Blank Texas Gift Deed Form

Documents used along the form

When preparing a Texas Gift Deed, there are several other documents that may be necessary to ensure a smooth transfer of property. Each of these documents plays a crucial role in the process, helping to clarify the terms of the gift and protect the interests of both the giver and the recipient. Below is a list of commonly used forms and documents that accompany a Texas Gift Deed.

- Affidavit of Gift: This document serves as a sworn statement confirming that the property is being given as a gift. It outlines the intent of the giver and can help prevent disputes in the future.

- Property Description: A detailed description of the property being gifted is often included. This may consist of the legal description, address, and any relevant identifying information to ensure clarity.

- Auto Bill of Sale Forms: Using this document can help ensure that the sale of the RV is properly documented and recognized, especially when dealing with the transfer of ownership and related legalities. For more information, visit Auto Bill of Sale Forms.

- Transfer Tax Exemption Form: In Texas, certain gifts may be exempt from transfer taxes. This form allows the giver to declare the exemption, which can save money during the transfer process.

- Title Company Affidavit: If a title company is involved, they may require an affidavit that confirms the legitimacy of the gift. This document helps ensure that the title is clear and free of any claims or liens.

- Record of Gift: Keeping a record of the gift, including any correspondence or agreements between the parties, can be beneficial. This document provides a paper trail that may be useful in case of future disputes or questions regarding the gift.

These documents work together with the Texas Gift Deed to create a comprehensive record of the property transfer. By ensuring that all necessary forms are completed and filed correctly, both the giver and recipient can enjoy peace of mind throughout the process.

Other Popular State-specific Gift Deed Templates

How to Transfer Property Deed in Georgia - This form outlines the donor’s intention to give property to the recipient, known as the donee.

The Arizona Motor Vehicle Bill of Sale form is a legal document used to record the transfer of ownership for a motor vehicle. This form includes important details such as the buyer's and seller's information, vehicle description, and purchase price. Completing this form helps ensure a smooth transaction and provides necessary proof of ownership change, which can be found at https://mypdfform.com/blank-arizona-motor-vehicle-bill-of-sale/.

Similar forms

A Quitclaim Deed is similar to a Gift Deed in that it transfers ownership of property without any warranties. In a Quitclaim Deed, the grantor conveys whatever interest they have in the property, if any, to the grantee. This type of deed is often used among family members or in situations where the parties know each other well. Like a Gift Deed, a Quitclaim Deed does not involve any exchange of money, making it a straightforward option for transferring property rights.

A Warranty Deed also shares similarities with a Gift Deed, particularly in the transfer of property ownership. However, unlike a Gift Deed, a Warranty Deed provides guarantees from the seller regarding the title's validity. This means that the grantor assures the grantee that they hold clear title to the property and have the right to transfer it. While both deeds accomplish the same goal of transferring property, a Warranty Deed offers more protection to the grantee than a Gift Deed does.

An Easement Deed, while primarily used for granting a right to use a portion of the property, can also resemble a Gift Deed in certain situations. For example, if a property owner allows a neighbor to use their land for access or utilities without any compensation, it can be viewed as a gift. Both documents involve the voluntary transfer of rights without financial consideration, although an Easement Deed specifically pertains to usage rights rather than full ownership transfer.

A Deed of Trust is similar to a Gift Deed in that it involves property transfer, but it serves a different purpose. This document is used primarily in real estate transactions to secure a loan. The property is transferred to a trustee, who holds it as collateral until the borrower repays the loan. While a Gift Deed transfers ownership outright without conditions, a Deed of Trust involves a conditional transfer aimed at securing a financial obligation.

A Lease Agreement can also share some characteristics with a Gift Deed, particularly when a property owner allows someone to occupy their property for free. In such cases, the arrangement may be considered a gift of use. Both documents involve the transfer of rights, but a Lease Agreement is typically a formal contract outlining terms, while a Gift Deed is a straightforward transfer of ownership without conditions.

For those looking to streamline their vehicle purchase process, using a legal form can significantly ease the transaction. The pdftemplates.info/texas-vehicle-purchase-agreement-form provides a clear outline of the necessary terms and conditions, ensuring that both buyer and seller are on the same page regarding the sale.

Finally, a Transfer on Death Deed (TOD) provides a method for property owners to transfer their property to beneficiaries upon their death, similar to a Gift Deed. The primary difference lies in the timing of the transfer. A Gift Deed transfers ownership immediately, while a TOD deed allows the property owner to retain full control during their lifetime. Both documents aim to simplify the transfer of property, but they cater to different needs and timelines regarding ownership change.

Steps to Filling Out Texas Gift Deed

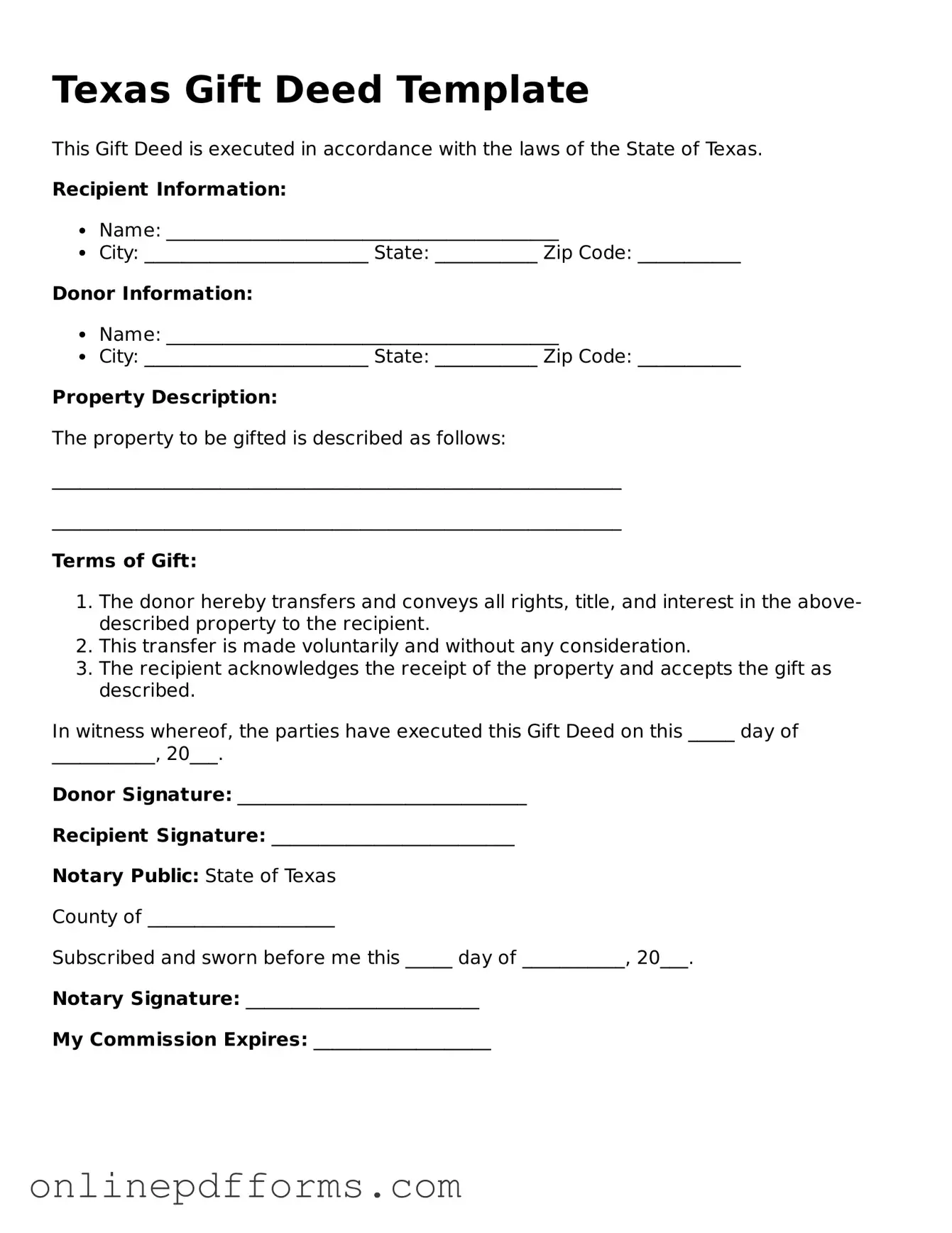

After gathering the necessary information, you can begin filling out the Texas Gift Deed form. This process involves providing specific details about the property and the individuals involved in the transaction. Follow these steps to ensure accuracy and completeness.

- Obtain the Form: Download the Texas Gift Deed form from a reliable source or visit your local county clerk’s office to get a physical copy.

- Identify the Grantor: Fill in the name and address of the person giving the gift (the grantor).

- Identify the Grantee: Enter the name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a detailed description of the property being gifted. This includes the address and any relevant legal descriptions.

- State the Consideration: Indicate that the property is being transferred as a gift, often by writing “for love and affection” or a similar phrase.

- Sign the Form: The grantor must sign the form in the designated area. Make sure the signature is clear and matches the name provided.

- Notarization: Have the form notarized. The notary will verify the identity of the grantor and witness the signature.

- File the Form: Submit the completed and notarized form to the county clerk’s office where the property is located. There may be a filing fee.

Once the form is filed, the gift deed will be officially recorded. This step is crucial for establishing the new ownership of the property. Keep a copy of the filed deed for your records.