Fill in Your Western Union Template

Documents used along the form

When using Western Union services, several other forms and documents may be required to facilitate transactions. Each document serves a specific purpose and helps ensure that the process runs smoothly. Below is a list of commonly used forms and documents in conjunction with the Western Union form.

- Identification Document: A government-issued ID, such as a driver's license or passport, is often required to verify the identity of the sender and receiver.

- Florida Medical Power of Attorney Form: To ensure your healthcare preferences are respected, consider utilizing the important Medical Power of Attorney form resources that guide you through the process of designating a trusted individual for medical decision-making.

- Money Transfer Receipt: This document provides proof of the transaction, including details like the amount sent, the sender's information, and a unique tracking number.

- Payment Authorization Form: This form authorizes Western Union to process the payment, confirming that the sender agrees to the transaction terms.

- Receiver's Information Form: This form collects essential details about the recipient, such as their name, address, and contact number, ensuring accurate delivery of funds.

- Currency Exchange Form: If the transaction involves different currencies, this form may be needed to specify the exchange rate and any applicable fees.

- Transfer Cancellation Request: In cases where a sender needs to cancel a transaction, this form outlines the request and reasons for cancellation.

- Refund Request Form: If there are issues with a transaction, this document is used to formally request a refund for the amount sent.

- Tax Identification Number (TIN) Form: For certain transactions, especially those involving large sums, a TIN may be required for tax reporting purposes.

- Compliance Verification Form: This form helps ensure that the transaction adheres to legal and regulatory requirements, protecting both the sender and the company.

- Service Agreement: This document outlines the terms and conditions of using Western Union services, including fees and responsibilities of both parties.

Understanding these documents can simplify the money transfer process and help ensure compliance with all necessary regulations. Being prepared with the right forms can lead to a more efficient and successful transaction experience.

More PDF Templates

Share Transfer Form - The form assists in tracking the ownership history of shares over time.

When buying or selling a motorcycle in Texas, it's essential to use the Texas Motorcycle Bill of Sale form, which serves as a vital record to formalize the transfer of ownership. This document not only protects the interests of both parties but also helps prevent potential disputes. You can access and fill out the form to ensure a hassle-free transaction by visiting https://pdftemplates.info/texas-motorcycle-bill-of-sale-form.

Health Guarantee for Puppies Template - The Breeder is available for advice after the sale.

Similar forms

The Western Union form shares similarities with a money transfer request form, commonly used by various financial institutions. Both documents require the sender's and recipient's details, including names, addresses, and contact information. Additionally, they necessitate the amount being transferred and may include options for tracking the transaction. This ensures that both the sender and receiver are informed throughout the process, maintaining transparency and accountability.

Another document that resembles the Western Union form is a wire transfer authorization form. This form is typically used to initiate electronic transfers between banks. Like the Western Union form, it requires specific information about the sender and recipient, including banking details. Both forms aim to facilitate secure transactions, ensuring that funds are directed to the correct accounts while minimizing the risk of errors.

A remittance form is also comparable to the Western Union form, as it serves a similar purpose of sending money, often across borders. Remittance forms typically include details about the sender's country, the recipient's country, and the purpose of the transfer. Both documents prioritize the collection of essential information to comply with regulatory requirements and to facilitate the smooth transfer of funds.

In the realm of vehicle ownership, key documents play a vital role in facilitating smooth transactions, and among them is the Auto Bill of Sale Forms, which are essential for ensuring that both parties in a sale are protected. This form records important details such as the date of sale and purchase price while establishing clear evidence of the ownership transfer.

The PayPal transaction form offers another parallel, as it is used for online money transfers. Much like the Western Union form, it requires sender and recipient information, along with the transaction amount. Both forms emphasize the need for secure transactions and provide users with confirmation of the transfer, thereby enhancing trust in the service being used.

A cash deposit slip bears similarities to the Western Union form, especially in the context of initiating a financial transaction. This slip captures the depositor's information and the amount being deposited, much like how the Western Union form captures the details of a money transfer. Both documents serve as records of the transaction, ensuring that there is a paper trail for accountability.

The check deposit form is another document that aligns closely with the Western Union form. When depositing a check, individuals must provide details about the check and their account information. This is similar to how the Western Union form collects information to ensure that funds are properly allocated. Both documents aim to facilitate the movement of money while ensuring that all necessary information is collected for processing.

A money order form is yet another document that shares characteristics with the Western Union form. Money orders are often used as a secure method of sending funds, requiring similar information from both the sender and recipient. The process of filling out a money order form mirrors that of the Western Union form, as both necessitate clear identification of parties involved and the amount being transferred.

The Venmo payment request form also resembles the Western Union form in its function of facilitating money transfers between individuals. Users must provide details about the transaction, including the amount and the recipient's information. Both forms prioritize ease of use and security, allowing users to send money quickly while ensuring that the necessary information is captured for processing.

Lastly, a gift card balance transfer form can be compared to the Western Union form in terms of its purpose of transferring value. While gift cards typically do not require extensive personal information, the process of transferring a balance from one card to another involves similar steps, including identifying the source and destination of funds. Both forms are designed to facilitate the movement of value securely and efficiently.

Steps to Filling Out Western Union

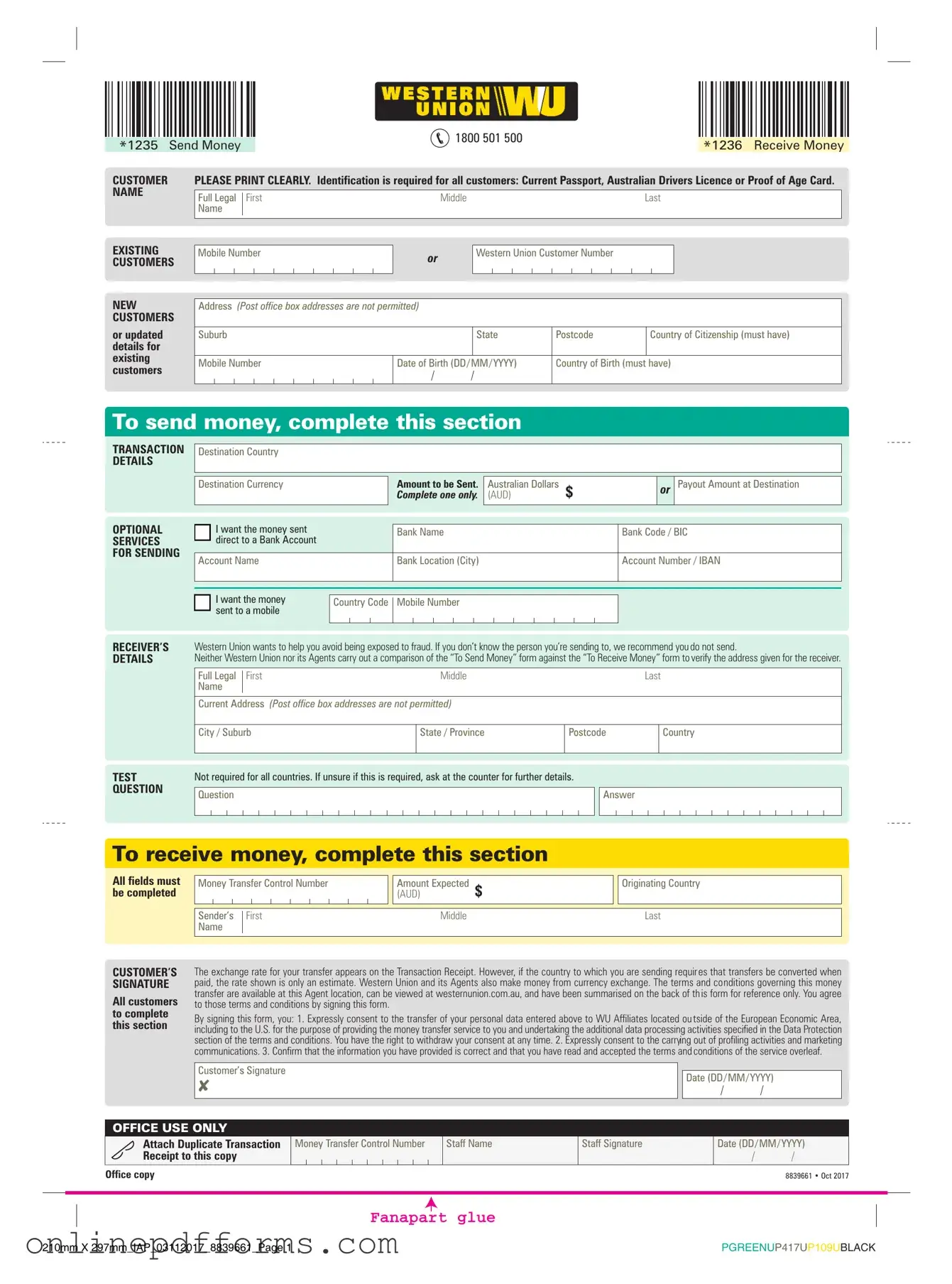

Filling out the Western Union form is straightforward. Ensure you have all necessary information ready before you begin. Follow these steps to complete the form accurately.

- Start by entering your personal information in the designated fields. This includes your full name, address, and phone number.

- Provide the recipient's details. Fill in their name, address, and contact information as required.

- Indicate the amount of money you wish to send. Make sure to double-check this figure for accuracy.

- Select the payment method. Choose whether you will pay with cash, debit, or credit card.

- Review the transaction details. Ensure all information is correct before proceeding.

- Sign and date the form where indicated. This confirms your authorization for the transaction.

- Submit the completed form at the designated location or online, depending on how you are sending the money.