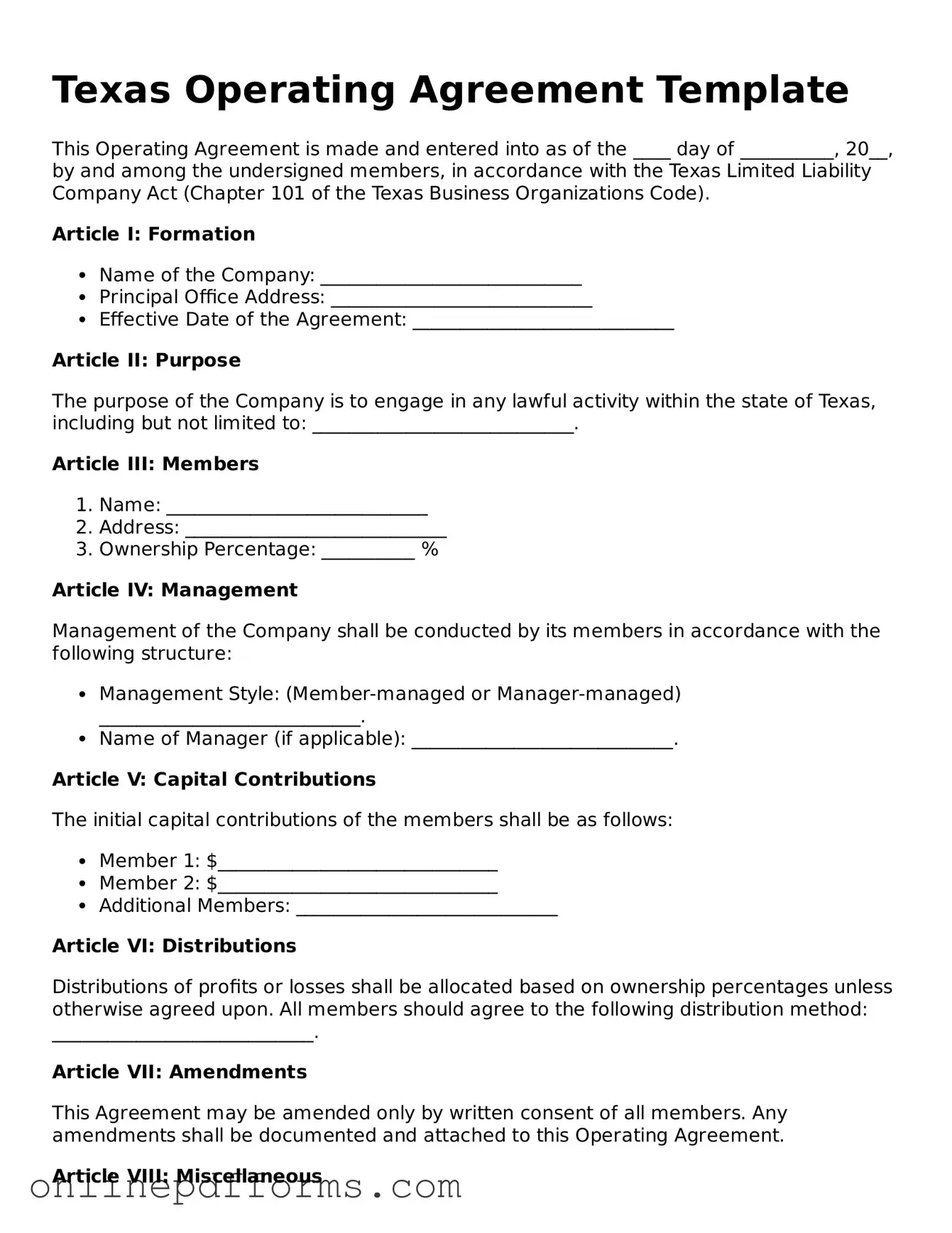

Blank Texas Operating Agreement Form

Documents used along the form

When forming a Limited Liability Company (LLC) in Texas, several key documents accompany the Texas Operating Agreement. Each of these documents serves a specific purpose in establishing the structure and regulations of the LLC. Below is a list of common forms and documents that are often used alongside the Operating Agreement.

- Certificate of Formation: This document is filed with the Texas Secretary of State to officially create the LLC. It includes essential information such as the LLC's name, registered agent, and purpose.

- Membership Interest Transfer Agreement: This agreement outlines the terms under which ownership interests in the LLC can be transferred. It protects the rights of existing members and ensures proper documentation of any changes in ownership.

- Initial Capital Contribution Agreement: This document specifies the initial contributions made by each member to the LLC. It details the amount and type of contributions, such as cash or property.

- Bylaws: While not always required for LLCs, bylaws can provide additional rules governing the internal operations of the company. They cover aspects like meetings, voting procedures, and member responsibilities.

- Operating Procedures: This document outlines the day-to-day operational procedures of the LLC. It can include guidelines for decision-making, financial management, and member interactions.

- Tax Election Forms: Depending on the desired tax treatment, LLCs may need to file forms with the IRS to elect their tax status. This could include choosing to be taxed as a corporation or a partnership.

These documents collectively support the effective management and legal standing of an LLC in Texas. Properly completing and maintaining these forms is crucial for compliance and operational efficiency.

Other Popular State-specific Operating Agreement Templates

How to Create an Operating Agreement for an Llc - It ensures that all members have a voice in business matters.

Create an Operating Agreement - It includes provisions to ensure compliance with state laws.

Similar forms

The Texas Operating Agreement is similar to the Partnership Agreement. A Partnership Agreement outlines the terms and conditions under which partners operate a business together. Like the Operating Agreement, it specifies each partner's contributions, responsibilities, and profit-sharing arrangements. Both documents serve to clarify the relationship between parties and establish guidelines for decision-making, ensuring that all partners are on the same page regarding their roles and expectations.

Another document similar to the Texas Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing the structure of the board, the process for holding meetings, and the rights of shareholders. Just as the Operating Agreement sets forth the rules for managing a limited liability company (LLC), Bylaws provide a framework for corporate governance. Both documents are essential for maintaining order and transparency within the respective entities.

The Shareholder Agreement is also comparable to the Texas Operating Agreement. This document outlines the rights and obligations of shareholders in a corporation. It addresses issues such as the transfer of shares, voting rights, and dispute resolution. Similar to the Operating Agreement, it aims to protect the interests of all parties involved and provides a clear roadmap for how the business will be managed and how conflicts will be resolved.

Lastly, the Joint Venture Agreement bears similarities to the Texas Operating Agreement. A Joint Venture Agreement is used when two or more parties collaborate on a specific project while maintaining their separate legal identities. It outlines each party's contributions, responsibilities, and profit-sharing. Like the Operating Agreement, it establishes a clear framework for cooperation, ensuring that all parties understand their roles and the terms of the partnership.

Steps to Filling Out Texas Operating Agreement

Completing the Texas Operating Agreement form is an important step for any limited liability company (LLC) in Texas. This document outlines the management structure and operating procedures of your LLC, ensuring that all members are on the same page. Once you have filled out the form, it will serve as a guiding document for your business operations and help protect your personal assets.

- Begin by gathering all necessary information about your LLC, including the name, address, and the names of all members.

- Clearly state the purpose of your LLC. This should be a brief description of the business activities you plan to engage in.

- Identify the members of the LLC. List each member’s name, address, and their ownership percentage in the company.

- Outline the management structure. Decide if your LLC will be member-managed or manager-managed, and provide details accordingly.

- Specify the voting rights of each member. This includes how decisions will be made and what percentage of votes are required for different types of decisions.

- Detail the distribution of profits and losses. Clearly explain how profits and losses will be allocated among members.

- Include provisions for adding new members or handling the exit of existing members. This ensures clarity in case of changes in membership.

- Address the dissolution of the LLC. Provide a plan for how the company will be dissolved if necessary, including how assets will be distributed.

- Finally, ensure that all members review the agreement and sign it. This is crucial for the agreement to be valid and enforceable.