Blank Texas Promissory Note Form

Documents used along the form

When dealing with a Texas Promissory Note, there are several other documents that may be useful to ensure clarity and protection for both parties involved. Each of these documents serves a specific purpose and can help facilitate the lending process.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It provides a comprehensive understanding of the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this document details the specific assets pledged by the borrower. It establishes the lender's rights to the collateral in case of default.

- Personal Guarantee: This document may be signed by a third party, guaranteeing repayment of the loan if the primary borrower defaults. It adds an extra layer of security for the lender.

- Disclosure Statement: This form provides important information about the loan, including fees, interest rates, and other key terms. It ensures that the borrower is fully informed before agreeing to the loan.

- Room Rental Agreement: For comprehensive rental terms, refer to our informative Room Rental Agreement resources to ensure both parties' rights are well-defined.

- Amendment Agreement: If any terms of the original Promissory Note need to be changed, this document outlines the modifications. It must be signed by both parties to be valid.

Having these documents in place can help both the lender and the borrower navigate the lending process more smoothly. Each form plays a vital role in protecting the interests of all parties involved.

Other Popular State-specific Promissory Note Templates

Promissory Note Template Ohio - A borrower should disclose their financial situation frankly to avoid complications later.

Promissory Note Georgia - This document is useful for establishing trust between lenders and borrowers.

Promissory Note Form California - This agreement can help in building a positive credit history for the borrower.

Completing a Trailer Bill of Sale is crucial for both parties involved in the transaction, as it ensures that all necessary details are documented officially. It is recommended to download and fill out the form before finalizing the deal, which you can access by visiting https://pdftemplates.info/trailer-bill-of-sale-form.

Promissory Note Florida Pdf - In corporate finance, promissory notes can be used to fund short-term operational needs.

Similar forms

The Texas Promissory Note shares similarities with a Loan Agreement. Both documents outline the terms of borrowing money, including the amount, interest rate, and repayment schedule. While a promissory note is often simpler and focuses on the borrower's promise to repay, a loan agreement typically includes additional details such as collateral requirements and specific conditions for default. Both documents serve to protect the lender's interests while establishing clear expectations for the borrower.

When engaging in the purchase or sale of a trailer in Missouri, it is essential to use the appropriate documentation, such as the Missouri Trailer Bill of Sale form, which acts as a legal record confirming the transaction. For those interested in detailed guidance, resources like Auto Bill of Sale Forms can provide crucial information and templates to ensure that all legal requirements are met and that both seller and buyer are protected throughout the process.

Another document that resembles the Texas Promissory Note is the Mortgage. A mortgage secures a loan with real property, while a promissory note is simply a promise to repay the borrowed amount. In both cases, the borrower agrees to repay the lender, and failure to do so can result in serious consequences. However, a mortgage provides the lender with a legal claim to the property, making it a more complex arrangement compared to the straightforward nature of a promissory note.

A third similar document is the Secured Note. Like a promissory note, a secured note represents a borrower's promise to repay a debt. The key difference lies in the security interest. A secured note is backed by collateral, which provides the lender with additional protection. This means that if the borrower defaults, the lender has the right to seize the collateral. In essence, both documents serve the same purpose but differ in the level of security provided to the lender.

Lastly, the Texas Promissory Note can be compared to a Personal Guarantee. A personal guarantee is a commitment made by an individual to repay a debt if the primary borrower defaults. While a promissory note focuses on the borrower's obligation, a personal guarantee shifts some responsibility to another party, often a business owner or partner. Both documents aim to provide assurance to the lender, but they do so in different ways, with personal guarantees adding an extra layer of accountability.

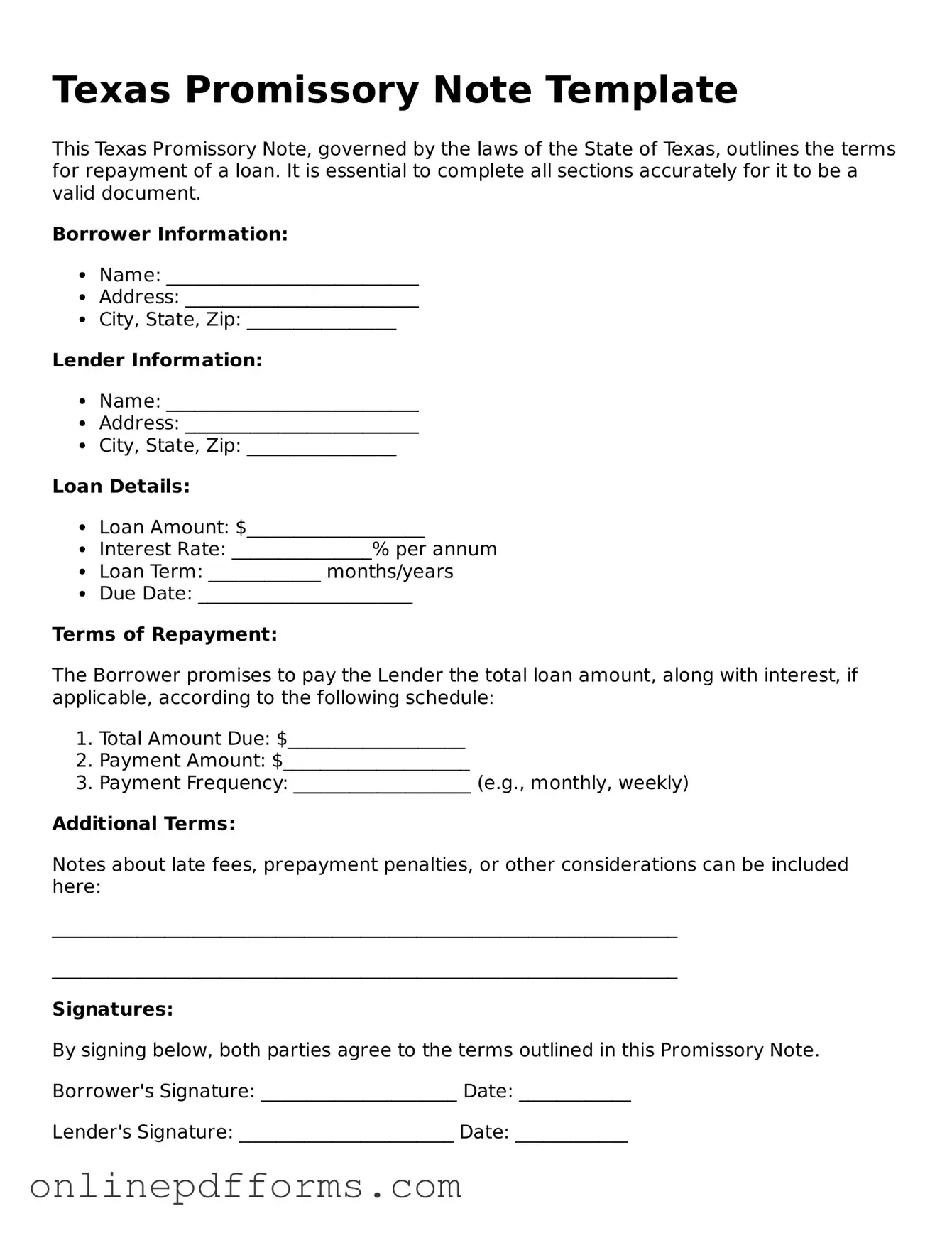

Steps to Filling Out Texas Promissory Note

Once you have the Texas Promissory Note form in hand, you are ready to fill it out. Completing this form accurately is crucial for ensuring that all parties understand their rights and obligations. Follow these steps carefully to ensure the form is filled out correctly.

- Identify the Parties: Write the full name and address of the borrower and the lender at the top of the form.

- Loan Amount: Clearly state the total amount being borrowed. This should be a numerical figure followed by the written amount in words.

- Interest Rate: Specify the interest rate for the loan. Make sure to indicate whether it is fixed or variable.

- Payment Terms: Outline how and when payments will be made. Include the payment schedule, such as monthly or quarterly, and the due dates.

- Maturity Date: Indicate when the loan will be fully paid off. This is the date when the final payment is due.

- Default Terms: Describe what happens if the borrower fails to make payments. Include any penalties or fees that may apply.

- Signatures: Both the borrower and lender must sign and date the document. Ensure that the signatures are clear and legible.

After filling out the form, review it carefully to ensure all information is accurate. Both parties should keep a signed copy for their records. This step is essential for maintaining clarity and accountability in the agreement.