Legal Vehicle Repayment Agreement Form

Documents used along the form

When engaging in a vehicle repayment agreement, several other forms and documents may be necessary to ensure clarity and legal compliance. These documents help outline the terms of the agreement, protect the rights of both parties, and facilitate a smooth transaction. Below is a list of commonly used forms that accompany the Vehicle Repayment Agreement.

- Promissory Note: This is a written promise to pay a specified amount of money at a certain time. It details the terms of the loan, including interest rates and payment schedules.

- Bill of Sale: This document serves as proof of the sale and transfer of ownership of the vehicle from the seller to the buyer. It includes details such as the vehicle identification number (VIN), make, model, and sale price.

- Loan Application: This form collects personal and financial information from the borrower. It helps lenders assess the borrower's creditworthiness and determine loan eligibility.

- Credit Report Authorization: This document allows a lender to obtain the borrower's credit report. It is essential for evaluating the borrower's financial history and ability to repay the loan.

- Security Agreement: This agreement outlines the lender's rights to the vehicle in case of default. It establishes the vehicle as collateral for the loan, ensuring the lender can reclaim it if payments are not made.

- Insurance Verification: Proof of insurance is often required to protect both the lender and borrower. This document confirms that the vehicle is insured, meeting the lender's requirements.

- Title Transfer Document: This form is used to officially transfer the vehicle's title from the seller to the buyer. It is crucial for ensuring that the new owner has legal ownership of the vehicle.

- Payment Schedule: This document outlines the specific dates and amounts of each payment due under the repayment agreement. It serves as a roadmap for the borrower to follow.

- Divorce Settlement Agreement: This document is essential for couples finalizing their divorce, outlining the division of assets, debts, and custody arrangements, and can be found at https://californiapdf.com.

- Default Notice: In the event of missed payments, this notice informs the borrower of their default status and outlines the potential consequences, including the possibility of repossession.

Each of these documents plays a vital role in the vehicle repayment process. They help establish clear expectations, protect the interests of both parties, and facilitate a transparent transaction. Understanding and properly managing these forms can contribute to a successful agreement and help avoid potential disputes in the future.

Other Templates:

Short Term Rental Lease Agreement - Provides for communication methods during the rental period.

When engaging in the sale of a trailer in Virginia, it's important to use the appropriate documentation to facilitate a smooth transaction. Utilizing the Virginia Trailer Bill of Sale form not only formalizes the sale but also aligns with the standards set out in various Auto Bill of Sale Forms, ensuring that both parties are protected and that the transfer of ownership is legally binding.

California Corrective Deed - Often, lawyers will prepare a Scrivener's Affidavit to ensure compliance with legal requirements.

Similar forms

The Vehicle Repayment Agreement form shares similarities with a Loan Agreement. Both documents outline the terms under which a borrower receives funds to purchase a vehicle. They detail the repayment schedule, interest rates, and consequences of default. A Loan Agreement often includes provisions for collateral, which in the case of a vehicle, is the vehicle itself. This ensures that the lender has a claim to the vehicle should the borrower fail to meet their repayment obligations.

Another document akin to the Vehicle Repayment Agreement is the Promissory Note. This is a legal document in which one party promises to pay a specified sum to another party under agreed-upon terms. Like the Vehicle Repayment Agreement, it includes details such as the amount borrowed, interest rate, and payment schedule. However, the Promissory Note is typically less detailed regarding the consequences of non-payment, focusing primarily on the borrower's commitment to repay the loan.

A Lease Agreement is also comparable, particularly when the vehicle is being leased rather than purchased. Both documents outline payment terms and responsibilities. A Lease Agreement will specify the duration of the lease, monthly payments, and any fees for exceeding mileage or damages. While the Vehicle Repayment Agreement focuses on ownership transfer, a Lease Agreement emphasizes the temporary use of the vehicle.

The Bill of Sale is another relevant document, especially in the context of vehicle transactions. It serves as proof of the sale and includes details such as the purchase price, vehicle identification number, and buyer and seller information. While the Vehicle Repayment Agreement focuses on the repayment terms, the Bill of Sale confirms the transfer of ownership from the seller to the buyer.

For those interested in investments, understanding the essential details about the Investment Letter of Intent is crucial to navigating agreements effectively. This document helps outline the fundamental intentions behind investment proposals, serving as a foundation for future contracts.

Similar to the Vehicle Repayment Agreement is the Security Agreement. This document is often used when a loan is secured by collateral, such as a vehicle. It outlines the rights of the lender in relation to the collateral and specifies what happens if the borrower defaults. The Security Agreement provides additional protection for the lender, ensuring they can reclaim the vehicle if necessary.

Finally, the Credit Agreement also shares characteristics with the Vehicle Repayment Agreement. This document governs the terms of credit extended to a borrower. It includes details about the credit limit, interest rates, and repayment terms. While a Vehicle Repayment Agreement is specific to vehicle financing, a Credit Agreement can cover a broader range of borrowing scenarios, yet both aim to establish clear terms for repayment and obligations of the borrower.

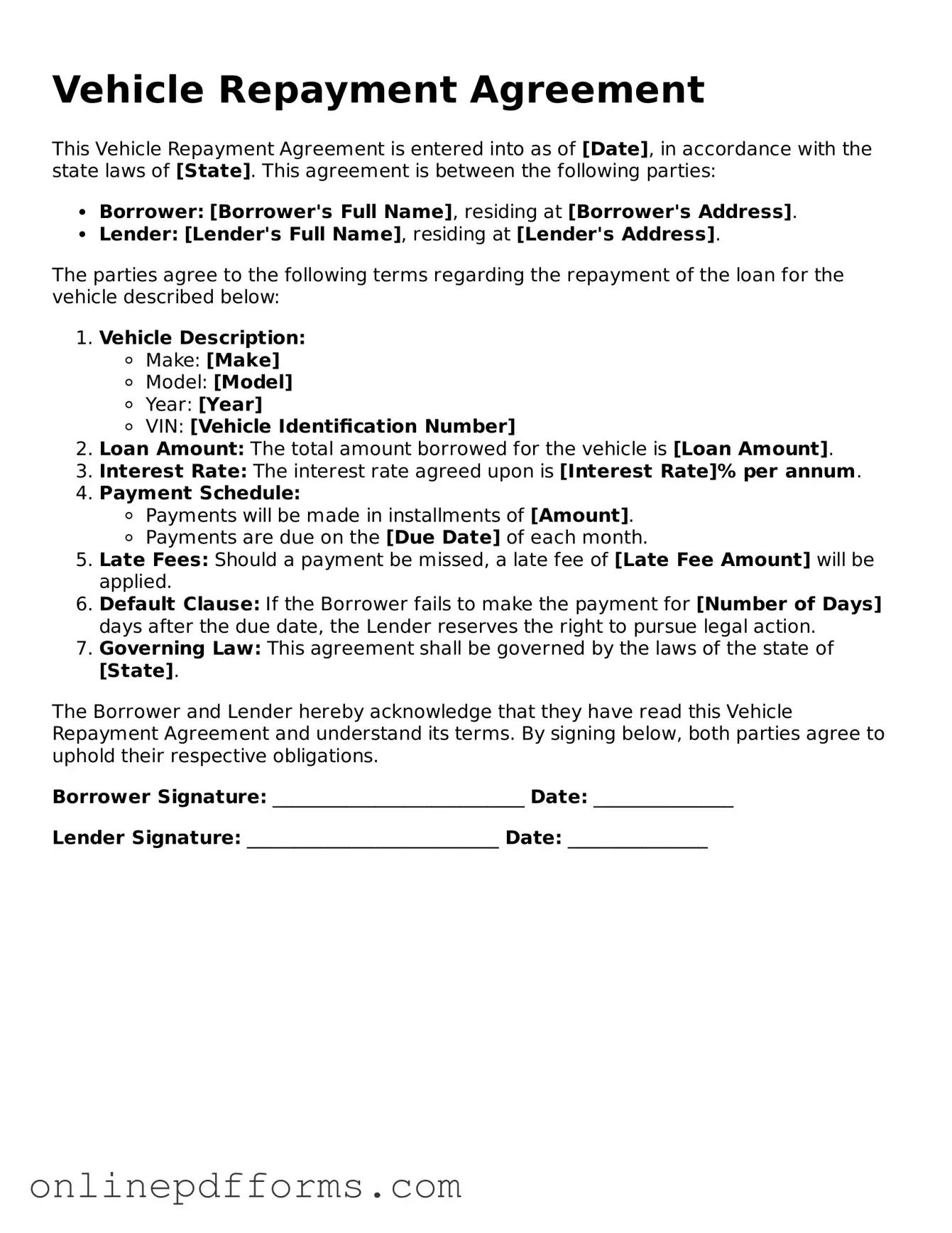

Steps to Filling Out Vehicle Repayment Agreement

Filling out the Vehicle Repayment Agreement form is an important step in formalizing the terms of your repayment plan. Once you have completed the form, it will be submitted to the appropriate party for review and approval. This process ensures that both parties understand their obligations and can help prevent misunderstandings in the future.

- Begin by entering your full name in the designated field at the top of the form.

- Next, provide your current address, including street, city, state, and ZIP code.

- Fill in your contact information, including your phone number and email address.

- In the section for vehicle information, include the make, model, year, and Vehicle Identification Number (VIN) of the vehicle.

- Specify the total amount owed on the vehicle, as well as the proposed repayment amount for each installment.

- Indicate the frequency of payments, such as weekly, bi-weekly, or monthly.

- Include the start date for the repayment plan.

- Review the terms and conditions outlined in the form and ensure you understand them before signing.

- Sign and date the form at the bottom where indicated.

- If required, have a witness or co-signer sign the form as well.

Once you have completed all the steps, make a copy of the form for your records before submitting it to the designated party. This will help ensure that you have a reference for your agreement moving forward.