Legal Transfer-on-Death Deed Form

Transfer-on-Death DeedTemplates for Specific States

Documents used along the form

A Transfer-on-Death (TOD) Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding probate. While the TOD Deed is a crucial document, several other forms and documents often accompany it to ensure a smooth transition of property ownership. Below is a list of these important documents.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can also appoint guardians for minor children.

- Beneficiary Designation Forms: Used for financial accounts and insurance policies, these forms specify who will receive the assets upon the account holder's death.

- Living Trust: A legal arrangement that allows a person to place their assets into a trust during their lifetime, specifying how those assets should be managed and distributed after death.

- Power of Attorney: This document grants someone the authority to make financial or medical decisions on behalf of another person, particularly if they become incapacitated.

- Affidavit of Heirship: A sworn statement used to establish the identity of heirs and the distribution of property when a person dies without a will.

- Property Deed: The legal document that conveys ownership of real estate. It may need to be updated or recorded in conjunction with a TOD Deed.

- Notice of Death: A formal notification that may be required to inform relevant parties of a person's death, which can affect property ownership and rights.

- Vehicle Purchase Agreement: This crucial document outlines the terms of the vehicle sale, including the purchase price and warranties to ensure a smooth transaction. For more details, visit pdftemplates.info/texas-vehicle-purchase-agreement-form/.

- Estate Tax Return: A form filed with the IRS to report the estate's value and determine any taxes owed, which may be necessary depending on the estate's size.

Understanding these documents can help ensure that your property and assets are transferred according to your wishes, minimizing potential disputes and complications for your beneficiaries. Proper planning and documentation are essential for a smooth transition of ownership.

Consider More Types of Transfer-on-Death Deed Forms

What Is Deed in Lieu - Borrowers should assess the impact of a Deed in Lieu on their overall financial situation.

In situations where a parent or guardian is unable to be present, having a reliable system for making decisions for a child is vital. The Arizona Power of Attorney for a Child form provides a framework for appointing another trusted adult to act on behalf of the child. This not only covers essential areas such as education and health care but also ensures the child's overall well-being. For those interested in this important legal safeguard, more information can be found at arizonaformspdf.com/, making it easier to take the necessary steps to fill out the form effectively.

How to File a Lady Bird Deed in Michigan - Homeowners can enjoy peace of mind knowing their loved ones will inherit their property seamlessly.

Similar forms

A will is a legal document that outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, a will allows individuals to specify beneficiaries who will receive property. However, a will typically requires probate, a court process that can be time-consuming and costly. In contrast, a Transfer-on-Death Deed allows property to pass directly to the designated beneficiaries without going through probate, simplifying the transfer process and potentially reducing expenses for the heirs.

The Wisconsin RV Bill of Sale form is an essential document for anyone planning to buy or sell an RV in Wisconsin, as it serves to formally document the transaction. This legally binding form not only details the specifics of the sale but also ensures that the transfer of ownership and title is officially recognized. For those looking to streamline this process and obtain the necessary paperwork, resources like Auto Bill of Sale Forms can provide valuable assistance.

Steps to Filling Out Transfer-on-Death Deed

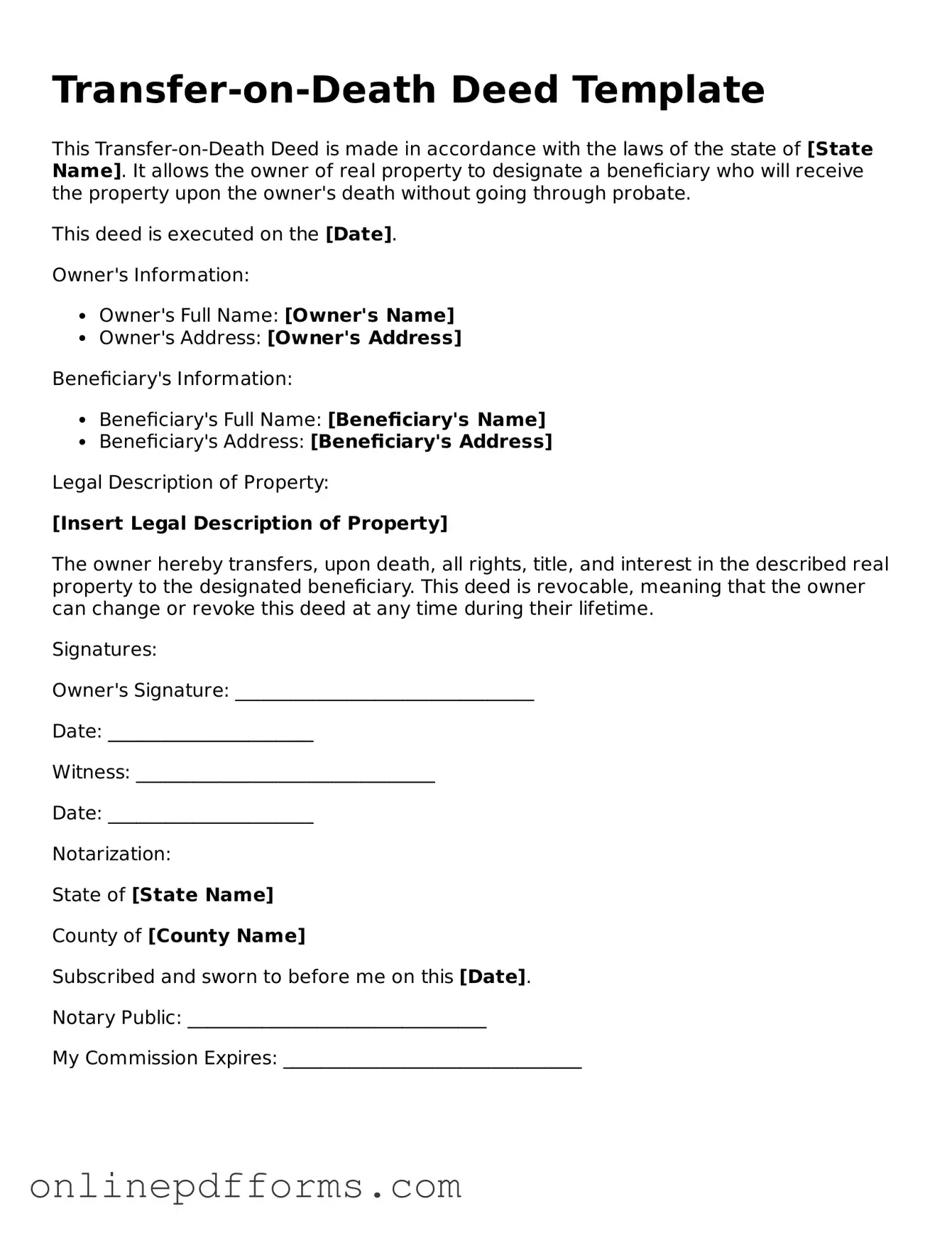

After obtaining the Transfer-on-Death Deed form, it is essential to complete it accurately. Once filled out, the form must be filed with the appropriate local government office to ensure its validity. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name of the property owner, including any middle names or initials.

- List the address of the property, including the street number, street name, city, state, and zip code.

- Identify the legal description of the property. This may include details from the property deed.

- Enter the name of the beneficiary who will receive the property upon the owner's death.

- Include the beneficiary's address, ensuring accuracy for future correspondence.

- Sign the form in the designated area. Ensure that the signature matches the name provided earlier.

- Have the form notarized. A notary public must witness the signature.

- Make copies of the completed and notarized form for personal records.

- Submit the original form to the appropriate local government office for recording.