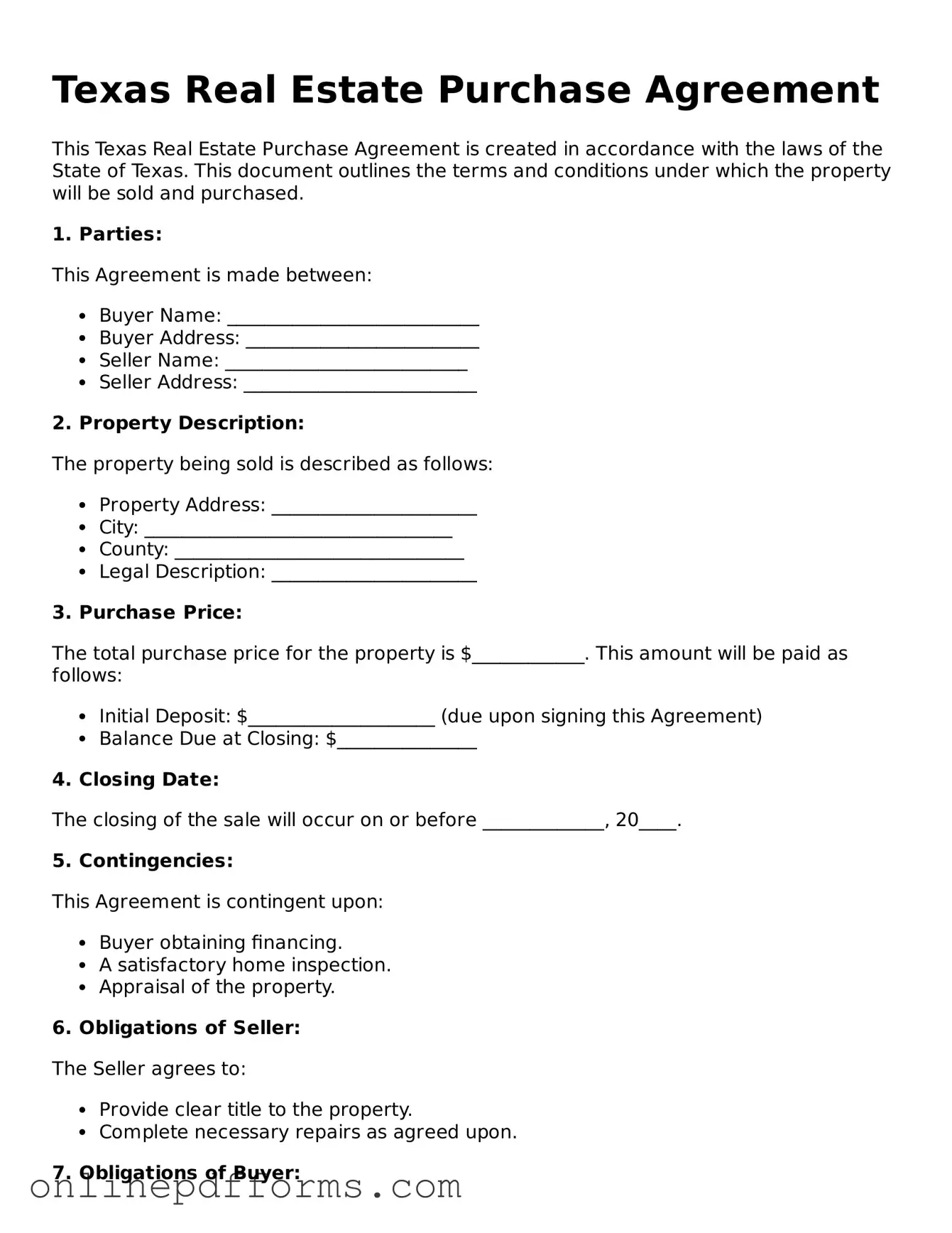

Blank Texas Real Estate Purchase Agreement Form

Documents used along the form

When engaging in a real estate transaction in Texas, several documents often accompany the Texas Real Estate Purchase Agreement. These forms help clarify the terms of the sale and protect the interests of both buyers and sellers. Below is a list of commonly used documents.

- Seller's Disclosure Notice: This document requires the seller to disclose known issues with the property. It helps buyers make informed decisions by revealing potential problems that could affect the property's value or safety.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about the potential presence of lead-based paint. It is crucial for protecting the health of occupants, especially children.

- Option Fee Agreement: This agreement allows the buyer to pay a fee for the right to terminate the contract within a specified period. It provides the buyer time to conduct inspections and secure financing without the risk of losing the property.

- Loan Estimate: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates and closing costs. It helps buyers understand their financial obligations before committing to a mortgage.

- Closing Disclosure: This form is provided to buyers and sellers before closing. It details the final terms of the loan, including all costs associated with the transaction, ensuring transparency in the closing process.

Having these documents ready can streamline the buying or selling process. Each form serves a specific purpose and contributes to a smoother transaction, helping both parties feel secure in their agreement.

Other Popular State-specific Real Estate Purchase Agreement Templates

Residential Purchase Agreement - The document may outline contingencies, such as inspections or financing requirements.

Real-estate Sale Contract - A legal document outlining the terms for buying real estate.

Pa Real Estate Contract - This form can clarify any conditions that must be met before closing.

Similar forms

The Texas Real Estate Purchase Agreement is similar to the Residential Purchase Agreement, which is commonly used in many states. Both documents serve the purpose of outlining the terms and conditions under which a buyer agrees to purchase a property from a seller. They detail important aspects such as the purchase price, financing arrangements, and contingencies. Additionally, both agreements require signatures from both parties to become legally binding, ensuring that each party understands their rights and obligations throughout the transaction process.

Another document that shares similarities is the Commercial Purchase Agreement. Like the Texas Real Estate Purchase Agreement, this document is used in real estate transactions but focuses on commercial properties rather than residential ones. It includes clauses related to zoning, business use, and environmental assessments, which are crucial for commercial transactions. Both agreements provide a framework for negotiations and help protect the interests of both buyers and sellers.

The Offer to Purchase Agreement is also comparable. This document is typically used when a buyer expresses interest in purchasing a property, serving as a formal offer to the seller. It outlines the terms the buyer is willing to accept, including the price and any conditions that must be met for the sale to proceed. Similar to the Texas Real Estate Purchase Agreement, it is a crucial step in the transaction process and can lead to the creation of a more detailed purchase agreement once both parties agree on the terms.

The Lease Purchase Agreement is another related document. This agreement allows a tenant to lease a property with the option to buy it later. It combines elements of both leasing and purchasing, making it unique. However, like the Texas Real Estate Purchase Agreement, it includes terms related to the sale price, financing, and conditions for the purchase, ensuring that both parties understand their responsibilities during the lease period and at the time of purchase.

The Option to Purchase Agreement shares similarities as well. This document gives a buyer the right, but not the obligation, to purchase a property at a later date for a specified price. It outlines the terms of the option, including how long the buyer has to exercise it. Both this agreement and the Texas Real Estate Purchase Agreement establish clear expectations and timelines for the transaction, protecting the interests of both parties involved.

The Seller Financing Agreement is another document that relates closely to the Texas Real Estate Purchase Agreement. In this case, the seller provides financing to the buyer, allowing them to purchase the property without going through a traditional lender. This agreement details the terms of the financing arrangement, including interest rates and payment schedules. Both documents are essential in clarifying the financial aspects of the transaction and ensuring that both parties are on the same page regarding payment obligations.

Lastly, the Real Estate Listing Agreement is relevant as well. While this document primarily serves the seller by outlining the terms under which a real estate agent will market the property, it shares common elements with the Texas Real Estate Purchase Agreement. Both documents are integral to the real estate transaction process, as they set forth the expectations and responsibilities of the parties involved. The Listing Agreement ensures that the seller’s interests are represented while the Purchase Agreement focuses on the terms of the sale itself.

Steps to Filling Out Texas Real Estate Purchase Agreement

After obtaining the Texas Real Estate Purchase Agreement form, the next steps involve carefully filling out the necessary information to ensure all parties are accurately represented. This process requires attention to detail and a clear understanding of the terms being agreed upon.

- Begin by entering the date of the agreement at the top of the form.

- Identify the parties involved: fill in the names and addresses of the buyer(s) and seller(s).

- Specify the property address, including any relevant details such as the county and legal description if applicable.

- State the purchase price of the property, ensuring it is clearly indicated in both numerical and written form.

- Detail the earnest money amount, including the method of payment (check, wire transfer, etc.).

- Outline any financing terms, such as the type of loan and lender information if applicable.

- Indicate the closing date and any contingencies, such as inspections or financing approvals.

- Include any additional provisions or special agreements that may be relevant to the transaction.

- Sign and date the agreement at the bottom, ensuring all parties have the opportunity to review and sign.

Once the form is completed, it should be reviewed by all parties to confirm accuracy before submission. This ensures clarity and minimizes the risk of disputes later on.