Blank Texas Transfer-on-Death Deed Form

Documents used along the form

The Texas Transfer-on-Death Deed allows property owners to pass their property directly to beneficiaries without going through probate. To ensure the deed is effective and the transfer is smooth, several other forms and documents may be needed. Below is a list of common documents often used alongside the Transfer-on-Death Deed in Texas.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person. It is often used when there is no will, providing a legal declaration of who inherits the property.

- Motor Vehicle Bill of Sale: serves as a recorded agreement for the transfer of ownership of a vehicle, ensuring clarity and legal compliance, particularly when utilizing forms like Auto Bill of Sale Forms.

- Last Will and Testament: A will outlines how a person's assets will be distributed after their death. It can work alongside a Transfer-on-Death Deed if there are additional wishes regarding other assets.

- Beneficiary Designation Forms: These forms are used for financial accounts or insurance policies. They specify who will receive the funds upon the account holder's death, complementing the property transfer.

- Property Deed: The original property deed is essential for reference. It shows the current ownership and legal description of the property being transferred.

- Notice of Transfer-on-Death Deed: Filing this notice with the county clerk can help inform interested parties about the transfer, providing clarity and reducing potential disputes.

- Power of Attorney: This document allows someone to act on behalf of the property owner. It can be useful if the owner is unable to manage their affairs before passing.

- Real Estate Purchase Agreement: If the property is being sold before the owner's death, this agreement outlines the terms of the sale, ensuring the Transfer-on-Death Deed aligns with the sale process.

Each of these documents plays a role in the estate planning process. Having them prepared and organized can simplify the transfer of property and help avoid complications later on.

Other Popular State-specific Transfer-on-Death Deed Templates

Transfer on Death Deed Georgia - This deed designates a beneficiary who receives the property automatically after the owner passes away.

Transfer on Death Deed Ohio Pdf - This deed can ensure that family properties remain within the family for future generations.

For those looking to secure their financial agreements, a thorough understanding of the New York Promissory Note template is invaluable. This document outlines the responsibilities of each party, ensuring that the terms of payment are clear and legally binding.

Right of Survivorship Deed Pennsylvania - With a Transfer-on-Death Deed, the property owner can keep the property and not worry about taxes during their lifetime.

Where Can I Get a Tod Form - Once executed, a Transfer-on-Death Deed remains in effect until revoked, providing ongoing security for property wishes.

Similar forms

The Texas Transfer-on-Death Deed (TODD) allows property owners to transfer real estate to beneficiaries upon their death without going through probate. This document shares similarities with a Living Trust. A Living Trust also enables individuals to pass on their assets outside of probate. In both cases, the property is transferred directly to the beneficiaries, simplifying the process and often reducing costs. However, unlike a TODD, a Living Trust can manage assets during the grantor's lifetime, providing more flexibility and control.

An Affidavit of Heirship is another document that resembles the Transfer-on-Death Deed. This affidavit is used to establish the heirs of a deceased person and can help transfer property without formal probate. While a TODD specifies beneficiaries ahead of time, an Affidavit of Heirship is typically utilized after death to determine who inherits the property. Both documents aim to streamline the transfer process and minimize legal complications.

The Quitclaim Deed is another document that can be compared to the Transfer-on-Death Deed. This type of deed transfers whatever interest a person has in a property without any warranties. While a TODD conveys property upon death, a Quitclaim Deed can be used during the owner's lifetime to transfer property rights. Both documents can simplify property transfers, but they serve different purposes and timelines.

A Beneficiary Designation form is similar in intent to the TODD, particularly regarding financial accounts and certain assets. This form allows individuals to name beneficiaries for accounts like life insurance or retirement plans. Like a TODD, the assets pass directly to the named beneficiaries upon death, avoiding probate. However, the Beneficiary Designation form typically applies to non-real estate assets, while a TODD is specific to real property.

A Life Estate Deed is a document that allows a property owner to retain the right to live in the property during their lifetime while transferring the remainder interest to another party. This arrangement is similar to a TODD because it also involves transferring property upon death. However, a Life Estate Deed grants the original owner certain rights until their death, while a TODD transfers ownership entirely upon death.

The USCIS I-134 form, also known as the Affidavit of Support, serves as a crucial document for those looking to sponsor an immigrant or non-immigrant in the United States. This form demonstrates the sponsor's financial ability to support the applicant, ensuring they can sustain themselves without government assistance. Understanding the importance of the I-134 can significantly impact the success of an immigration application. For more information, you can refer to the USCIS I-134 form.

The Power of Attorney (POA) is another document that bears some resemblance to the Transfer-on-Death Deed. A POA allows one person to make decisions on behalf of another, including managing property. While the TODD is concerned with transferring property after death, a POA can be effective during the grantor's lifetime. Both documents can simplify property management and transfers, but they operate at different stages of life.

The Deed of Gift is similar to the TODD in that it involves the transfer of property. A Deed of Gift is used to transfer ownership of property while the donor is still alive, often without compensation. In contrast, the TODD facilitates a transfer upon death. Both documents can help avoid probate, but they differ in timing and intent regarding the transfer of ownership.

Lastly, the Transfer-on-Death Registration for Securities is akin to the TODD, but it applies to financial assets rather than real estate. This registration allows individuals to designate beneficiaries for their securities, ensuring a smooth transfer upon death. Like the TODD, this document helps avoid probate and allows for a direct transfer of assets to the designated beneficiaries.

Steps to Filling Out Texas Transfer-on-Death Deed

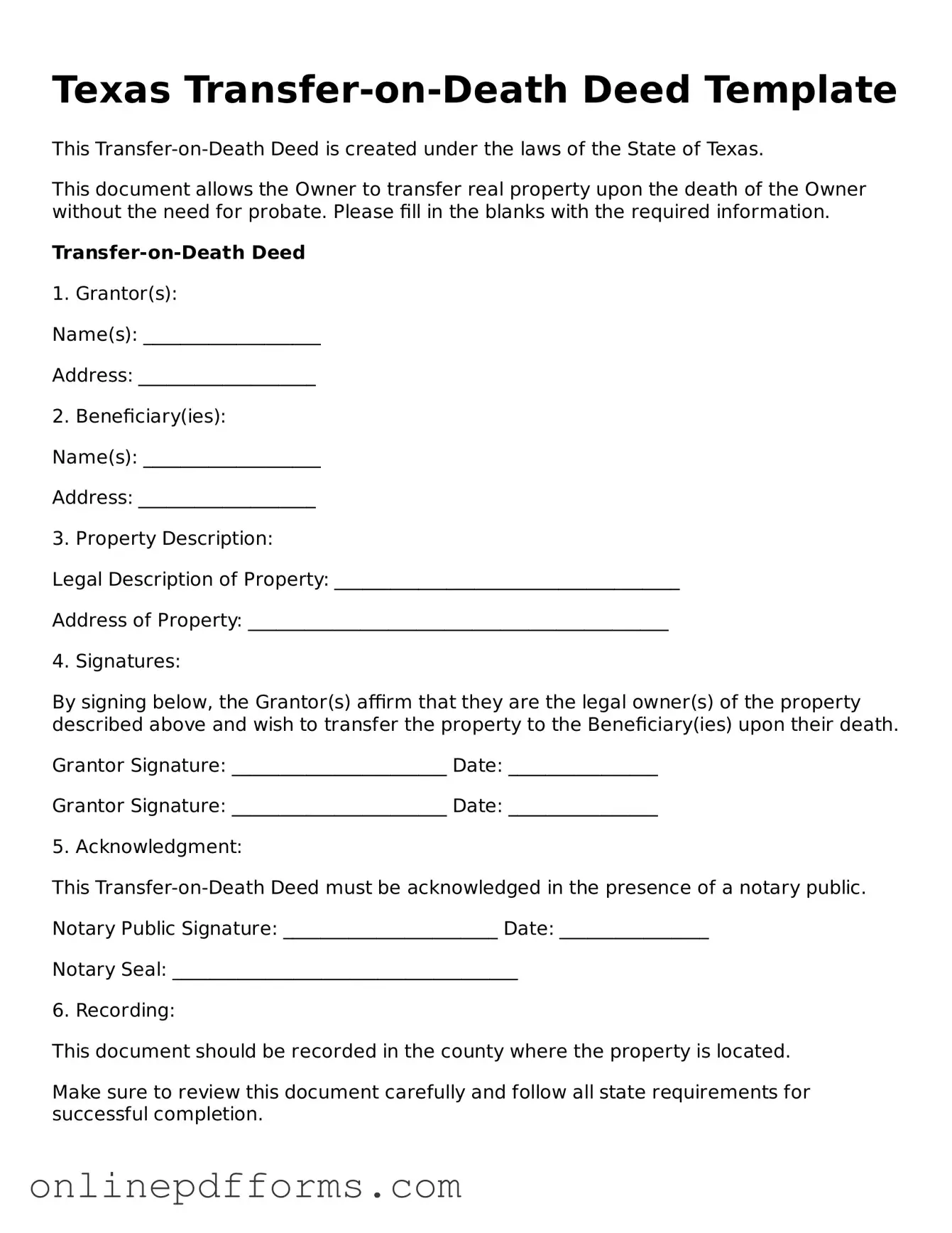

After you have gathered all necessary information, it's time to fill out the Texas Transfer-on-Death Deed form. This form allows you to designate a beneficiary who will receive your property upon your passing. Follow these steps to complete the form accurately.

- Obtain the form: Download the Texas Transfer-on-Death Deed form from the Texas Secretary of State's website or obtain a hard copy from your local county office.

- Fill in your information: At the top of the form, enter your full name and address as the grantor (the person transferring the property).

- Describe the property: Provide a complete legal description of the property you wish to transfer. This may include the address and any relevant details that clearly identify the property.

- Designate the beneficiary: Clearly write the full name and address of the person or entity you want to inherit the property upon your death.

- Include additional beneficiaries (if desired): If you wish to name more than one beneficiary, include their names and addresses as well. Specify how the property will be divided among them.

- Sign the form: As the grantor, you must sign the form in the presence of a notary public. Ensure that your signature is clear and matches the name you provided.

- Notarization: The notary will verify your identity and witness your signature. They will then complete the notarization section of the form.

- File the deed: Once the form is signed and notarized, file it with the county clerk’s office in the county where the property is located. There may be a filing fee, so check in advance.