarized to ensure its validity.

- Obtain the Texas Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Begin by filling in your personal information at the top of the form. This includes your full name, address, and date of birth.

- Next, identify the person you are appointing as your agent. Provide their full name, address, and relationship to you.

- Decide whether you want to grant your agent broad powers or specific ones. Indicate your choice by checking the appropriate box on the form.

- If you wish to specify certain powers, list them clearly in the designated section. Be as detailed as possible to avoid confusion.

- Consider whether you want to include any limitations on your agent's authority. If so, write those limitations in the appropriate section of the form.

- Review the form carefully to ensure all information is accurate and complete.

- Sign the form in the presence of a notary public. This step is crucial for the document to be legally binding.

- Have the notary public complete their section by signing and sealing the document.

- Make copies of the signed and notarized form for your records and for your agent.

Once the form is completed and properly executed, it is essential to communicate your wishes with your agent and any relevant family members. This ensures everyone understands your decisions and can act accordingly if the need arises.