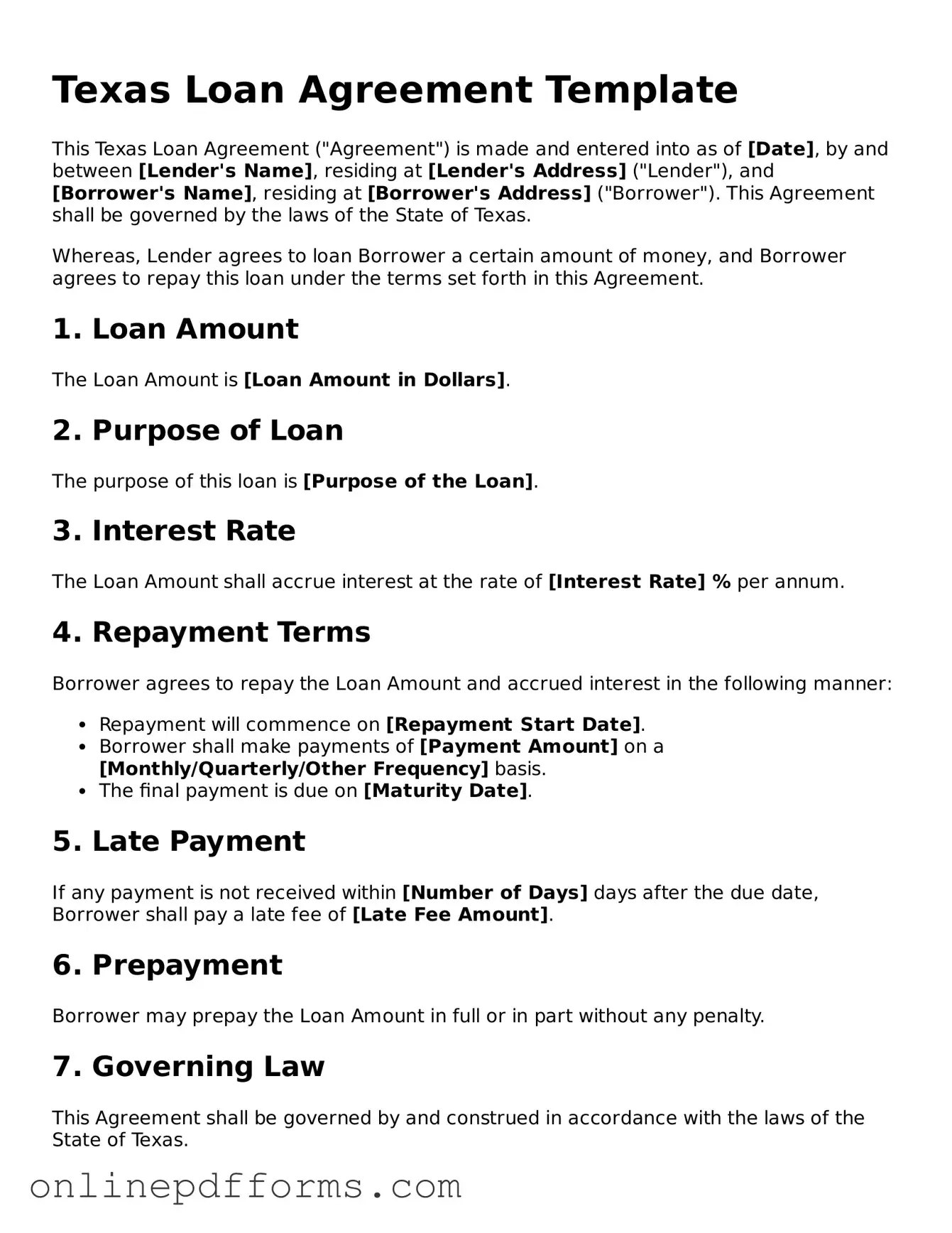

Blank Texas Loan Agreement Form

Documents used along the form

When entering into a loan agreement in Texas, several other forms and documents may be necessary to ensure clarity and compliance. Below are four commonly used documents that often accompany the Texas Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets being used as security. It details the rights of the lender in case of default.

- Promissory Note: To secure your understanding of loan agreements, refer to our detailed Promissory Note guidelines that clarify the necessary terms and conditions.

- Loan Disclosure Statement: This statement provides important information about the loan terms, including fees and costs associated with the loan. It ensures that borrowers understand their financial obligations.

- Personal Guarantee: If the borrower is a business entity, this document may require an individual to personally guarantee the loan. It holds the individual responsible for repayment if the business defaults.

These documents work together to protect both the lender and the borrower. Understanding each one is essential for a smooth lending process.

Other Popular State-specific Loan Agreement Templates

Promissory Note Template New York - The form might include collateral requirements to secure the loan.

In addition to the fundamental aspects of a Louisiana Trailer Bill of Sale form, it is also important for buyers and sellers to understand the broader implications of such documents. For those looking to sell or purchase a trailer, having access to reliable resources such as Auto Bill of Sale Forms can simplify the process and provide clarity on the necessary steps involved in ensuring a smooth transaction.

Promissory Note Template Georgia - It may include a waiver of rights by the borrower in certain scenarios.

Similar forms

The Texas Promissory Note is similar to the Texas Loan Agreement in that it serves as a written promise to repay a loan. Both documents outline the terms of the loan, including the amount borrowed, interest rates, and repayment schedules. While the Loan Agreement may include additional terms and conditions, the Promissory Note focuses primarily on the borrower's commitment to repay the debt, making it a more streamlined option for straightforward loans.

The Security Agreement is another document that shares similarities with the Texas Loan Agreement. This document outlines collateral that secures the loan, providing the lender with a legal claim to specific assets if the borrower defaults. Like the Loan Agreement, the Security Agreement specifies the obligations of both parties, ensuring that the lender has recourse in case of non-payment. Together, they create a comprehensive framework for the loan transaction.

If you are looking to apply for a position at Trader Joe's, it is important to complete the necessary forms correctly. The Trader Joe's application form is a key component of this process, as it gathers essential details about your skills and availability. You can find the application form at pdftemplates.info/trader-joe-s-application-form/, which will guide you through the steps to officially express your interest in joining the Trader Joe's team.

The Texas Mortgage Agreement is closely related to the Loan Agreement, especially when the loan is used to finance real estate. Both documents detail the terms of the loan, but the Mortgage Agreement specifically establishes the lender's rights over the property. It serves as a security interest in the property, while the Loan Agreement covers the financial terms of the loan itself. This relationship is crucial for protecting the lender's investment in real estate transactions.

The Loan Modification Agreement also bears resemblance to the Texas Loan Agreement. This document is used when changes are made to the original loan terms, such as interest rates or payment schedules. Both agreements outline the obligations of the borrower and lender, but the Loan Modification Agreement specifically addresses alterations to existing terms. This ensures that both parties are on the same page regarding any adjustments made to the loan.

The Texas Lease Agreement can be similar in structure to the Loan Agreement when it involves financing for leased property. Both documents outline terms such as payment amounts, duration, and responsibilities of the parties involved. However, the Lease Agreement focuses on rental terms rather than a loan, making it crucial for landlords and tenants. Despite their differences, both agreements aim to create clear expectations and protect the rights of the parties.

Finally, the Texas Partnership Agreement can share some similarities with the Loan Agreement, particularly when a loan is made between business partners. Both documents outline the terms of financial arrangements, including contributions and repayment obligations. The Partnership Agreement, however, focuses more on the relationship between partners, while the Loan Agreement is centered on the financial transaction. This distinction is essential for ensuring clarity in business dealings.

Steps to Filling Out Texas Loan Agreement

After obtaining the Texas Loan Agreement form, you will need to complete it accurately to ensure that all parties understand the terms of the loan. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the lender and the borrower in the designated fields.

- Specify the loan amount in the appropriate section.

- Indicate the interest rate, if applicable, and whether it is fixed or variable.

- Outline the repayment terms, including the payment schedule and due dates.

- Include any additional terms or conditions that are relevant to the loan.

- Both parties should sign and date the form at the bottom to indicate their agreement.

Once the form is completed and signed, ensure that each party retains a copy for their records. This will help maintain clarity and accountability throughout the loan process.