Blank Texas Quitclaim Deed Form

Documents used along the form

A Texas Quitclaim Deed is a useful document for transferring property ownership without warranties. When preparing to use a Quitclaim Deed, you may find that other forms and documents are often needed to complete the process smoothly. Here’s a list of documents that may accompany a Quitclaim Deed in Texas.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, it offers more protection to the buyer.

- Affidavit of Heirship: Used when property is inherited, this document establishes the heirs of a deceased person and their rights to the property.

- Property Transfer Tax Affidavit: This form is often required by the county to report the transfer of property and may include information about the sale price.

- Title Insurance Policy: This policy protects the buyer from potential title issues that may arise after the property transfer. It is not mandatory but is often recommended.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller, including the purchase price and any conditions of the sale.

- Notice of Sale: If the property is being sold at a foreclosure auction, this document provides public notice of the sale, including the date and location.

- Transfer on Death Deed: This allows property owners to transfer their property to beneficiaries upon their death without going through probate.

- Lease Agreement: If the property will be rented out, this document outlines the terms of the lease between the landlord and tenant.

- Power of Attorney: This document allows someone to act on behalf of the property owner, which can be useful in property transactions if the owner cannot be present.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

Having these documents ready can help ensure a smoother property transfer process. Each serves a specific purpose and can protect the interests of all parties involved. Always consider consulting a professional for guidance tailored to your situation.

Other Popular State-specific Quitclaim Deed Templates

Florida Quit Claim Deed - This form aids in the facilitation of real estate portfolio adjustments.

Quitclaim Deed Georgia - A quitclaim deed can also act as a release of interest.

Pennsylvania Quit Claim Deed Pdf - A Quitclaim Deed must be filed with the appropriate county office to be effective.

Ohio Quit Claim Deed Form - This deed is straightforward, making it an appealing choice for non-commercial property transfers.

Similar forms

A Warranty Deed is similar to a Quitclaim Deed in that both are used to transfer property ownership. However, the key difference lies in the guarantees provided. A Warranty Deed offers a guarantee that the seller holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed makes no such guarantees, which means the buyer assumes the risk of any title issues. This makes Warranty Deeds more secure for buyers, while Quitclaim Deeds are often used in less formal transactions, such as transferring property between family members.

A Bargain and Sale Deed also serves the purpose of transferring property ownership, but it includes some assurances about the title. This type of deed implies that the seller has the right to sell the property, but it does not guarantee that the title is free from encumbrances. Like a Quitclaim Deed, it is often used in situations where the buyer knows the seller well, but it offers a bit more protection regarding the seller's ownership rights.

A Special Warranty Deed is another document similar to a Quitclaim Deed. It transfers property ownership but provides a limited warranty on the title. The seller guarantees that they have not encumbered the property during their ownership. This differs from a Quitclaim Deed, which offers no guarantees at all. Special Warranty Deeds are often used in commercial transactions where the seller wants to limit their liability regarding the title.

A Deed of Trust is related but serves a different purpose. It is used to secure a loan with real property as collateral. In a Deed of Trust, the borrower conveys the property to a trustee, who holds the title until the loan is repaid. While a Quitclaim Deed transfers ownership outright, a Deed of Trust creates a security interest in the property, making it an essential document in real estate financing.

A Life Estate Deed allows a property owner to transfer ownership while retaining the right to use the property for the rest of their life. This is similar to a Quitclaim Deed in that it transfers property rights, but it does so with specific conditions. The new owner, known as the remainderman, receives full ownership only after the original owner passes away. This type of deed is often used for estate planning purposes.

Finally, a Transfer on Death Deed (TOD) allows an individual to transfer property upon their death without going through probate. This deed is similar to a Quitclaim Deed in that it transfers ownership, but it only takes effect after the owner's death. The property owner retains full control during their lifetime, making it a useful tool for estate planning. Unlike Quitclaim Deeds, which transfer ownership immediately, a TOD Deed ensures that the property passes directly to the designated beneficiary without additional legal hurdles.

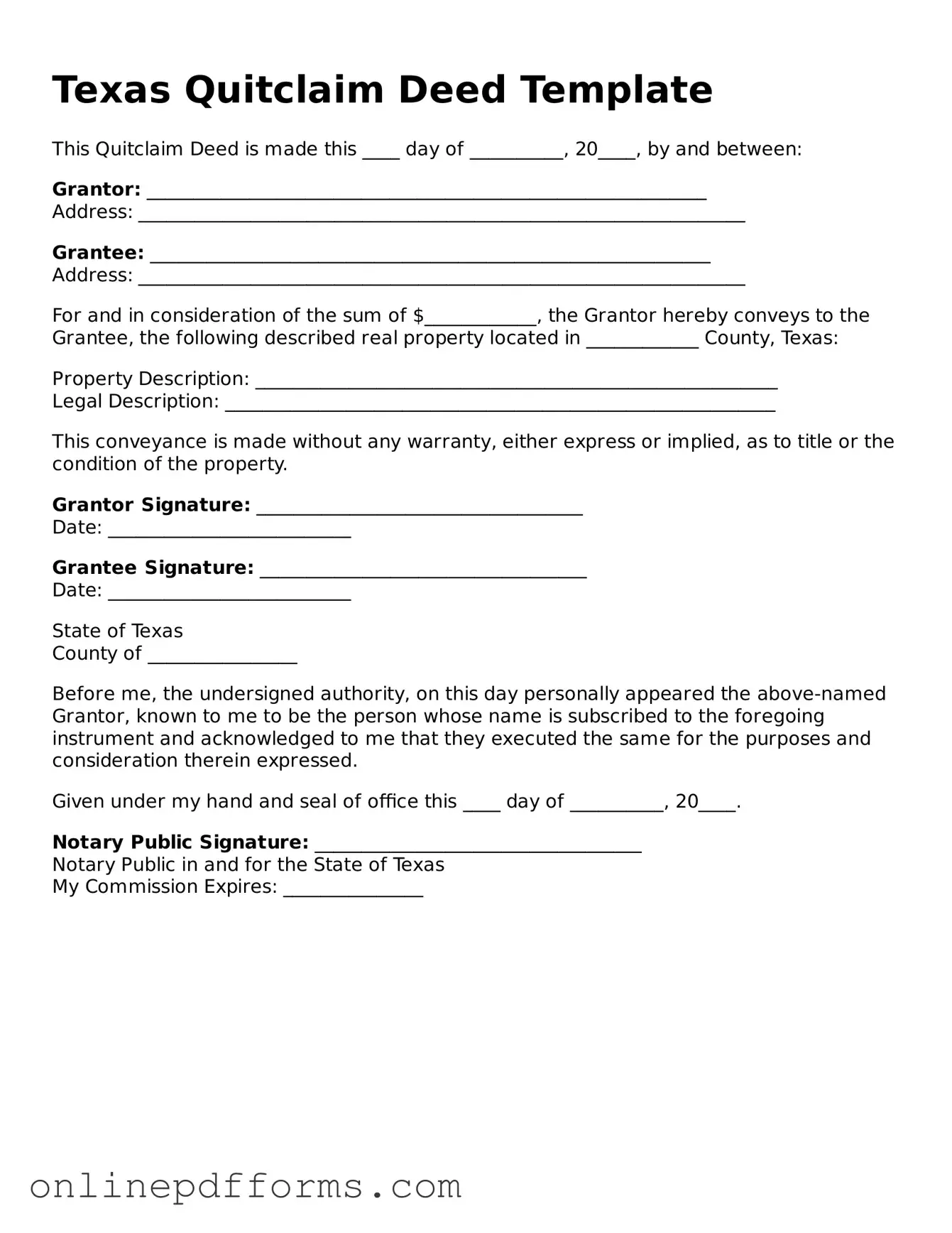

Steps to Filling Out Texas Quitclaim Deed

Once you have the Texas Quitclaim Deed form ready, it’s time to fill it out accurately. This form is essential for transferring property rights. Follow these steps to ensure you complete it correctly.

- Obtain the form: Get a blank Texas Quitclaim Deed form from a reliable source, such as a legal website or local government office.

- Fill in the grantor's information: Write the full name of the person transferring the property (the grantor). Include their address.

- Fill in the grantee's information: Write the full name of the person receiving the property (the grantee). Include their address as well.

- Describe the property: Provide a clear description of the property being transferred. Include the address and any legal description if available.

- Include the consideration: State the amount being paid for the property, or write "for love and affection" if no money is exchanged.

- Sign the document: The grantor must sign the deed in front of a notary public. Ensure the signature is clear and matches the name listed.

- Notarize the deed: The notary public will verify the grantor’s identity and witness the signing. They will then add their seal and signature.

- File the deed: Submit the completed Quitclaim Deed to the county clerk’s office in the county where the property is located. There may be a filing fee.

After filing, keep a copy for your records. This process ensures that the property transfer is officially recorded and recognized by the county. You’re on your way to completing the transfer successfully!